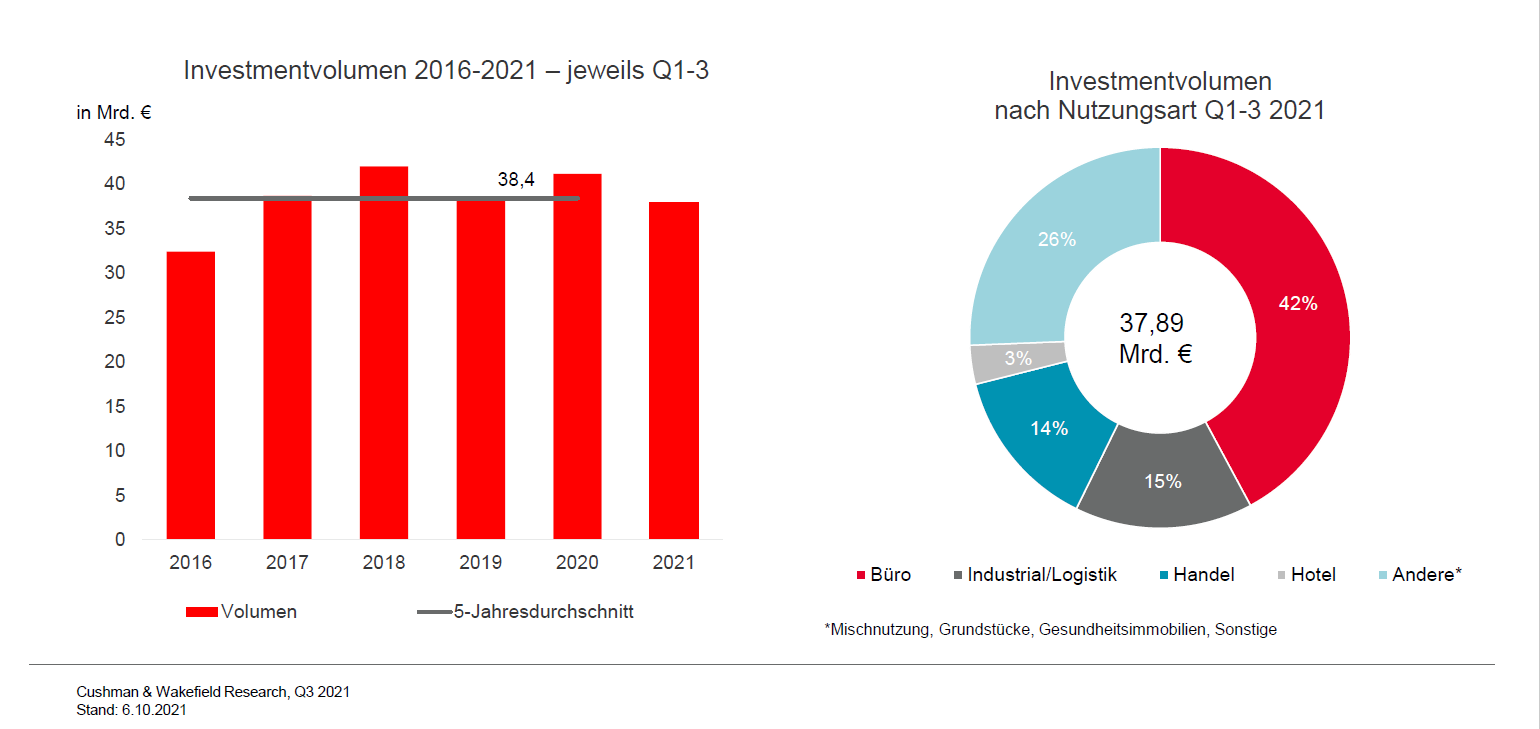

According to research by the international real estate consultancy firm Cushman & Wakefield (C&W) 2021, commercial real estate and development site transaction volume in Germany totalled around €37.9 billion to the end of September. This fell short of the previous year's equivalent result of EUR 41.1 billion by around eight per cent. The average value for the first nine months of the previous five years was missed by around two percent. However, the current figure is still 24 per cent above the Q1-Q3 ten-year average.

