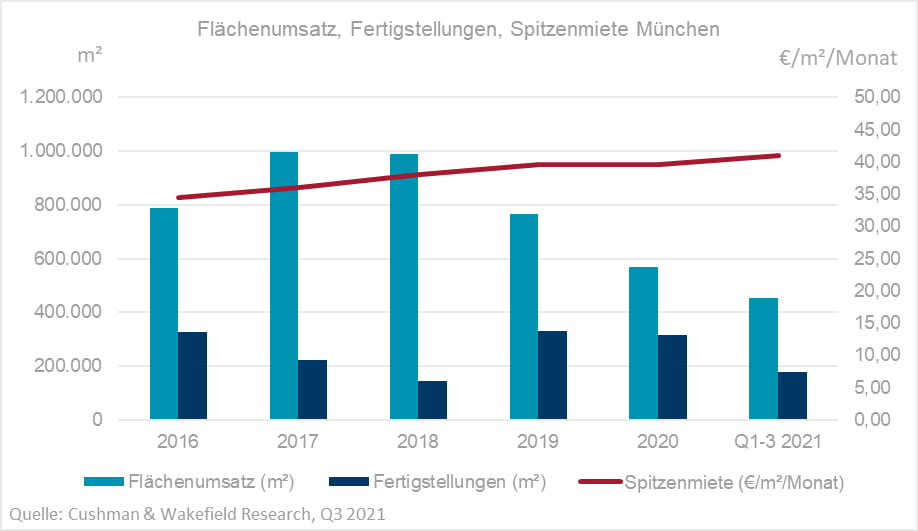

With take-up 214,400 sq m, the 3rd quarter was the strongest of the current year in Munich’s office letting market (Q1: 103,900 sq m, Q2: 132,000 sq m). From January to September, take-up totalled 452,800 sq m, according to international real estate consultancy firm Cushman & Wakefield (C&W). The overall result so far is thus 2.9 per cent below that of the same period last year and around 23 per cent below the five-year average, it is however 17 per cent above the 10-year average.

Monthly prime rent rises to record high of 41 EUR/sq m

The achievable prime monthly rent rose to a new historic high in the 3rd quarter. Compared to the end of Q2, it rose by 2.5 percent from EUR 40.00 to EUR 41.00/sq m. C&W has already recorded five deals at this level in and around the Altstadtring in Munich. In addition, the monthly average rent for new leases has increased over the past twelve months and now amounts to EUR 22.21/sq m. This is EUR 1.01 (4.8 per cent) more than at the end of Q2.

Hubert Keyl, Head of Office Agency Munich Cushman & Wakefield Germany, explains the current development: "Tenants are still uncertain about their requirements for future office space. Nevertheless, the market has become extremely lively again. For example, large international searches are returning to the Munich office market. We also observe that building and location quality play an essential role. Properties with high mobility efficiency, i.e. in locations that are very easy to reach by public transport and without frequent changes between services, are favoured by tenants. We are also seeing a strong increase in demand for both new buildings and existing properties with sustainability certificates."

Public sector with largest lease of the year

In the 3rd quarter, the largest letting of the current year took place; 44,700 sq m of office space to the German Patent and Trademark Office in Pandion Soul in the Munich East submarket. In total, 51,100 sq m or 24 per cent of the office space take-up in the past quarter was accounted for by the public sector, which thus leased more than any other sector.

Vacancy rate continues to rise

Due to the already declining level of new lettings since 2020, the vacancy rate has increased over the past twelve months and has risen by 290,600 sq m (46 per cent) to currently just under 924,000 sq m. The vacancy rate in the market area is thus 4.3 per cent (Q3/2020: 3.0 per cent). There has been a particularly strong increase in the region surrounding Munich: from 5.5 per cent in Q3 2020 to 7.7 per cent now.

Volume of new construction still high

In the 3rd quarter, 118,900 sq m of office space was completed. This brings the year-to-date completion volume to 176,700 sq m. A further 65,700 sq m of office space will be added by the end of the year. Of this, 61 per cent has already been pre-let. In addition, 842,000 sq m of office space is under construction and scheduled for completion in 2022 and 2023. The pre-letting rate here is currently 31 per cent.

A large number of the development projects are located in the centre of the Bavarian state capital. For example, 217,300 sq m of office space in the south of the city centre and 113,600 sq m in the west of the city centre are scheduled for completion by the end of 2023.