Prior to 2020, the shopping trend was already clearly away from stressful bag lugging and towards decelerated online shopping. Then Covid-19 came along and many saw it as another nail in the coffin of bricks-and-mortar retail. But things were to turn out differently.

Although still confronted with economic uncertainty, the future of traditional retail is now being talked about again - as an important component of an omnichannel world. In this, the most successful brands will better understand their customers and come to them wherever they are. The ways to achieve this are as diverse as the products themselves and range from new formats and changed presentation methods to new locations.

These activities give cause for optimism, even if the forecasts for the global economy predict further challenges. This is because many brands are planning for the long term and see the crisis as an opportunity to break out from the well-trodden path. At the same time, new concepts are emerging to set themselves apart from competitors. Above all, the experiential character of retail and shopping as an event play a major role here.

Rental prices recovering at different rates

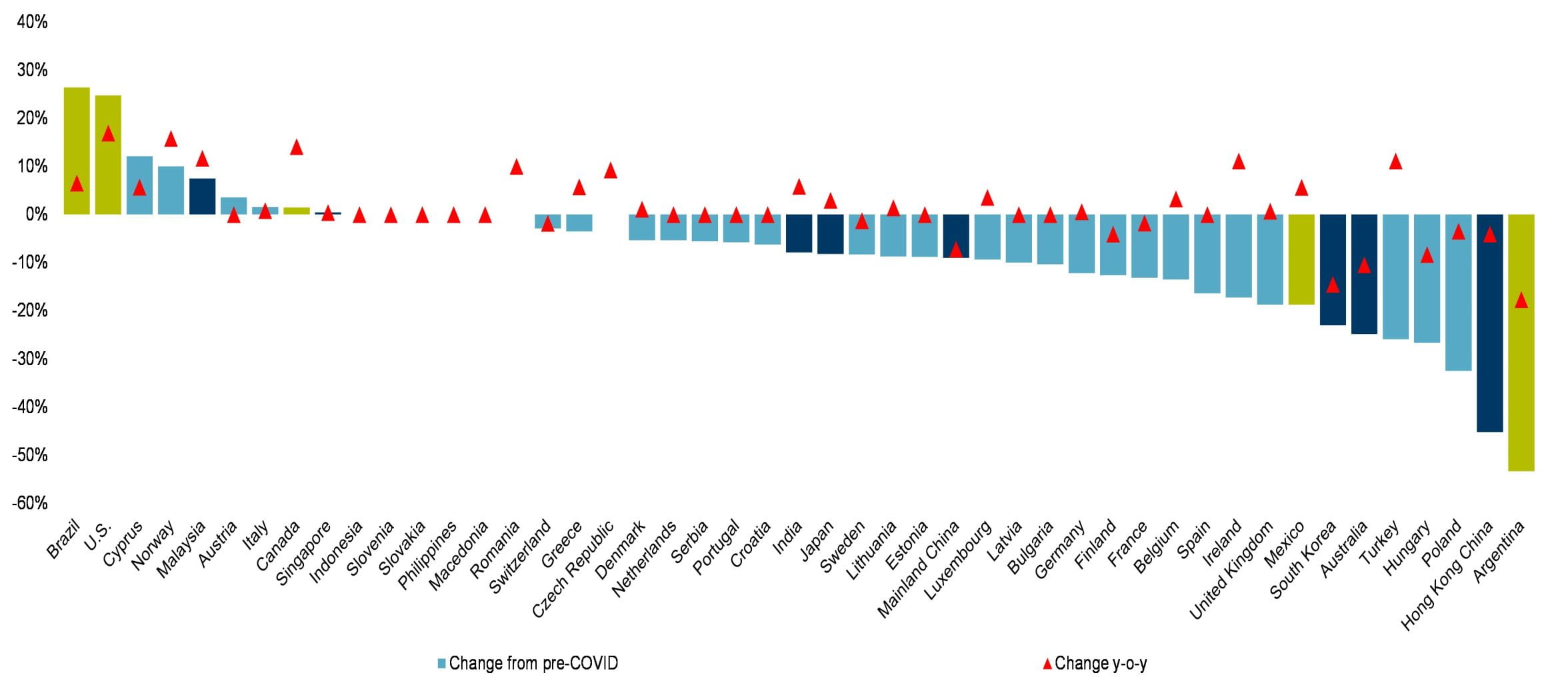

The increased confidence in bricks-and-mortar retail of the future is now also reflected in the rental prices of the world's largest shopping high streets. While prices here fell by a full 13 percent on average worldwide during the pandemic, they have now recovered significantly and are only 6 percent below pre-Covid-19 levels.

A detailed look at the Asia-Pacific region shows that rents there are currently still 12 per cent lower on average than before Covid-19. India has recovered, thanks to strong domestic consumption. In contrast, this recovery process has been slower in Australia, Singapore and Japan, where restrictions have been eased more cautiously and borders opened later.