Large deals as drivers in the third quarter

With a total volume of EUR 15.8 billion, the third quarter was the strongest of the current year so far (Q1: EUR 9.5 billion, Q2: EUR 12.5 billion). This is due to some very large-volume transactions, such as the sale of the Frankfurt T1 for around EUR 1.4 bn to Allianz Real Estate. In addition, some portfolio transactions in the upper three-digit million euro range were agreed in the 3rd quarter, including Aggregate taking an 85 percent stake in ten development projects, including eight with planned commercial use, and x+bricks acquiring a portfolio of 34 former Real stores. In total, the eleven largest transactions of the first nine months of the year accounted for approximately EUR 9 billion, around a quarter of the total volume.

Prime yields remain low

The median prime yield for office properties in the top seven cities is currently 2.80 per cent, 14 basis points lower than at the same point last year. Munich is the most expensive market (2.50 per cent). Cologne (3.00 per cent) and Stuttgart (3.15 per cent) are comparatively the cheapest markets.

For logistics properties, the mean level of prime yields has fallen by 55 basis points in the past twelve months to the current 3.11 per cent. The gap between median office (2.80 per cent) and median logistics property yields has more than halved in this period from 72 basis points to 31 basis points, underlining how intense the competition among investors for logistics properties is. With the exception of Stuttgart (3.20 per cent), 3.10 per cent applies to all top locations.

The mean value of prime yields for first-class commercial properties is currently 3.63 per cent, seven basis points lower than at the end of September 2020, ranging from 3.15 per cent in Munich to 3.80 per cent in Düsseldorf, Cologne and Stuttgart.

By the end of the year, C&W expects further, but predominantly slight, yield compression due to the unabated high demand pressure for prime properties in the main use classes.

Industrial more popular than retail

The office segment remains the most popular asset class for investors. A transaction volume of around EUR 16 billion was achieved here, which corresponds to 42 per cent of total transaction volume in the first three quarters of 2021. Competition remains high for properties with crisis-proof tenants and long-term leases, as well as for properties in central locations with good transport links.

The second-strongest sector is industrial properties, which were in third place in the same period last year, well behind retail properties. Transactions involving warehouses, light industrial properties and distribution centres amounted to a volume of around EUR 5.7 billion. Their share of total turnover is 15 percent.

Retail properties follow at 14 percent. Here, market activity increased significantly in Q3 2021. In addition to the large number of smaller and medium-sized transactions, C&W registered some large-volume sales, such as the sale of two retail park packages by Patrizia, which boosted transaction volume from EUR 2.1 billion to EUR 5.2 billion between the end of June and the end of September.

Hotels account for only 3.0 per cent of transaction activity so far this year.

International capital accounted for 37 percent of the transaction volume in the first nine months of 2021. This corresponds roughly to the level of last year (Q1-3 2020: 39 percent). European investors were particularly active.

Alexander Kropf, Head of Capital Markets at Cushman & Wakefield in Germany, commented: "We see continued high liquidity in the market. Given the current interest rate environment and the stable economic strength despite all of the current challenges, real estate retains its attractiveness to investors. Sustainability aspects are also increasingly a hot topic in the investment market. The previous 'nice-to-have' is becoming a 'must-have', even if measurable criteria catalogues are still lacking and the additional costs still have to be taken into account in many a business plan."

