Now Available: Trump 2.0—The First 100 Days

Explore the economic and commercial real estate impacts of the new U.S. administration’s policy agenda with region-specific insights on trade, tax, immigration policies and more.

Access reports

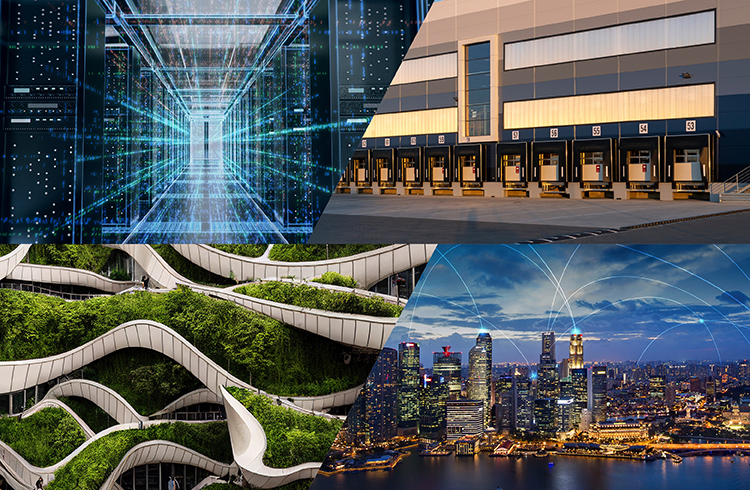

INCLUSIVE CITIES 2024

Asia Pacific Specialty Hub

EXPLORE INSIGHTS

EXPLORE SERVICES

Client Success Stories

- 52,000 Team Members

- $9.4 billion 2024 Revenue

- 60 Countries

EXPLORE CAREERS

Recent Press Releases

Frasers Property Industrial and an investment vehicle sponsored by Morgan Stanley Real Estate Investing to establish new capital partnership in Australia

Frasers Property Industrial has today announced our first capital partnership in Australia with an investment vehicle sponsored by Morgan Stanley Real Estate Investing (“MSREI”).

Jess Freeman • 05/05/2025

DA-Approved Randwick Hotel site hits the market in Eastern Suburbs development hotspot

A prominent hotel development site in the heart of Randwick is set to hit the market, offering a rare opportunity to capitalise on a DA-approved project in one of Sydney’s most tightly held Eastern Suburbs pockets.

Jess Freeman • 05/05/2025

Freehold Bungalow Along Swiss Club Road for Sale at $18.5 Million

Cushman & Wakefield (S) Pte Ltd (“C&W”), as the sole and exclusive marketing agent, is pleased to offer the opportunity to acquire a freehold bungalow along Swiss Club Road (the “Property”). The sale will be conducted through an Expression of Interest (EOI) campaign.

Jacyn Kang • 29/04/2025

Innovative housing solutions set to secure the future of Victoria’s $3B dairy industry

Victoria’s dairy regions are facing growing challenges in accessing housing, affecting workforce attraction and retention and threatening the long-term sustainability of the state’s $3 billion dairy industry.

Jess Freeman • 28/04/2025

Office Market Records Seven Straight Quarters of Vacancy Decline amid Limited Supply

India’s office real estate market maintained its upward trajectory in Q1 2025, driven by robust leasing and tight new supply, pushing overall vacancy down for the seventh consecutive quarter to 15.7% - a cumulatively steep drop of 275 basis points (bps) from 18.45% in Q2 2023.

Aditi Vij • 25/04/2025

Private Investor snaps up Landmark Eaton Mall property for record $12.1m in fiercely contested auction

In one of the most hotly contested auctions Melbourne has seen in recent years, a landmark retail property in the heart of Oakleigh’s bustling Eaton Mall has sold for $12.1 million – setting multiple records and underscoring the surging demand for blue-chip retail assets.

Jess Freeman • 25/04/2025

New Kids on the Block: Generation Z and the Changing Office Workplace on the Chinese Mainland

Cushman & Wakefield's new report New Kids on the Block: Generation Z and the Changing Office Workplace on the Chinese Mainland analyzes the evolving needs of the “new kids on the block”, Generation Z, on the Chinese mainland and their implications for the office workplace in the region.

Mandy Qian • 24/04/2025

Cushman & Wakefield Names Matthew Bouw Chief Executive, APAC & EMEA

Cushman & Wakefield (NYSE: CWK) announced today the appointment of Matthew Bouw as Chief Executive, APAC & EMEA, effective from 1 May 2025.

Richard Coleman • 16/04/2025

Cushman & Wakefield Names Matthew Bouw Chief Executive, APAC & EMEA

Mandy Qian • 16/04/2025

Hong Kong Residential Market Post-Budget Sentiment Strengthens as Smaller-Sized Unit Transactions Pick Up

Rosanna Tang • 07/04/2025

Freehold Brand New 6-Storey Commercial Building on Serangoon Road for Sale at $75 Million

Cushman & Wakefield (“C&W”), the exclusive marketing agent, is pleased to present for sale a freehold, brand new 6-storey commercial building, Piccadilly Serangoon, located at 1377 Serangoon Road (the “Property”) via an Expression of Interest exercise. The indicative price is $75 million.

Shaun Poh • 27/03/2025

China’s “Two Sessions” 2025 Government Policy Outlook Indicates Renewed Opportunities for Commercial Real Estate

Mandy Qian • 11/03/2025

Insights

Research

Philippines Property Market News

Research • Economy

Southeast Asia Outlook 2025: Long-Term Growth Prospects Remain Intact

MarketBeat

MarketBeat

Research • Workplace

REWORKING the Office Asia Pacific

Research • Workplace

Rethinking the office sector in Asia Pacific