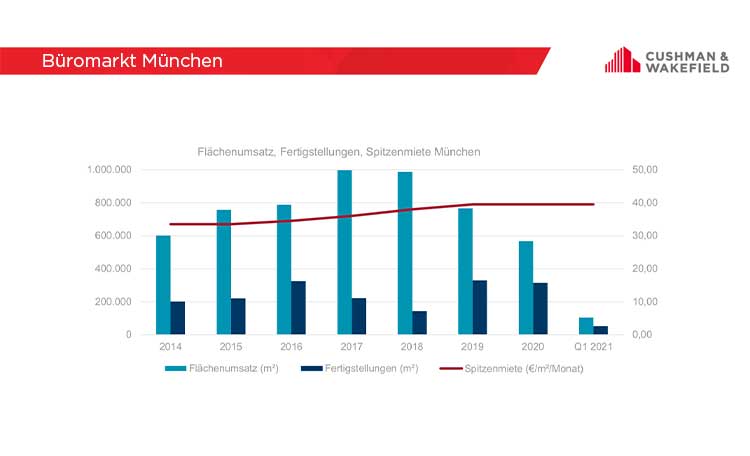

The international real estate consultancy firm Cushman & Wakefield reports a take-up of 103,900 square metres for the Munich office market in the first quarter of 2021. The COVID-19 pandemic had already slowed down leasing activity in 2020. This trend continued into the new year. The quarterly result is more than 40 per cent below the previous year's equivalent figure of 177,600 square metres. The averages of the previous five and ten years were fallen short of by 51 percent and 44 percent respectively. No lower value for a first quarter has yet been recorded since the turn of the millennium.

Hubert Keyl, Munich branch manager at Cushman & Wakefield Germany, comments: "As expected, take-up remains low due to the ongoing COVID-19 pandemic. No large deals above 8,000 square metres were concluded in the first quarter. Take-up in the current year could remain below the 600,000 square metre threshold and fall to a similar level as in the crisis year 2009."

Take-up in central locations declining

The decline in take-up is most severe in the city centre, but has also affected the rest of the city. In the first quarter, 47,700 square metres of new office space was let in the city centre and 25,500 square metres in the rest of the city, 55 per cent and 51 per cent less than in the equivalent period last year. The market share of the city of Munich compared to the surrounding area fell from 60 per cent to 46 per cent. This contrasts with the situation in Munich’s surrounding region: Take-up in the first quarter was 30,400 square metres, 59 per cent above the previous year's figure of 19,100 square metres. Individual transactions of more than 7,000 square metres contributed to this high result. These include the leasing of 8,000 square metres by TE Connectivity Germany in Ottobrunn.

Falling average rent, stagnating prime rent

While the achievable prime rent has once again reaffirmed its historically high level of 39.50 euros per square metre and month, the average rent has fallen steadily since the second half of 2020. The weighted average rent for all new lettings in the first quarter of 2021 is currently 20.85 euros per square metre per month, 3.9 per cent or 85 cents lower than at the same point last year.

ICT sector most in demand, lawyers/notaries increasingly renting

The ICT sector remains the sector generating the highest demand in the Munich office market. It contributes almost 30 per cent to the overall result. Compared to the equivalent period last year, its take-up has risen by 27 per cent from 24,300 square metres to 33,100 square metres. On the other hand, the take-up of space by consultancy firms and the transport, traffic and logistics sector in particular fell sharply. The market share of the consultancy sector fell from 44 percent to six percent and the market share of the transport, traffic and logistics sector dropped from 15 percent to just under two percent.

Demand for office space from lawyers and notaries was strikingly strong, renting a good 7,300 square metres in the first quarter of 2021; in the same period last year they rented only 2,100 square metres.

Completions remain stable, subletting space increases

Construction activity in the Munich office market is relatively stable despite COVID-19. A good one million square metres of space is currently under construction for occupation by 2024. In the first quarter, around 52,400 square metres of new office space was completed, five per cent more than in the previous year. A further 554,300 square metres is under construction with planned completion by the end of 2021, of which 63 per cent is already pre-let at this stage. Almost 468,000 square metres is already under construction with planned completion in 2022, only 45 percent of which is still available for rent. The absolute vacancy has risen from 516,400 to 786,400 square metres compared with a year ago. The vacancy rate in the market area is now 3.7 per cent, the last time it was this high was at the end of 2017.

New supply of space for office users has increasingly come onto the market in the form of sublet space. Around 7,400 square metres of office space was sublet in the market in the first quarter, compared to only 700 square metres in the same period last year.

Low investment volume

On the investment market for commercial real estate, the year also began very cautiously. Jan Isaakson, Head of Capital Markets Munich at Cushman & Wakefield, comments: "There was a particular lack of large-volume transactions. Nevertheless, demand for suitable office properties is high, especially for core and core+ properties, but there were hardly any offers on the market corresponding to the capital ready to invest." Against this backdrop, prime yields in central locations compressed by 10 basis points to 2.50 per cent in the first quarter.

>> Download Munich office market data Q1 2021