Stronger transaction volume in the second quarter, office properties clearly in focus

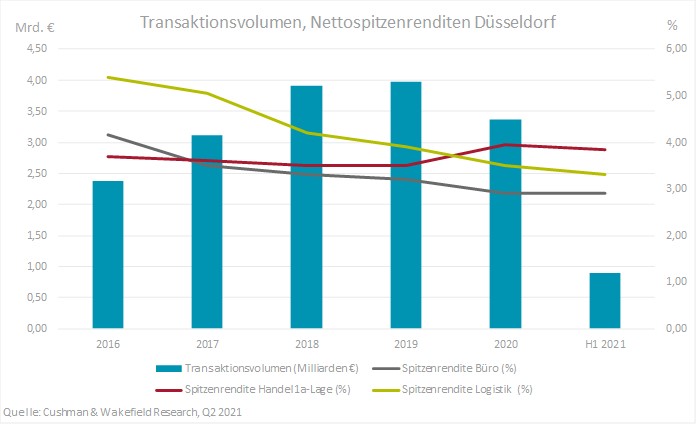

The commercial real estate investment market in Düsseldorf achieved a transaction volume of around 890 million euros in the first half of 2021. Compared a year ago, this corresponds to a decline 51%. After a meagre first quarter, however, transaction volume increased considerably between April and June and, at around 647 million euros, more than doubled the result of the first quarter

Office properties were the dominant asset class in the investment market in the first half of the year and continue to enjoy a high level of investor confidence. A total of around 688 million euros was invested in office properties. This corresponds to 77 % of total transaction volume.

A significant proportion of office transaction volume was contributed by two major transactions of over 100 million euros each; the sale of HSBC's current corporate headquarters at Königsallee 21-23 to developer Momeni and the acquisition of the "Smart Office" office development project at Klaus-Bungert-Strasse 5 by Hanse Merkur from the Bema Group.

Investment in retail properties has played a subordinate role in the year to date, achieving a turnover volume of around 38 million euros, contributing just under 4 % of the total. This is followed by logistics and industrial transactions, contributing around 3% and hotel properties with a good 1%. Significant increases in volume were recorded in transactions involving land, healthcare properties and mixed-use properties. With a total of around 126 million euros (14% share), this represents the second-strongest asset class.

All risk classes are acquired

The first half’s investment volume does not indicate a clearly dominant risk class. At around 32%, a large proportion was contributed by opportunistic investments, of which a considerable share is accounted for by development properties. Low-risk core segment properties contributed the second strongest share at around 30 %. Value-add property transactions rose to around 21% for the half-year and underpin the degree of diversification in the Düsseldorf investment market.

Angelo Augenbroe, Head of Capital Markets in Düsseldorf at Cushman & Wakefield, explains: "The lack of high-quality, attractive core office properties on the market continues and, at the same time, the capital placement pressure from numerous investors is increasing. A circumstance that has been prompting institutional investors to continuously adjust their risk parameters for some time now. For this reason, office properties in other risk classes are increasingly coming to the fore. Furthermore, institutional owners continue to act cautiously with regard to their exit strategies. Thus, we expect a modest number of high-priced core sales by the end of the year and a commercial real estate transaction volume of around 2.6 billion euros for the year as a whole."

Yield compression for office, logistics and absolute prime retail

Prime yields for the three main types of use, office, logistics and retail, have all compressed over the past twelve months. At mid-year 2021, the prime yield for high-quality core office properties with a high-credit-rating tenant mix and long-term leases is 2.90%. Compared to the same point last year, this represents compression of 20 basis points.

Stronger decreases in yields were registered for logistics properties in the same period. The prime yield here fell by 60 basis points to the current 3.30%.

Prime yields for top retail properties had been rising following the first lockdown in 2020 due to lack of demand and great uncertainty. However, the upward trend halted in parallel with the decline in new infections and the easing of COVID-19 restrictions this year. The prime yield is currently 2.85%, 5 basis points below the mid-year level of 2020.

Further slight yield compression is forecast for office and logistics to the end of the year.