The COVID-19 pandemic is entering its second year. The lockdown, which has been ongoing since November 2020, and the third wave of infections are slowing economic activity. In the office letting market, the effects are evident in the form of restrained demand and increasing availability. Office users are increasingly considering the nature of future office structure post-pandemic. This indicates increased market activity for the rest of the year.

The economic situation at the end of the first quarter of 2021 is robust, despite the months-long lockdown, with a positive outlook in sentiment indicators:

- The unemployment rate has risen to 6.2% in March 2021, 1.1 percentage points higher year-on-year. This represents an increase in unemployment of around half a million people.

- The number of people registering for short-time work fell significantly in the spring. Whereas in January 2021 there were still around one million, in March just over 200,000 people were newly registered for short-time work. The latest projection by the Federal Employment Agency on the number of employees currently on short-time work (realised short-time work) is 2.85 million for January 2021 (the most recent figure available).

- The ifo Business Climate Index rose to 96.6 points in March 2021 largely driven by more positive business expectations. The manufacturing, service and trade sectors are continuing their upswing.

- The ifo Employment Barometer rose significantly in March 2021 to stand at 97.6 points (+4.1 points over the year). The recovery continues in the labour market.

- After a decline in GDP of a good 5% in 2020, growth of slightly over 3% is expected for the current year. Especially for the second half of the year, a significant revival in private consumption as well as investment is expected.

"Despite the brightening economy, uncertainty and caution remained in the office letting market in the first quarter of 2021. Office users largely held-off on their space decisions. As was already the case in the second half of 2020, 'If you don't have to make a decision, wait and see' continues to apply. In many markets there was a high level of volatility in sentiment during the quarter, a back and forth between good news (economic brightening) and bad news (new or extended lockdown, vaccination strategy progressing slower than hoped). So there were two moods, a binary market, so to speak," comments Christian Lanfer, Head of Office Agency Germany at Cushman & Wakefield.

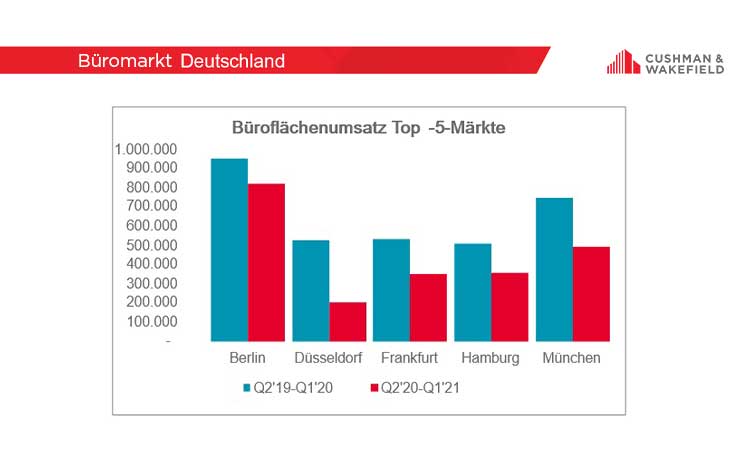

Office take-up down six per cent year-on-year

In the first quarter of 2021, take-up was 561,400 sqm in the top 5 office markets. This is only 6% below the previous year's Q1 2020 result, which was still unaffected by COVID-19, and 13% below the five-year average of first quarters. In contrast, the decline in take-up for all four "COVID-19 quarters" (Q2 2020 to Q1 2021) is around one third compared to the previous 12-month period.

Among the top 5 markets, Berlin is by far the strongest in terms of take-up, at just over 200,000 sqm (+54% year-on-year). Hamburg follows with 126,000 sqm (+13%) and Munich with 104,000 sqm (-41%). Berlin is also clearly ahead in terms of large-scale deals. Of the total of nine deals of 10,000 sqm or more (around a quarter of total take-up), six were in the German capital. This includes the largest deal of the quarter, the development project pre-leasing by Deutsche Kreditbank (DKB) of 34,000 sqm. The analysis of concluded leases by rental price shows a continuing shift towards the high-priced segment. The proportion of deals with a rental price of 20.00 euros per sqm and month or more has increased significantly and steadily in recent years. From around 30% in 2017 to over 50% in the first quarter. This trend is largely driven by rising rents in Berlin and Munich.

In the sector statistics, as in the long-term view, the ICT/online platform sector (17%) leads ahead of public administration (14%). Banks and financial service providers (13%) contributed a significantly higher share of take-up than in previous years (7%), not least due to three deals of 5,000 sqm or more.

"We had already noticed in autumn that the supply of space for subletting was increasing. This supply of space is now being let more and more, accounting for around 6% of take-up in the quarter. In the whole of the previous year this figure was 4% and in the preceding years it was around 1%," analyses Helge Zahrnt, Head of Research & Insight Germany at Cushman & Wakefield. And he continues: "But the amount of sublet space on offer also increased further in the quarter, with around 360,000 sqm available in the top 5 markets."

Aggregate vacancy rate rises to 4.6%

The office vacancy rate across the top 5 markets increased by 0.3 percentage points over the quarter and now stands at 4.6%. This is far below the level of the last crisis, the financial crisis of 2009 (peak during the crisis: 10.3%). Berlin (2.9%) and Munich (3.7%) continue to see the least space availability in their office stock. However, Berlin recorded the strongest increase in vacancy over the course of the year, by 1.3 percentage points. Frankfurt has the highest vacancy rate at 7.8%. A further increase is expected in all markets to the end of the year, ranging from 0.2 percentage points in Düsseldorf to 0.8 percentage points in Munich and Frankfurt.

In the first quarter of 2021, a total of 300,000 sqm of new or core-refurbished office space was completed. The highest completion figure was registered in Berlin (106,000 sqm). For 2021 as a whole, 1.7 million sqm is expected. This would be 14% above the level of 2020. A further increase to 2.4 million sqm is expected for 2022. There is currently 4 million sqm of office space under construction, including 1.7 million sqm in Berlin alone and 1 million sqm in Munich. More than half of this space has already been pre-let or is for owner-occupation.

Prime rents remain stable for the most part

Prime rents remained stable, with the exception of Frankfurt, where an increase to 46.00 euros per sqm per month was recorded, as the availability of prime space has fallen significantly. There is no uniform picture for average rents: developments vary from Düsseldorf (-11%) to Hamburg (+5.9%). In general, however, it may be stated that nominal rents remain stable, while effective rents are declining slightly on average. Rent incentives in central locations have risen from an average of 1.4 to 3.3 rent-free months in the 12-month period - equivalent to 5.5% for a term of five years.

Outlook: Hybrid office solution will prevail

"The working from home experiment is currently continuing for many companies. The initial success is being replaced by an increasing level of home-office fatigue as five days per week working from home is too much for the vast majority of employees. A hybrid solution will emerge, with a mixture of priority work in the office and remote working from home or other locations. What is certain is that offices will have to reinvent themselves and spatial structures will have to be adapted more to suit working methods," comments Helge Zahrnt.

"As soon as the pandemic is contained by tests and vaccinations and companies make decisions regarding their future office work structures, many occupiers will again be more active in the letting market. This is expected to make the second half of the year more dynamic and thus to achieve an annual take-up of 2.4 million sqm, up from 2.2 million sqm in 2020. This would still be 25% below the previous five-year average of 3.2 million sqm," Christian Lanfer sums up.