The lingering COVID-19 related anxieties cloud the short- and medium-term growth outlook

The Philippine economy finally exited recession which lasted for five quarters after registering a double-digit growth of 11.8% YoY in Q2 2021. Whilst the government-led inoculation program has already commenced, the limited supply of vaccines has influenced the rate of the nationwide rollout. The availability of vaccines has instilled a sense of positivity, but the rather slow rollout of the inoculation drive amidst the spread of the highly-contagious and newly-discovered variants puts the economy as a whole and the industry sectors in a fragile state.

The real estate sector is not safe from this vulnerability. Having had enough financial pressures as operations remain constrained, and as investor and consumer confidence continue to be clouded, real estate developers can only anticipate a better business environment in the medium-term. These uncertainties led 62% of real estate developers to remain unsure of the country’s economic recovery path in the next 12 months, as shown in Cushman & Wakefield Philippines’ COVID-19 Real Estate Developer Sentiment Survey Second Edition.

Key findings of the survey:

1) The short-term does not bode well for the real estate market

Real estate developers in the Philippines remain less optimistic in the short-term as they expect the real estate market to remain vulnerable with weak sentiment and trimmed supply and demand, as well as declining property values and rental rates. The survey respondents expressed optimism in the mid-term (or the next 12 months) with some 31% expecting the real estate market to show early signs of recovery – with both supply and demand strengthening, as well as moderate growth in property values and rental rates. Nonetheless, real estate developers see the vulnerability of the real estate market to persist in the next 12 months. In the long-term (or a period of 2 to 3 years), 62% anticipate the real estate market to build-up momentum with strong rebound of both supply and demand. During that timeframe, 31% believe that property values and rental rates will revert to pre-pandemic level while the other 31% see moderate growth in property values and rental rates.

