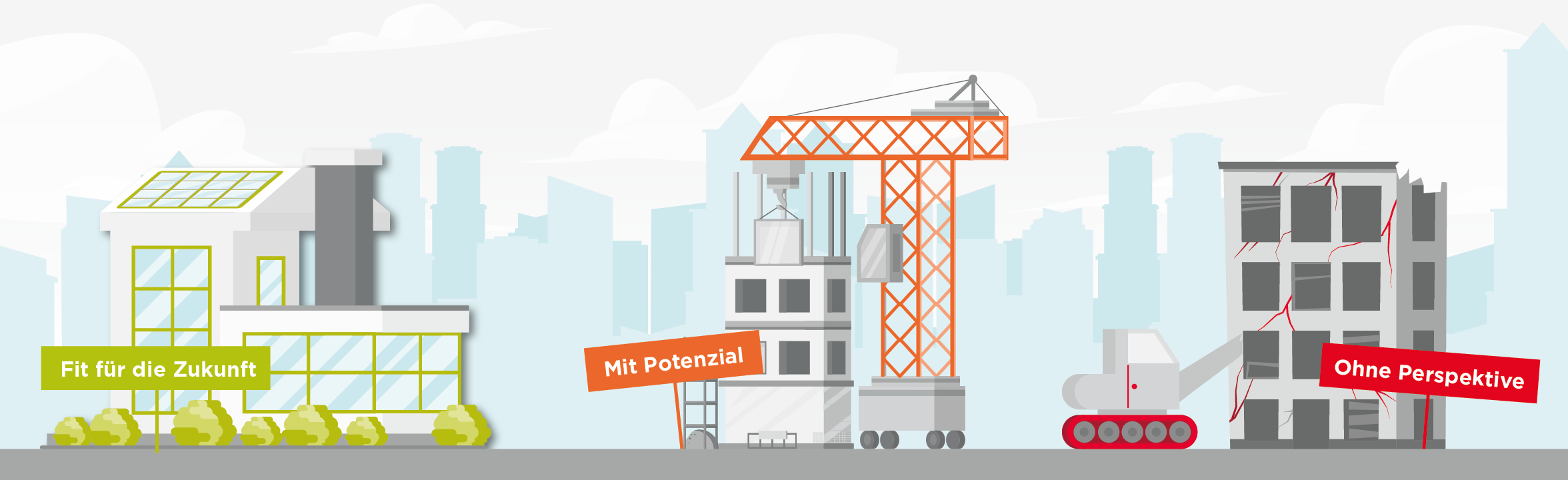

Is it better to convert or demolish? When is your property fit for the future, when does it have potential and when is even a conversion a hopeless prospect?

Every 22nd of April is Earth Day. An important day. Because while the earth sustains us 365 days a year, this day of action is all about caring for the earth: How is it doing? What encumbers it? What is good for it? What can we do to make it feel better?

This year, the official leitmotif of Earth Day in Germany is "Your clothes make people". You may be asking: How does this fit the real estate industry? Honestly, not really. We have therefore adapted the motto for the real estate industry, to provide tips beyond Earth Day: "New from old – conversion or demolition?"