Low transaction volume in Hamburg's investment market

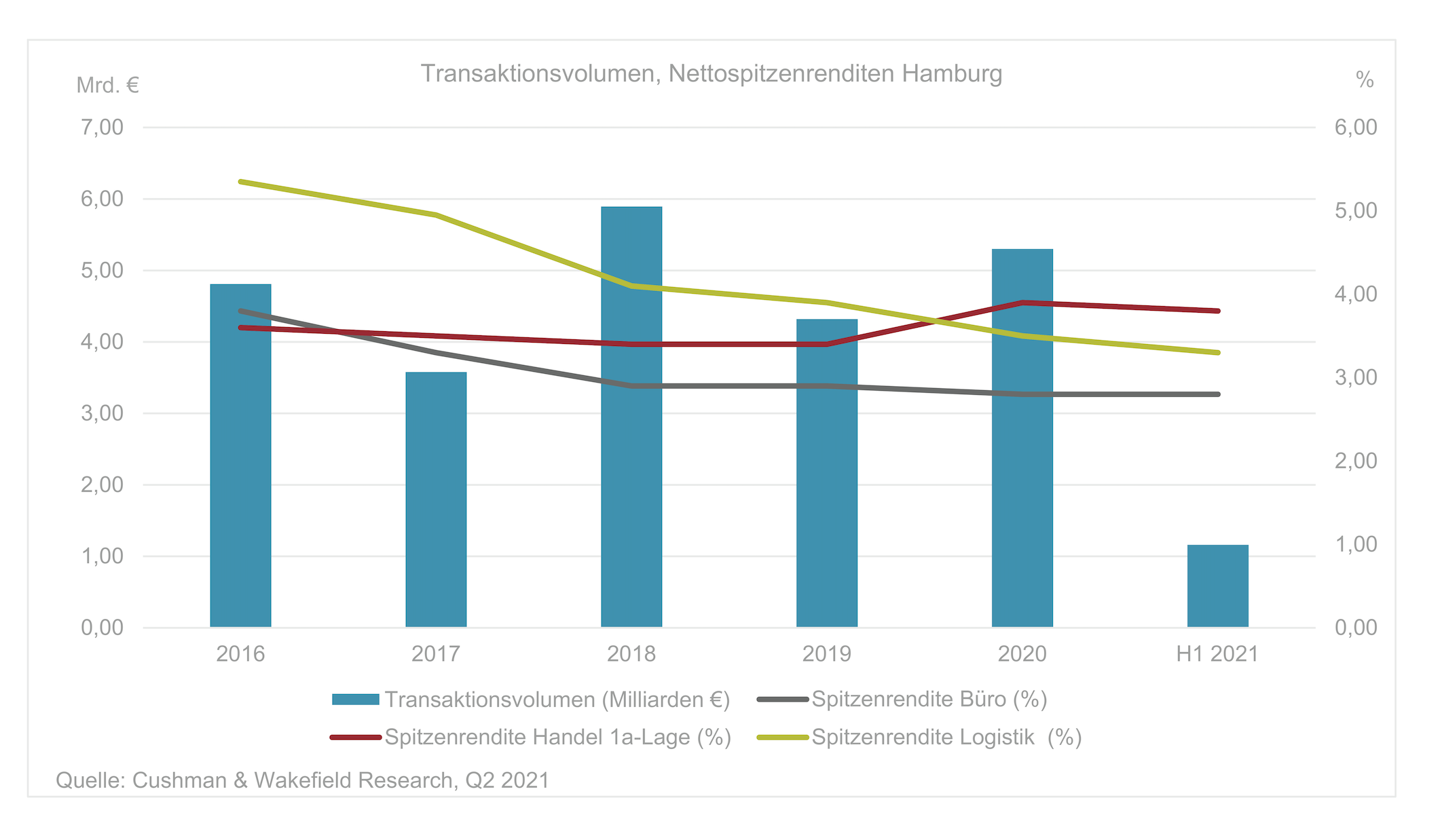

Following record turnover in Hamburg's commercial investment market in the first half of 2020, this year's mid-year figure is 43% lower at around €1.16bn. This means that the transaction volume lags behind the 5 and 10-year averages by 34 % and 24 % respectively. In contrast to last year, when investments were largely concentrated in city centre locations, a large proportion of the investment volume (over 30%) was transacted in the eastern city locations in H1 2021.

Offices were again the asset class with the highest transaction volume. In total, around €460 million was invested in office properties and development projects to mid-year, corresponding to 40% of the total. Compared to the first half of 2020, the result is a decline in turnover of around 55%. The reason for this is primarily the low number of large-volume transactions of office properties in the three-digit-million-euro range. So far, only the sale by the Oetker Group of the Hamburg Süd Haus property to Union Investment in the City submarket in the first quarter for around 155 million euros falls into this size category.

Transaction volume for logistics and industrial properties was above average, accounting for 34% of the total of 390 million euros. A significant contribution to this was made by the sale by Fiege Logistik to the DWS Group of the Spectrum logistics centre in an eastern city location for around 189 million euros in the second quarter.

The transaction volume for retail properties contributed around 9% of the total via a volume of 102 million euros in H1. Compared to last year, this is a fall of 51%, the reason being primarily the lack of suitable properties.

Marc Rohrer, Head of Capital Markets and Branch Manager of Cushman & Wakefield in Hamburg, explains: "In the course of the year to date, investors' attention was primarily focused on core and core+ properties, but there was a lack of corresponding product availability. This slowed potential market activity and capped the transaction volume. Investors’ strong risk aversion is reflected in the more than 80% proportion of transaction volume for core and core+ properties in H1. In addition, there were not many large-volume deals. Even though there are some large transactions in the pipeline, the demand overhang for core properties will continue to characterise the second half of the year, which leads us to expect a lower transaction volume for the year as a whole than those of recent years."

Excess demand for core properties puts pressure on prime yields

The net initial yield for prime office properties in Hamburg's central locations has been stable at 2.80 % since the beginning of 2020, while in the non-central locations it is currently 3.90 %. In view of the consistently high demand for highly attractive core office properties with stable cash flows and tenants with strong credit ratings, yields are expected to compress slightly over the remainder of the year. The excess demand for logistics properties is similarly noticeable. The yield for high-quality logistics properties was 3.30% at mid-year. Compared to the same point last year, it has fallen by 60 basis points. The prime yield for city centre commercial properties is currently 3.80%