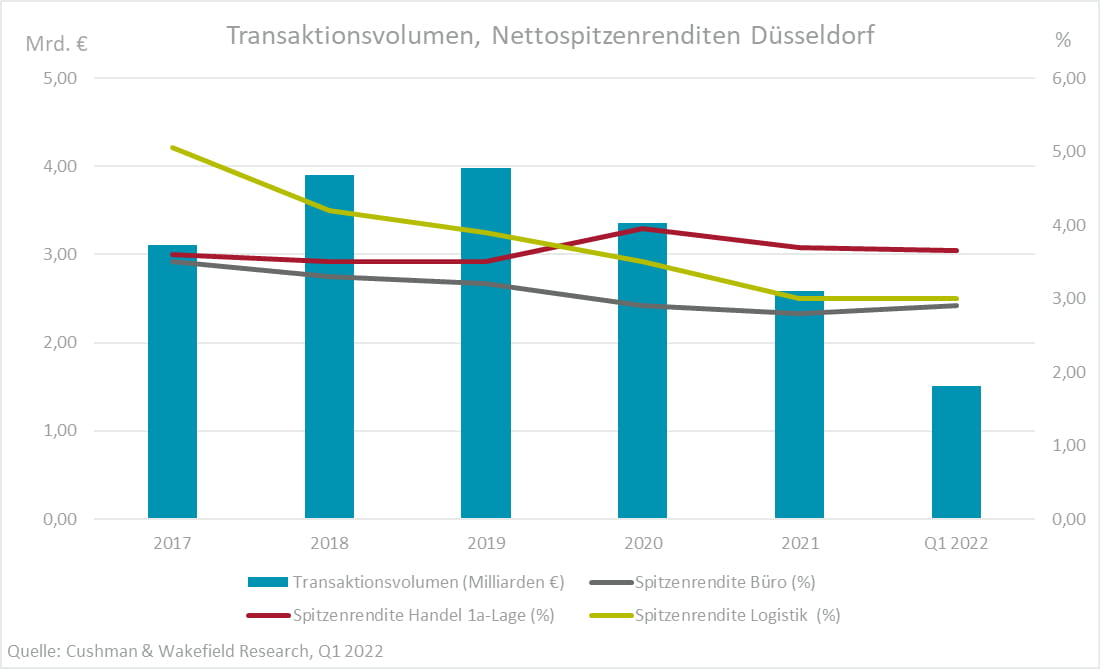

The commercial real estate investment market in Düsseldorf achieved a total transaction volume of EUR 1.51 billion in Q1 2022. Compared to a year earlier (EUR 0.43 billion), when the result was marked by the pandemic, volume has thus more than tripled. The Q1 five-year average was also clearly exceeded. Two large acquisitions of shares drove the transaction volume up.

Düsseldorf’s real estate investment result was significantly boosted by two major share acquisitions: Canadian firm Brookfield Asset Management acquired around 92 percent of the German Alstria Office REIT and Austrian Immofinanz AG sold around 53 percent of its company shares to Luxembourg based CPI Property Group. The Düsseldorf office real estate holdings of Alstria Office REIT alone contributed around EUR 853 million to transaction volume.

Contribution of office properties at 87 percent

Overall, office properties accounted for around 87 percent of transaction volume in Q1 2022. Never before has so much, namely a total of around EUR 1.32 billion, flowed into this asset class in the first three months of a year. Logistics and industrial properties lag far behind as the second-strongest asset class. In the Düsseldorf logistics market area, which also includes the surrounding region, the transaction volume for this asset class totalled around EUR 110 million or 7 percent in the first quarter. Here, too, the transaction volume more than tripled compared to the equivalent last year. Transactions in the retail segment continue to be very restrained (just under 1 percent).

Angelo Augenbroe, Head of Capital Markets in Düsseldorf bei Cushman & Wakefield, explains: "With the two major share acquisitions, the exceptionally strong quarterly result has laid a promising foundation for a dynamic investment market in 2022. Looking at the sales pipeline, the Düsseldorf office market will gain further momentum, as the number of individual transactions has been relatively moderate so far. The current market environment - high inflation, rising borrowing rates, possible interest rate turnaround by the European Central Bank and geopolitical tensions in Europe - are also taken into account in the purchasing scenarios of institutional investors. Demand for core assets in established submarkets with good potential for value appreciation and tenants with strong credit ratings will therefore intensify further over the course of the year."

No further yield compression in the course of the year

The prime yield for high-quality and modern core office properties is currently unchanged compared to the first quarter of last year at 2.90 percent. Compared to the previous quarter (Q4 2021), the prime yield has already risen by 10 basis points.

For office properties in B locations and away from the established office submarkets, purchase price discounts have been noted. Here, the prime yield is currently 4.20 percent, having risen by 30 basis points in the past twelve months. Primarily, rising borrowing costs are already having an impact on office yields and are weighing on institutional investors' willingness to pay. The prime yield for core office properties is expected to remain static until the end of the year.

The prime yield for prime retail properties is 3.65 percent as of Q1 2022. Prime logistics yields have compressed by a further 30 basis points over the past twelve months to 3.00 percent. For both asset classes, static to slightly compressing yield development is expected over the remainder of the year.