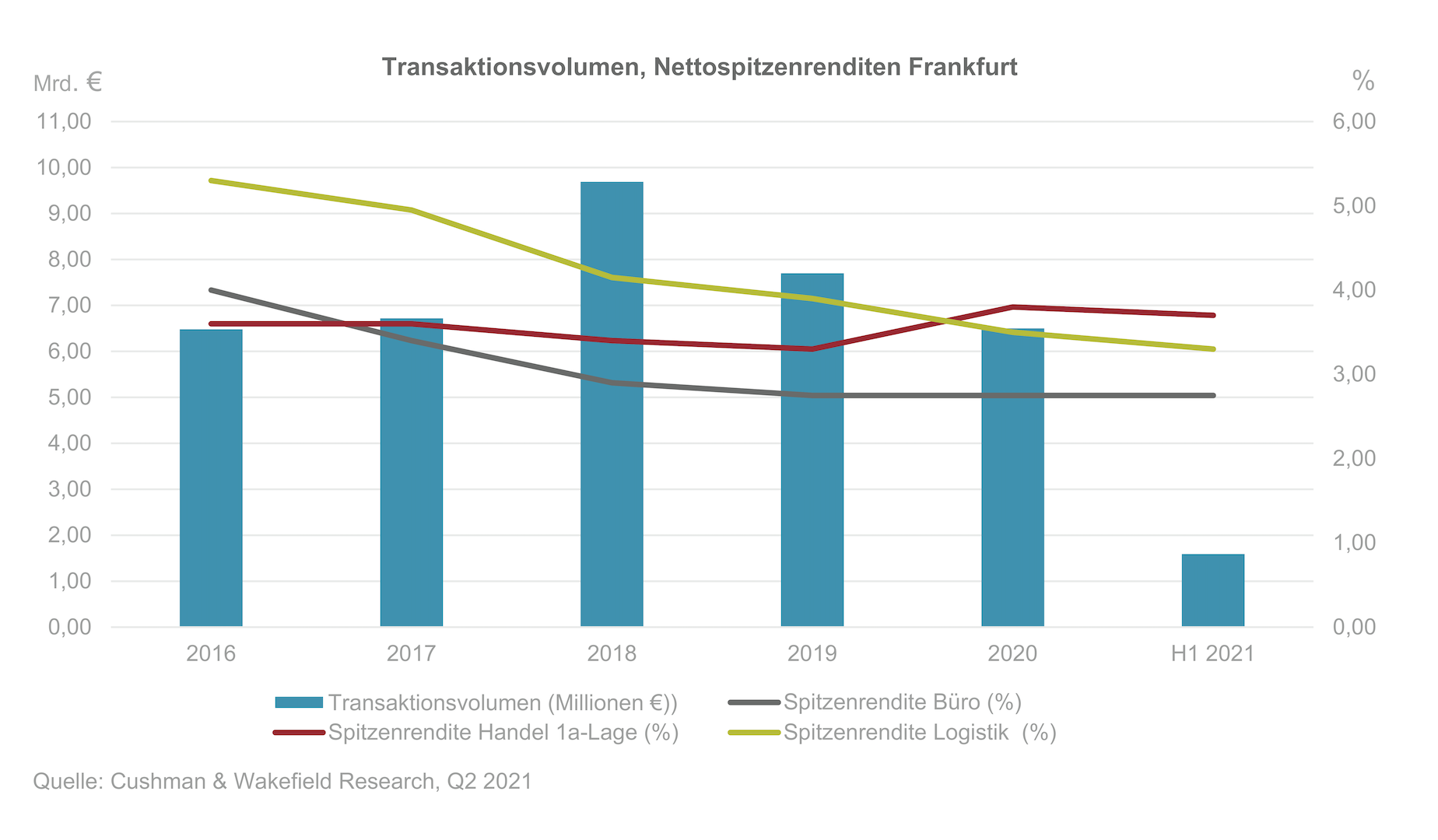

Transaction volume significantly below previous year's level

In the first half of the year, commercial properties and development sites in Frankfurt changed hands for 1.59 billion euros. This failed to match the 2.94 billion euros of H1 2020. The largest contributor to total transaction volume was office property, at 56 %. In the year to date, there have only been three office transactions in the three-digit-million-euro range, one of which was the acquisition of the Westend Carree office building by Ardian Real Estate from the Publity subsidiary Preos for over 200 million euros in the second quarter. The transaction volume for retail properties is low at 30 million euros, having been significantly influenced by pandemic-related uncertainties. In the logistics and industrial real estate segment, a transaction volume of 157 million euros was registered in the first half of 2021, which corresponds to a share of just under 10%.

Some large-volume transactions

Four sales above the €100 million mark were transacted in the first half of the year; one mixed-use property and three office properties. Together these contributed 50% of total volume. A further driver of the Frankfurt market was the segment from 25 million to 50 million euros, contributing 23% of total volume. Foreign capital accounted for 26% of total transaction volume in H1, a very substantial fall in comparison with the last five years, where foreign investors contributed between 41 % and 63 %. The strong demand for low-risk properties is reflected in the high proportion of core transactions, which account for around 43% of the total commercial real estate transaction volume. The shares of core+ and value-add properties were almost equal at 21% and 23% respectively.

Richard Tucker, branch manager and head of Cushman & Wakefield's Frankfurt investment team, explains: "Market activity was still subdued in the first half. There is sufficient capital on the demand side, but a lack of ready-made investment product on the supply side. This is especially true of the office asset class, which is in particularly high demand, as a significant proportion of leases have been postponed. As momentum returns in the letting market, investors' willingness to commit will also increase over the second half of the year. Riskier investments may also come back into focus. Nevertheless, the levels of both office transaction volume and total commercial transaction volume for the year as a whole will not match those of 2020."

The net initial yield for prime quality office properties in prime locations has remained unchanged at 2.75% since December 2019 and 4.45% in non-central locations. These values are also expected to remain unchanged in the second half of the year. The prime yield for logistics properties is 3.30% at the end of June. The demand for logistics services triggered by the COVID-19 pandemic and the resulting competition for logistics properties put great pressure on yields, causing them to compress by 60 basis points over the last twelve months. We expect a further slight compression to the end of the year. The prime yield for city centre commercial properties is quoted at 3.70 % and is thus static compared to a year previously.