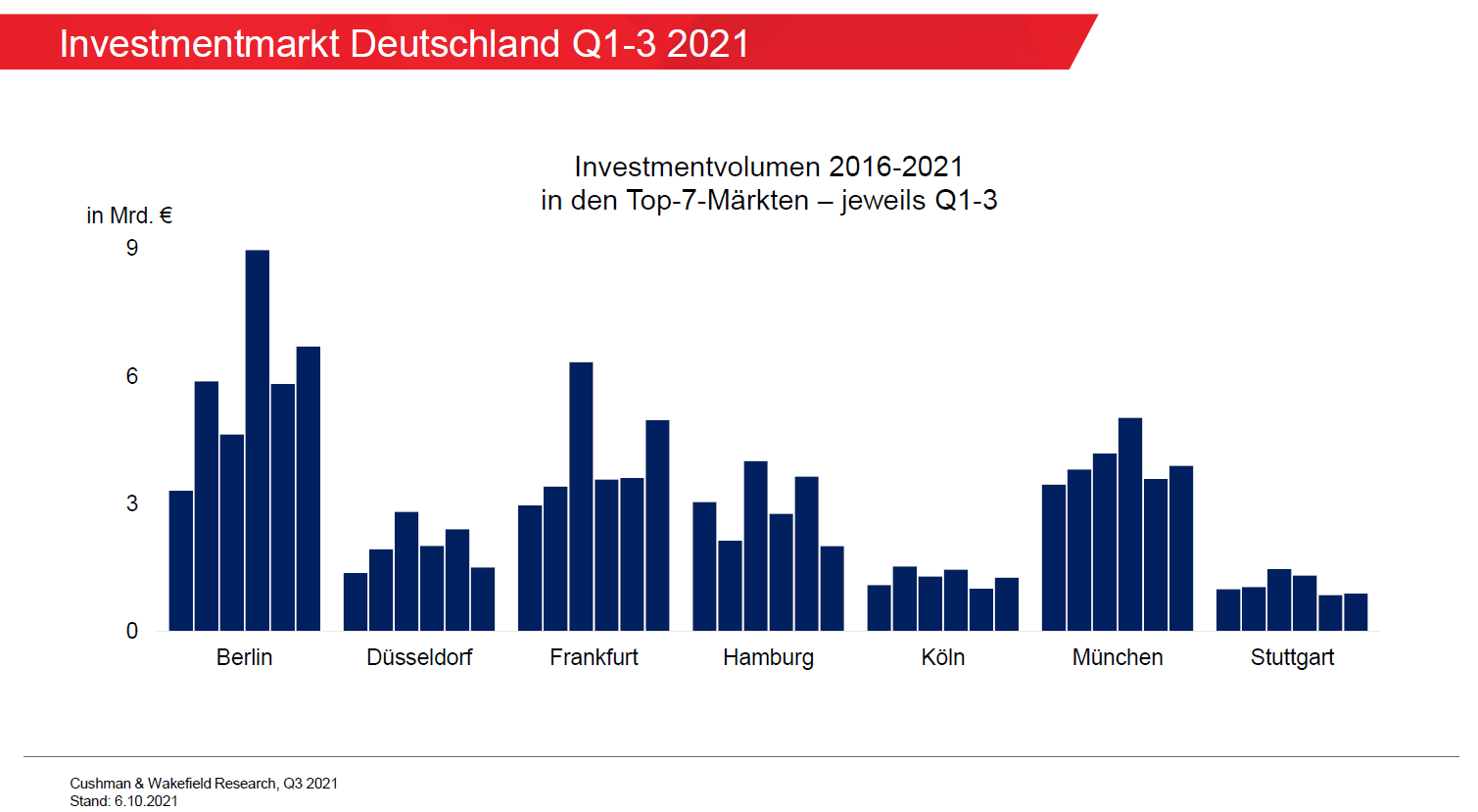

Berlin attracts the most capital - Frankfurt gains the most year-on-year

With a transaction volume of EUR 21.2 billion, the top seven markets contributed more than half of the total German volume, increasing their result by 1.5 per cent compared to the same period last year. Berlin leads the ranking unchallenged (EUR 6.7 billion), followed by Frankfurt (EUR 5.0 billion), Munich (EUR 3.9 billion) and Hamburg (EUR 2.0 billion) as well as Düsseldorf (EUR 1.5 million), Cologne (EUR 1.3 billion) and Stuttgart (EUR 885 million). Among the top-7 markets, only Hamburg and Düsseldorf remained below the levels achieved in the same period last year. Frankfurt and Cologne saw the most marked increases on their previous year's results.

Transaction volume forecast reaffirmed

C&W reaffirms the forecast made in summer that the transaction volume will rise to well over EUR 50 billion by the end of the year.