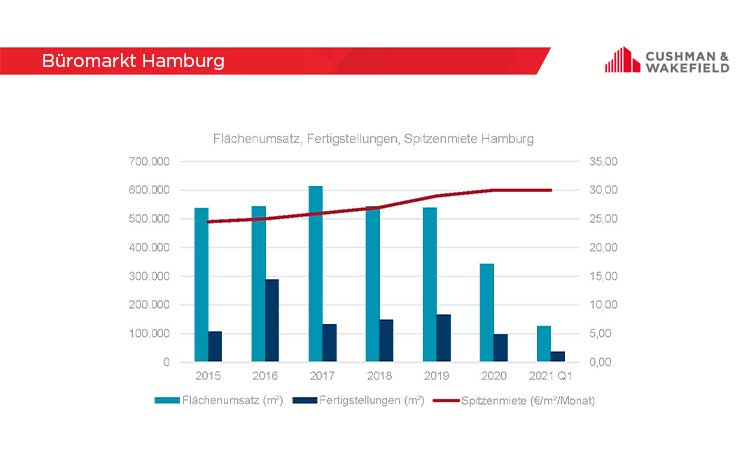

In the first quarter of 2021, international real estate consultancy firm Cushman & Wakefield (C&W) registered a take-up of 126,000 square metres in the Hamburg office market. After the crisis-ridden 2020, the new year is off to a comparatively strong start. In contrast to the previous three quarters, a quarterly result of over 100,000 square metres was achieved for the first time since the beginning of the pandemic. While the office letting market was able to start the new year with positive signals, the office investment market, with a transaction volume of around 425 million euros, is somewhat weaker than in the same period last year, but still at the level of the ten-year quarterly average.

Compared 94,000 square metres in the fourth quarter of 2020, take up increased by 35 in the first quarter of 2021 to 126,000 square metres. The year-on-year comparison also shows an increase of 13 per cent. "Against the backdrop of the pandemic, letting activity confirms that the mood in the market is fundamentally becoming more optimistic again," comments Tobias Scharf, Head of Leasing at Cushman & Wakefield in Hamburg, adding: "However, many occupiers are still waiting with their leasing decisions until it is more certain when the situation will finally ease." With the pace of vaccinations picking up and, at the same time, companies being able to plan more easily, leasing activity is likely to increase significantly and take-up in 2021 could be higher than last year. This development is also confirmed by some larger space searches in the market.

Overall, the pandemic has led to a significantly changed view of office space on the demand side. "The time is being used to adjust future space requirements and react to new needs," observes Tobias Scharf, continuing. "With the growing importance of working from home and the associated changes in the world of work, there are opportunities to create attractive workplaces for employees in terms of location and expansion, towards more collaborative space,".

"On the one hand, we see considerable change potential in this readjustment and, on the other hand, this change in demand may lead to an increase in demand for new office space later in the year," adds Marc Rohrer, Head of Capital Markets and Branch Manager of Cushman & Wakefield in Hamburg. In the current market environment, this potential demand is being met by a slight increase in supply. In the first quarter, the vacancy rate rose by 0.3 percentage points to 4.2 per cent, including a growing supply of subletting space. "However, this is still far below the level of the last crisis, the financial crisis of 2009, when vacancy peaked at 9.3 per cent," analyses Helge Zahrnt, Head of Research & Insight Germany at Cushman & Wakefield.

Two major deals over 10,000 square metres

With 126,000 square metres of take-up, the result for the first quarter of 2021 is in line with the five-year average of first quarters. The number of leases concluded is slightly below the quarterly average of the past five years having fallen by five per cent (Q1 2021: 128 new leases; 5-year average: 134 new leases).

In contrast to the first quarter of last, when no large-scale leases for over 10,000 square metres were signed in Hamburg's office letting market, two deals totalling around 29,000 square metres made a significant contribution to take-up in the first quarter of 2021. The largest deal was registered in the City submarket. Here, the Attorney General's Office leased around 17,600 square metres in Michaelis Quartier. The second largest deal was the lease by Wintershall Dea in a new development directly at Lohsepark in HafenCity. Wintershall Dea will move into around 11,300 square metres after completion.

