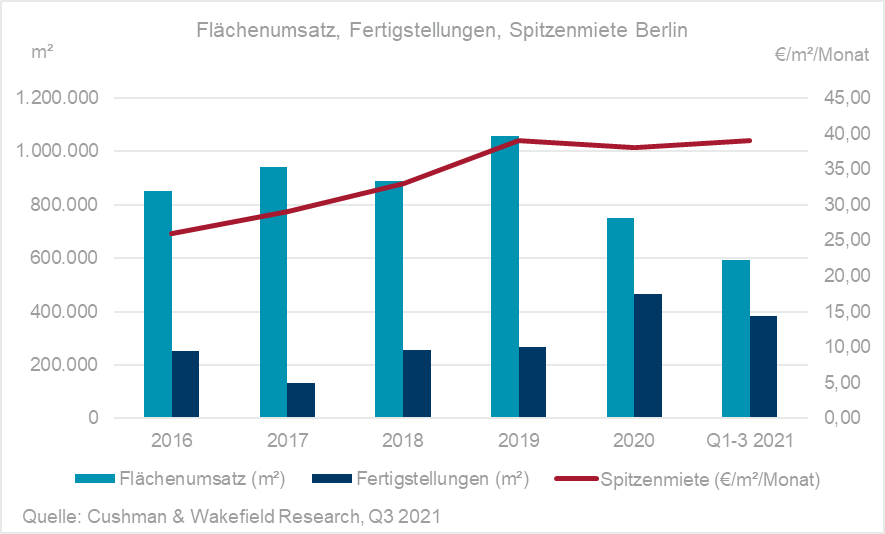

With take-up of 216,500 sq m, the third quarter was the strongest of the year so far, in terms of take-up in the Berlin office letting market. This brought the total take-up for the period from January to the end of September to 592,000 sq m, according to international real estate consultancy firm Cushman & Wakefield (C&W). This corresponds to an increase of 30 percent compared to last year. However, this figure is still around eight percent below the five-year average.

Prime and average rents in the capital stagnate

As in the previous quarter, the achievable prime rent is EUR 39.00/sq m per month (Q3/2020: EUR 38.00/sq m). The area-weighted average rent is unchanged from the same point last year at EUR 26.60/sq m per month. C&W does not expect any changes until the end of the year.

TMT sector provides increasing market momentum

Companies from the technology, media and telecommunications (TMT) sector have leased significantly more space in the first nine months than in the equivalent period last year. By the end of Q3/2021, they were responsible for take-up of 136,500 sq m (Q1-Q3/2020: 65,300 sq m), 58,600 sq m of which was in the past three months.

At the same time, activity in the public sector declined. Leases for 18,100 sq m of office space were signed in Q3. This brought the 2021 cumulative total take-up to 80,700 sq m, which is 54 percent less than in the same period last year. However, this figure is still ten percent above the average for the five pre-Covid-19 years under consideration.

The size distribution of the converted space is noteworthy. Donn Lutz, Head of Office Agency Berlin at C&W, explains: "The negative influence of the pandemic on the leasing decisions of smaller companies has noticeably decreased. Take-up of space under 1,000 sq m is 18 percent higher than the average for the comparable period of the pre-crisis years 2015 to 2019. We are also observing many prospective tenants for small and medium-sized offices now more frequently looking for space available at short notice, which indicates a catch-up effect. Large occupiers, on the other hand, will only conclude more leases again when they are sure of the sustainability of their new work and office concepts."

For Q4, C&W expects the overall positive trend to strengthen and an annual office take-up of more than 800,000 sq m to be achieved.

Vacancy rises by 59 percent within a year

At the end of Q3 2021, the vacancy rate, including subletting space on offer, was 3.8 percent. In the capital, 736,500 sq m is available for short-term occupancy, 272,000 sq m or 59 percent more than at the same point last year. The vacancy rate has thus increased for the sixth quarter in a row.

Of the completions in the first three quarters of 2021, 95,000 sq m is still vacant, 26,000 sq m of which is in the vicinity of BER Airport in Schönefeld. 64 percent or 474,300 sq m of the office space available at short notice is accounted for by properties within the S-Bahn rail ring.

Due to the extensive development project pipeline, C&W expects vacancy to rise further even if demand for space continues to increase.

Large completion volume expected at the end of the year

Completions in new construction and core refurbishment projects totalled 383,700 sq m to the end of Q3 2021. The completion of a further 266,400 sq m is expected to the end of the year. This includes 93,900 sq m that is not yet let.

In addition, around 775,000 sq m of new office space is expected to be ready for occupation in 2022. A total of almost 1.8 million sq m of space in property development projects is currently under construction. Of this, around 54 percent is let or for owner-occupation.