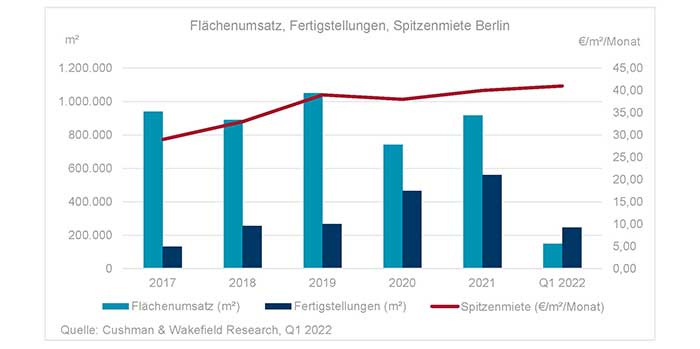

For the 1st quarter of 2022, international real estate consultancy firm Cushman & Wakefield (C&W) reports office take-up of 149,900 sq m in Berlin. This is 24 percent less than in the same period last year. The figure is also 23 percent below the five-year average.

Donn Lutz, Head of Office Agency Berlin at C&W, explains the reasons: "There was a lack of large lettings of 10,000 sq m or more. However, fluctuations of this magnitude in take-up are not unusual for Berlin and should not be over-interpreted at this early point in the year. Several major large-area deals were concluded shortly before the end of 2021 and are now noticeable by their absence at the beginning of the year."

After take-up of small spaces already recovered last year, this trend was also seen for medium-sized spaces between 1,000 and 3,000 sq m in Q1 2022. In this size category, take-up of 40,200 sq m was 18 percent above the five-year average.

The largest letting of the quarter was 9,100 sq m, to ASML Berlin in the completed Bellevue Campus development project. The two most important sectors for the Berlin office market, IT and public administration, together contributed 32 percent of take-up and thus remained significantly below the average of the past five years (45 percent). In contrast, consultancy firms increased their proportion of take-up to a good 13 percent, which is more than three times the five-year average.

New record highs for prime and average rents

The achievable prime rent rose to a new record high to EUR 41.00/sq m per month, which is EUR 3.00 euros above the level of twelve months earlier and EUR 1.00 above the level of the end of 2021. The area-weighted average rent also reached a new peak to stand at EUR 27.90/sq m per month, an increase of EUR 1.00 on 12 months previously and 20 cents above the previous quarter. Further records for prime rents are expected to be set by the end of the year, not least due to new high-quality product in prime locations.

Vacancy rate at 3.9 percent, trend still rising

At the end of March 2021, the vacancy rate including sublet space on offer was 3.9 percent, with 788,100 sq m available for immediate occupancy, which is 223,700 sq m or 40 percent more than a year earlier. 61 percent or 478,500 sq m of the vacant office space is in properties inside the S-Bahn rail ring. At last count, 48,700 sq m was offered subletting, which is 41,100 sq m less than at the end of March 2021.

After absolute vacancy and the vacancy rate fell due to the very high take-up in Q4 2021, both increased again in Q1 2022. In addition to the low take-up, this was due to high completion figures with some new space that had not yet been let. The vacancy rate will continue to rise due to the still well-filled development project pipeline. In the long term, this will particularly affect older extant properties in less good locations.

Very high completion volume

Completions in new-build and core refurbishment projects reached a record 245,700 sq m in Q1 2022, which was around three times the five-year average. 40,700 sq m or 20 percent of the space was still without an occupier at completion. Of the 601,000 sq m for completion by the end of 2022, 61 percent is already pre-let or earmarked for owner-occupiers. Overall, development projects totalling 1.6 million sq m are under construction, of which 52 percent is currently let or reserved for owner-occupiers.

More than 900,000 square metres of office take-up expected for the year as a whole

In general, C&W regards the Berlin office market as having returned to pre-pandemic level in terms of the number of lettings recorded. The pandemic is increasingly receding into the background, which is reflected in an increased office occupancy rate and demand for space. However, deteriorating financing conditions for companies, energy and raw material supply problems and the slowing economy could bring renewed uncertainty. Nevertheless, C&W expects take-up to exceed 900,000 sq m for 2022 as a whole.