Public administration and industrial companies with strongest turnover, Hamburg City most sought-after submarket

In the first quarter of 2021, public administration and industrial companies made the strongest contribution to take-up, just as in the previous year-end quarter. Five leases for a total of around 23,500 square metres were concluded in the public sector; industrial companies achieved the same take-up with nine leases. While the construction and real estate sector was still the strongest in terms of take-up in the same period of the previous year with 12,000 square metres, has fallen to fifth place in the sector ranking in the first quarter of 2021 with 10,500 square metres. Alongside public administration and industrial companies, the ICT sector accounted for the largest share of take-up in the quarter under review: 12,800 square metres were let via 16 deals.

Hamburg City is by far the most sought-after submarket, with around 43,500 square metres or about 35 per cent of take-up. A total of 42 new leases were concluded here. "Central location and good transport links remain of great importance for companies," explains Tobias Scharf. With 20,700 square metres or 16 per cent of take-up, HafenCity came second, closely followed by Ottensen-Bahrenfeld in third place.

Prime rent remains sustainably achievable at 30.00 euros per square metre and month

In the first quarter of 2021, the prime rent remains almost unaffected by the Covid-19 crisis. Over the past year, it has remained stable at a sustainably achievable level of 30.00 euros per square metre and month. In contrast, the prime rent reacted to the previous (financial) crisis with a decline of 1.00 euro, due to a significantly higher vacancy rate at the beginning of the crisis. While the vacancy rate at the beginning of the financial crisis was 6.9 per cent, the Covid-19 crisis started with a vacancy level of 3.3 per cent.

Unlike the prime rent, the weighted average rent rose slightly year-on-year. The weighted average rent across all building classes for the last twelve months in Hamburg is currently 17.90 euros per square metre per month. Compared to the same point last year, it has risen by 0.85 euros, or five per cent, from 17.05 euros. The main reason for this development is development project pre-lettings of over 2,000 square metres in the new developments that characterise the city, such as the Elbtower, the Ballinhof and the Springer Quartier.

Construction activity and pre-letting rates remain at a high level

During the first quarter of 2021, around 37,000 square metres of new office space was completed in Hamburg, 92 per cent of which is already pre-let or allocated to owner-occupiers.

A total of 605,000 square metres of office space is under construction and is expected to be completed to 2025. Of this, more than half (56 per cent) has already been allocated to users. For the space under construction, which is expected to be ready for occupancy in 2021 and 2022 (456,000 square metres), the pre-letting rate is already as high as 67 per cent. "The high pre-letting rates confirm that outstanding projects and project developments in good and very good locations are still in demand among users. The two large-scale leasings by Wintershall Dea and HCOB in HafenCity in the past two quarters are exemplary," Tobias Scharf summarises.

The largest proportion of development projects under construction is in the HafenCity (118,000 square metres), City (106,000 square metres) and City Süd (97,000 square metres) submarkets. In City, the "Deutschlandhaus" with almost 30,000 square metres of office space will be built by 2023. In Überseequartier Süd in HafenCity, "Luv & Lee", "The Yard" and "Skysegel" with a total of almost 50,000 square metres are expected to be completed by 2024.

Hamburg's office investment market transaction volume matches 10-year average at the start of the year

"Compared to last year, the start to the investment year 2021 has been somewhat more restrained, but remains stable at the level of the ten-year average," says Marc Rohrer, Head of Capital Markets and Branch Manager of Cushman & Wakefield in Hamburg, adding: "Overall, office properties changed hands for around 425 million euros. Office investments remain the asset class most in demand, but supply of the preferred core and core+ properties was limited." The largest office transactions were the sales of the "Hamburg Süd Haus" in Willy-Brandt-Strasse and "D10" in Domstrasse. In the value-add segment, the sale of the Wintershall Dea headquarters in City Nord is particularly noteworthy. The headquarters, developed for Dea in the 1970s, was acquired by Becken with the aim of bringing the property into the new age of modern offices.

The outlook for the first half of the year is cautiously positive. "Currently, office properties with an investment volume of just under 1.2 billion euros are up for sale. However, many willing sellers are still holding off. We can already see that the supply pipeline will fill up in the second half of the year," observes Marc Rohrer.

The prime yield for office properties is stable at 2.80 per cent. "High demand for core product is encountering low supply, which will probably lead to slight yield compression in the course of the year," concludes Marc Rohrer.

>> Download Hamburg office market Q1 2021