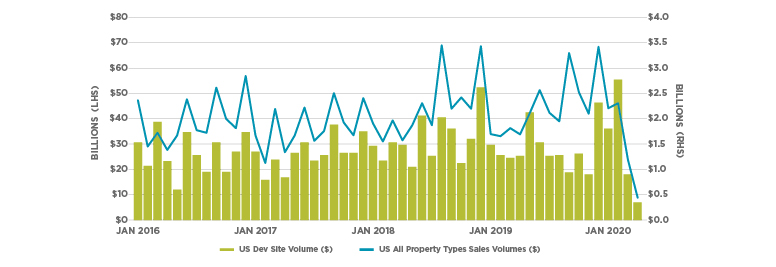

Capital markets activity in the United States began the year at a strong clip. Sales across all property types were $45 billion1 in both January and February 2020, making them the second and third most active Q1 months in the past five years.2 As the coronavirus made its way to the U.S., however, uncertainty has become the norm and real estate activity—leasing, sales and construction—have slowed down. March volumes were below $28 billion and April activity was near non-existent ($8.2 billion). Through four months, 2020 sales volumes are down 8.9% year-over-year (YOY).

Land sales have spent the first four months of 2020 on a similar trajectory. Sales in January and February were up significantly from the same two-month period in 2019. Volumes slowed down in March, but the quarter remained strong relative to recent Q1 history. However, April sales volume were lower than any month since 2010.

U.S. SALES VOLUME BY MONTH – DEV SITE & OVERALL (BN $)

Looking to the future, Cushman & Wakefield’s land brokerage experts are actively engaged with leaders in all real estate sectors and are tracking upcoming deal flow. The following Land Advisory Five Fast Facts explore the impact COVID-19 will have on land sales activity and how experiences across different property types vary.

FACT 1:

$21.6B

U.S. LAND SALES IN Q1 2020 (12-MONTH ROLLING)TOTALED $21.6 BILLION,3 AN INCREASE OF 7.4% FROM Q4 2019 SALES ($20.1 BILLION).4

- Q1 2020 sales were down 3.9%YOY, marking the third consecutive quarter to experience a decline from the previous year.

Fact 2:

76%

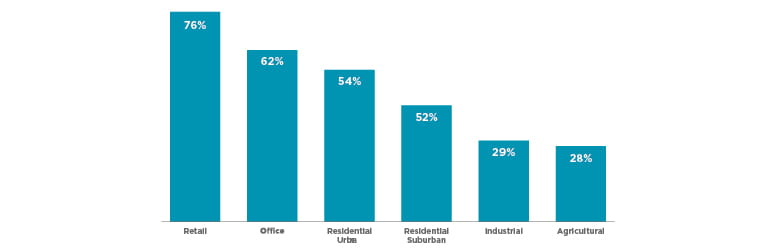

LAND BROKERS INDICATE COVID-19 HAS HAD A NEGATIVE IMPACT ON SALES OF LAND ZONED FOR RETAIL USE.

- The impact of COVID-19 on land sales varies by sector and is in line with where the economic impacts have been the felt the most. The broadest decline in expected activity is currently being experienced with land to be utilized for retail, followed by office and urban residential.

*Percentage represents proportion of land brokers indicating land sales have been negatively impacted by COVID-19 in their market (score of 1-3 on 10-point scale).

Fact 3:

50%

HALF OF BROKERS INDICATE NO IMPACT ON SUBURBAN MULTIFAMILY LAND SALES DUE TO COVID-19.

- Infill multifamily housing sites in key major metropolitan areas are still being pursued (albeit more slowly), and developers with long-term perspective are looking to acquire.

- Attractiveness of primary markets remains although liquidity is more challenging. Low-income housing is still in great need in many expensive coastal markets.

Fact 4:

30%

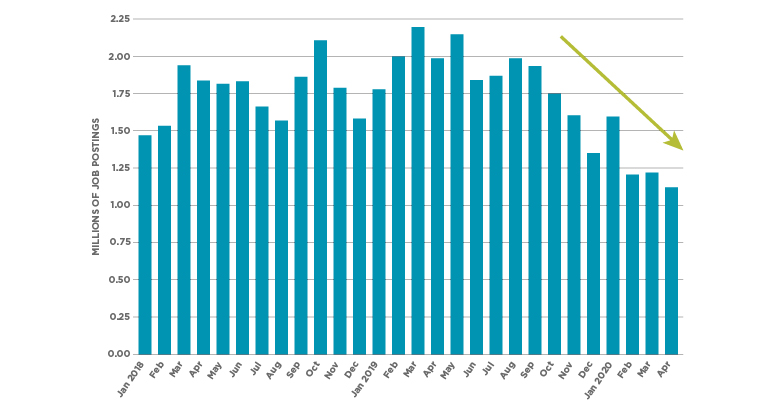

JOB POSTINGS FOR WAREHOUSE/DISTRIBUTION WORKERS WERE 30% BELOW THEIR 12-MONTH AVERAGE IN FEBRUARY AND MARCH 20205 AS COVID-19 BEGAN TO DISRUPT GLOBAL SUPPLY CHAINS.

- While many large eCommerce and distribution firms are hiring, parts of the sector will be negatively impacted by COVID-19.

- That being said, a fourth of land brokers have seen industrial land sales activity pick up in the wake of COVID-19.

WAREHOUSE / DISTRIBUTION JOB POSTINGS BY MONTH

Fact 5:

28%

ONLY A FOURTH OF LAND BROKERS HAVE SEEN NEGATIVE IMPACTS ON AGRICULTURAL LAND SALES.

- Agricultural land may serve as a hedge against an economic downturn, as food is a necessary expense for people.

- Key for this sector is land that is well-suited to crops with a longer shelf life, and agricultural operations for these types of crops have been declared essential operations.6

1 Real Capital Analytics, Inc.

2 The highest Q1 month in the past five years was January 2016 when U.S. sales volume was $47.9 billion. Monthly sales totals in January, February and March have averaged $36.6 billion (2016-2020). Sales volumes in January and February 2020 were $44.9 billion and $45.4 billion, respectively.

3 Totals are annualized (rolling 12 months ending at the conclusion of the quarter).

4 Real Capital Analytics, Inc

5 Emsi

6 U.S. Dept of Homeland Security