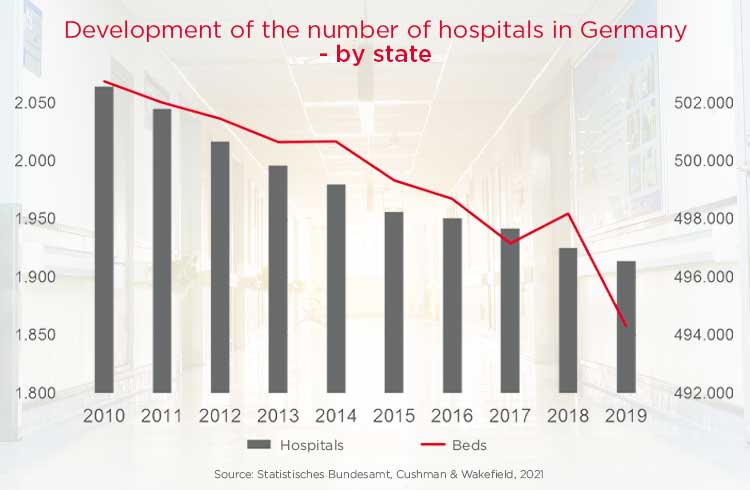

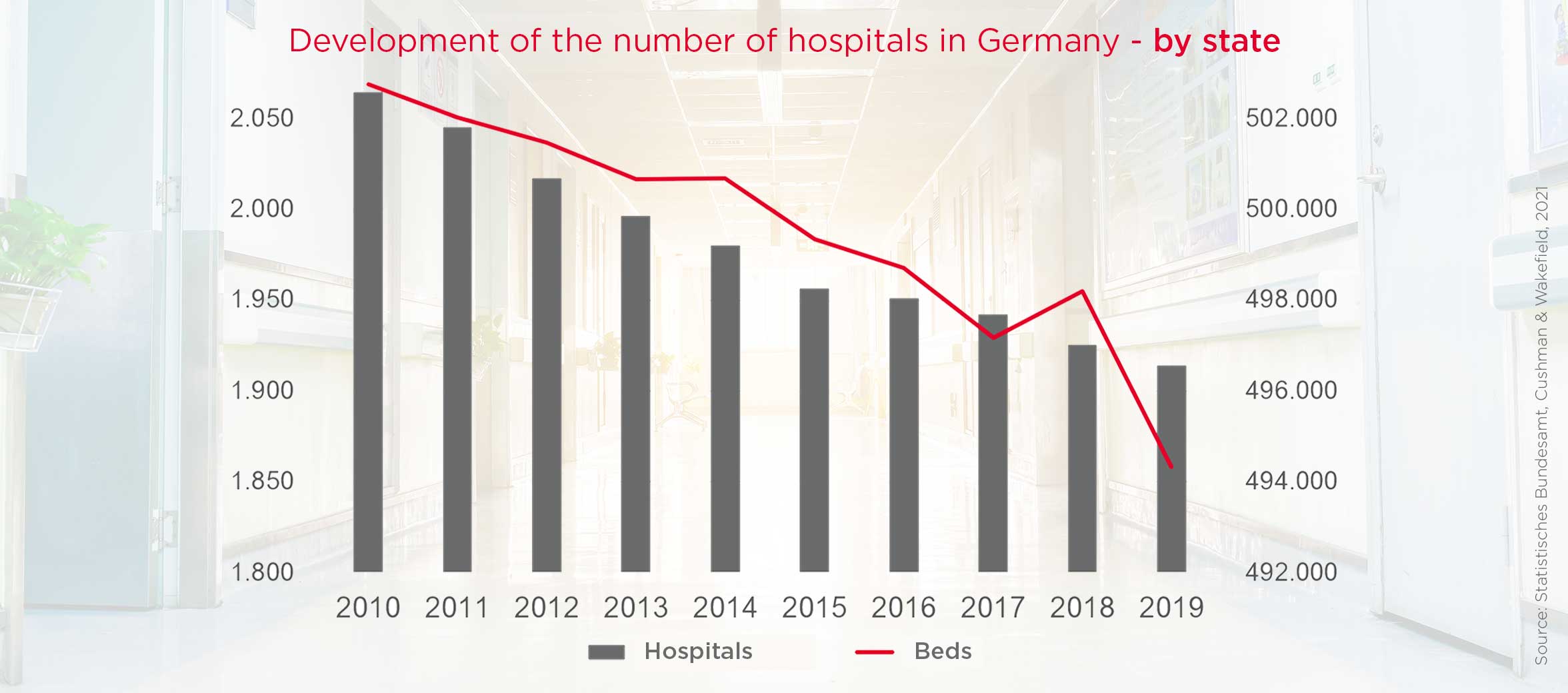

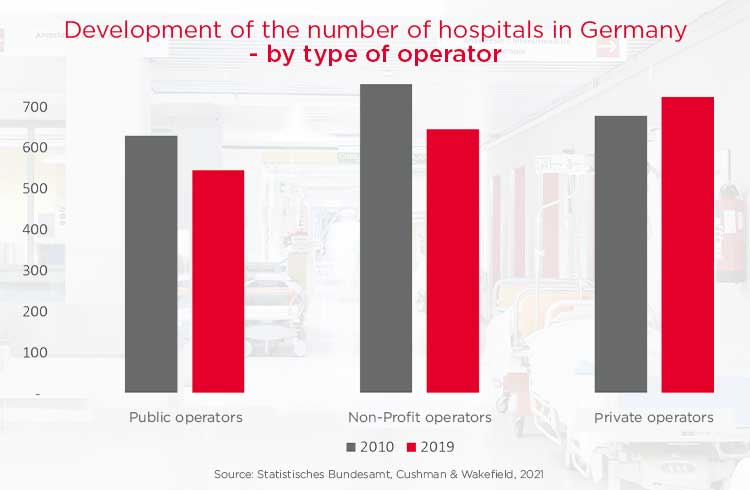

The German market for medical care services is undergoing profound structural change: regional overcapacities, loss-making hospitals, rising operating costs, a sometimes significant investment backlog in real estate and a shortage of staff, at least regionally, characterise the care landscape. At the same time, the federal, state and local governments are striving for a nationwide needs-based and efficient care structure. Public debates are becoming louder, not least fuelled by the COVID 19 pandemic, which exposed weaknesses in the health system. Is the German health system crisis-proof? Does it really make sense to reduce (excess) capacity? Or is it in society's and the national economy's interest to retain reserve capacity in case of a third wave or a new pandemic?

The federal government's hospital structure fund is intended to finance the reduction of overcapacities in inpatient care with up to two billion euros by the end of 2024. According to the guiding principle "outpatient before inpatient" from the Social Code, care is shifting towards medical care centres. These are to make the treatment of patients more efficient by combining specialisations and cooperating closely with rehabilitation facilities. Medical services in cities, and particularly in rural regions, should still remain available and accessible, but with optimised costs and higher quality.