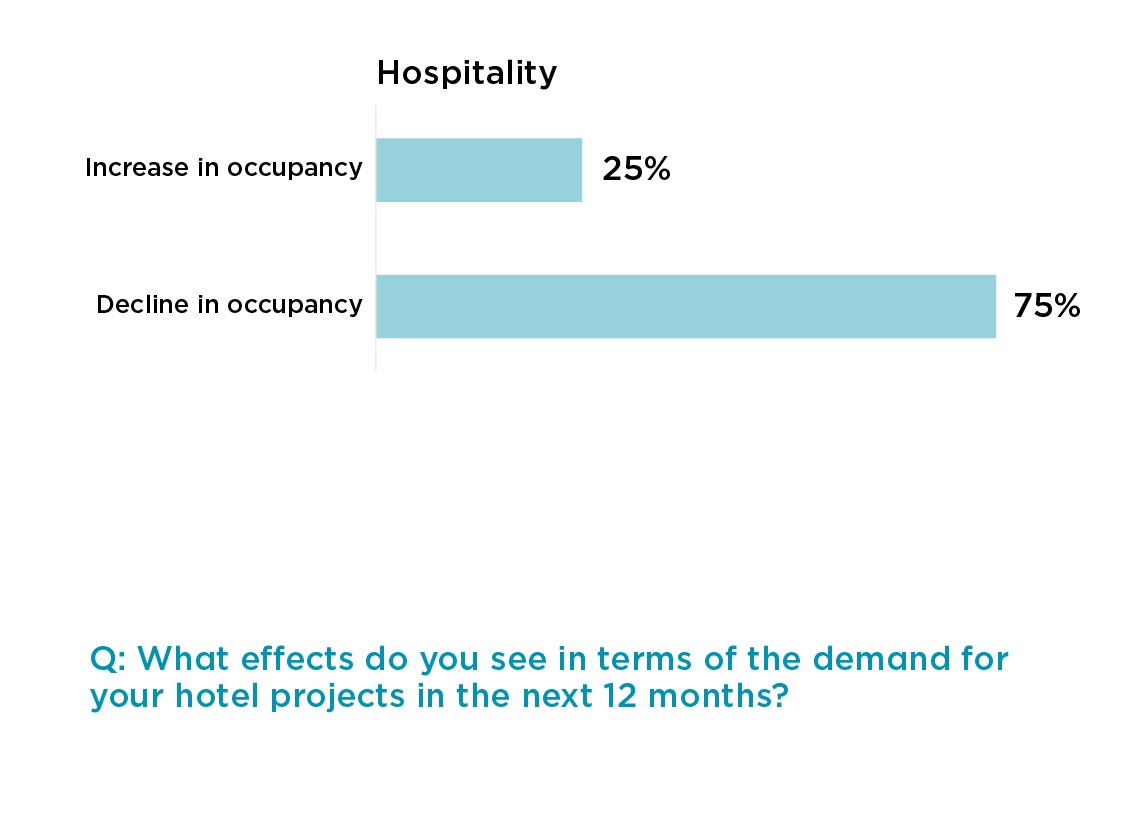

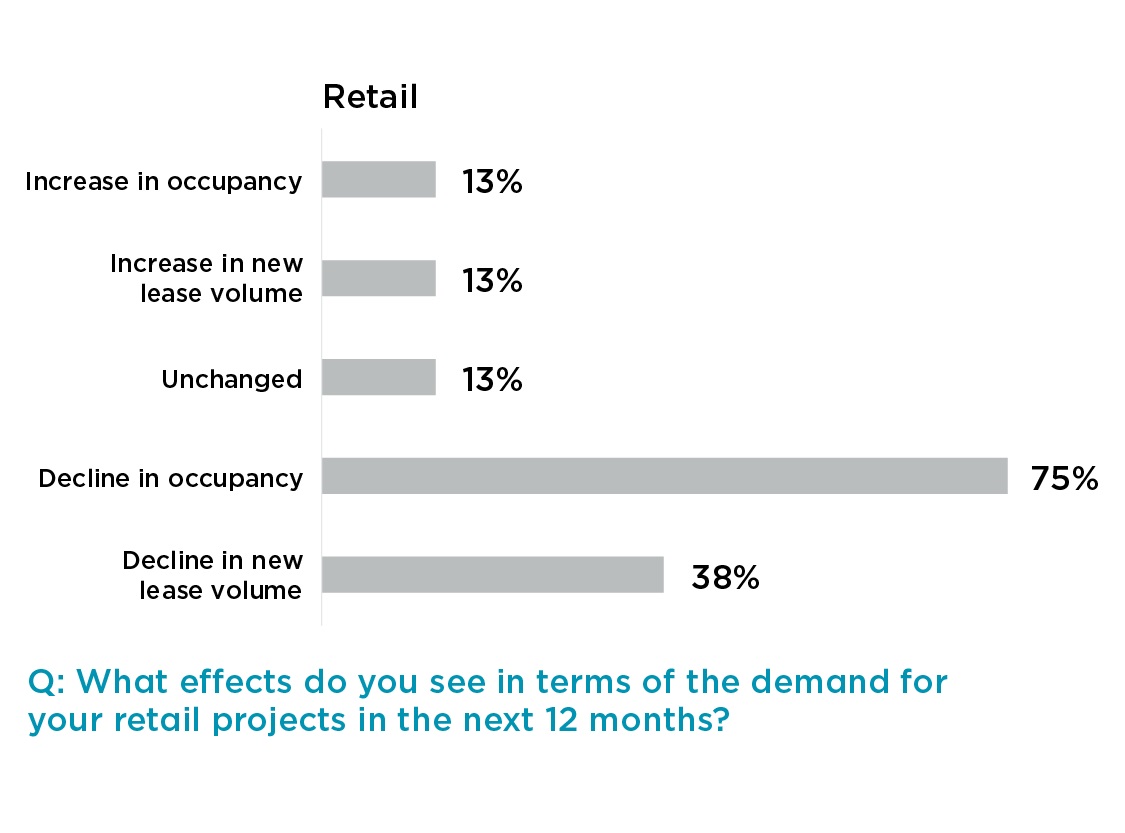

2) Worsening occupancy rate seen across real estate sub-sectors

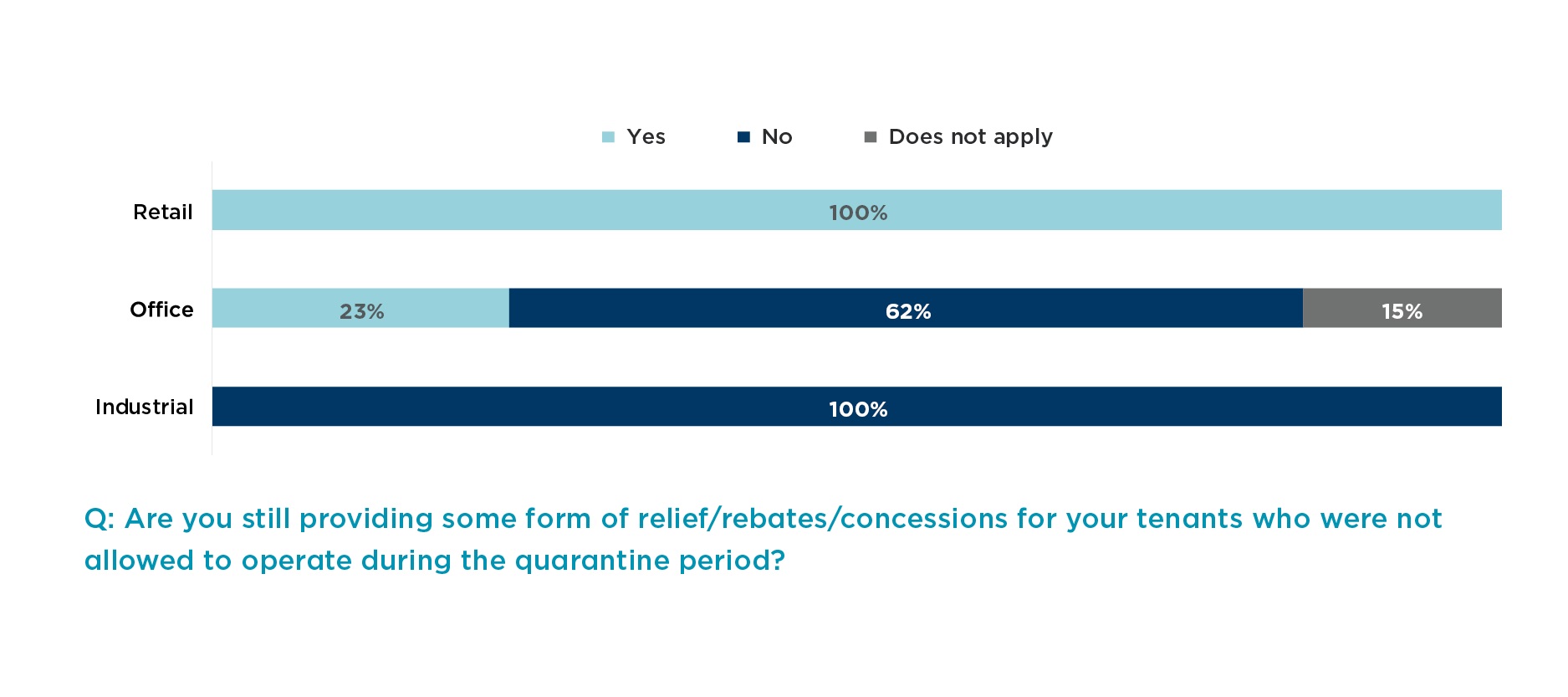

3) Rent concessions to extend in the next 12 months

Seventy-five percent (75%) of hotel developers think that they will continue to implement rental adjustments in the next 12 months, while 63% of retail developers are more likely to do the same. Whereas 31% of office developers think that there will still be rental adjustments in the next 12 months, another 31% believe that they are less likely to do so. Sixty-seven (67%) percent of industrial developers believe that rental adjustments are not necessary within the next 12 months.

Claro Cordero, Director and Head of Research, Consulting & Advisory Services at Cushman & Wakefield, said, “Market recovery will be uneven across the real estate sub-sectors, as the respective demand sources have been affected by varying degrees. The COVID-19 pandemic has disrupted the various sources and growth of demand for the different real estate sub-sectors, influenced by a similar uneven economic recovery across the global market.”

As the pandemic provides more challenges in the medium term, there are still several new trends that present various opportunities for the future growth of the real estate market.

Mr. Cordero further said, “The success of the recent listings prompted more local real estate developers to tap into the Real Estate Investment Trust (REIT) market. Several developers have lined up REIT listings, showing the potential of this investment vehicle to answer the demand for alternative investment instruments. Given the kind of market environment and