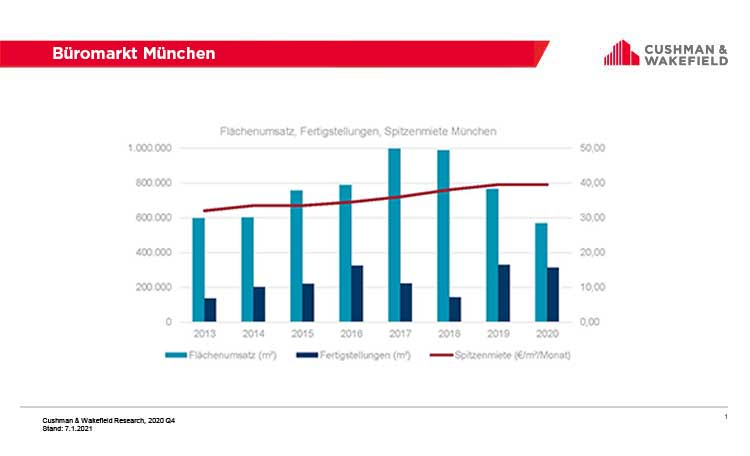

International real estate consultancy firm Cushman & Wakefield reports take-up of 101,000 square metres in the Munich office market in the fourth quarter, which maintains the downward trend in terms of take-up this year. Q4 2020 thus the weakest quarter since the turn of the millennium. Take-up for 2020 as a whole, at 567,000 square metres, is 34 per cent below the five-year average of 859,000 square metres. Compared to the previous year's 766,000 square metres take up fell by 199,000 square metres or 26 per cent. This makes 2020 the weakest year since 2009.

Hubert Keyl, Munich branch manager at Cushman & Wakefield Germany, says: "As expected, take-up continued to decline due to the ongoing Covid 19 uncertainties. Major deals were therefore conspicuous by their rarity." While 162,000 square metres of take-up was achieved via lettings in the over 10,000 square metre size category in the current year, a similar level to the previous year, this is still a far cry from the results achieved in 2017 and 2018, when more than 250,000 square metres were let in these size categories in each case. "In times such as these, it is difficult for large corporations to base their future forecasts on solid data," says Hubert Keyl. For the total of seven large-space lettings which did take place, it should be noted that five of these were pre-lettings in city centre development projects. These include, among others, the leasing of 31,300 square metres by KPMG in the "Optineo" project in the Werksviertel district at the beginning of the year.

Numerous lettings in development projects in the City Centre East submarket

In addition to the above-mentioned development project pre-leasing by KPMG in Werksviertel, other large-scale pre-leasings, among others in "Macherei" in the Munich Art District and in "I-Campus" in Werksviertel, contributed to an above-average take-up in City Centre East. There, the total annual take-up rose by 66 percent to 108,000 square metres. This makes City Centre East the submarket with the highest demand in 2020, followed by City Centre West, which ranks second despite a decrease in take-up, and City Centre North. Due to a decline in take-up in the other city centre submarkets, however, the city centre as a whole followed a negative trend. Take-up fell by nine per cent compared to the previous year and stood at 304,000 square metres at the end of the year. Nevertheless, more than half of the annual turnover is still accounted for by the city centre area (2019: 44 per cent).

Wider urban area and surrounding region in sharp decline

A particularly sharp decline was recorded in the rest of the city. Here take-up of 117,000 square metres was recorded, which is 42 per cent less than the previous year. In Munich’s hinterland a take-up of 146,000 square metres was registered. This corresponds to a decrease of 36 per cent compared to the previous year. This means that the Munich hinterland contributed 26 percent to the annual result, falling from the previous year's figure of 30 percent.

Prime rent remains stable, average rent rises to € 21.45 per square metre and month

Despite the Covid-19 pandemic, the prime rent remained stable throughout 2020 at € 39.50 per square metre per month; a historically high level. Similar to the prime rent, the weighted average rent has also defied the Covid-19 pandemic so far. At the end of the year, it stood at € 21.45 per square metre per month, an increase of € 1.50 or 7.5 per cent over the year. However, a change in rent incentives in the office market is also apparent. Hubert Keyl says: "The willingness of landlords to grant incentives is increasing. So we are seeing ever more rent-free periods of three or six months' rent with lease terms of five or ten years."

Construction activity remains at a high level

71,000 square metres of modern office space was completed in the Munich market area in the fourth quarter, of which around 10% is still available. This brings the total for 2020 to 314,400 square metres and is at a similarly high level to last year's figure of 330,000 square metres. Looking ahead to the coming year, Hubert Keyl says: "The volume of new construction in 2021 could reach a new post- millennium peak. There is currently more than 400,000 square metres of new office area under construction for completion in 2021." The pre-letting rate for this space was already close to 50 per cent by the end of 2020. In total, there is just under 900,000 square metres of modern office space under construction with completion scheduled for the next three years.

Take-up still low at the beginning of the year, then rising

"We expect a subdued start to the new year in terms of new space requirements. However, numerous deals that were not concluded last year due to the pandemic will be signed in the course of the year," says Hubert Keyl, regarding outlook for the coming year.