challenges posed by the COVID-19 pandemic, real estate developers should offer well-diversified assets across different sub-sectors and locations - i.e., those within key commercial business districts (CBDs) in Metro Manila and other asset classes and growth areas outside Metro Manila. A well-diversified REIT vehicle provides downside protection and creates value for its unitholders.”

The unprecedented growth of e-commerce presented opportunities to the various real estate sub-sectors, especially retail and hospitality sub-sectors. Several shopping mall operators and developers have implemented online ordering, payment, and delivery systems – allowing continued patronage and support for their respective tenants, especially during stricter community quarantine measures. Hospitality developments are increasingly looking at ways to use technology to create safe leisure spaces and vacation spots.

The rapid advancement of technology has prompted demand for Big Data analytics and its increasing role in forming strategic business decisions. Businesses have been using technology to collect and analyze consumer and customer data to customize and formulate targeted marketing campaigns. To accommodate this need, demand for data centers has grown in most emerging markets.

Mr. Cordero added, “The highly diversified consumer market of the Philippines has been, and is still, one of the remaining bright spots in the economy. Moving forward, as the vaccination program covers more areas in the population, consumer and market mobility will be the key to unlock the still strong pent-up demand and stunted growth of the market.”

Download a copy of the Covid-19 Real Estate Developer Sentiment Survey Second Edition here.