Transaction activity in Düsseldorf's commercial real estate market was subdued in Q3 2021, with office properties remaining the strongest use type, reports real estate consultancy firm Cushman & Wakefield. Commercial properties in all risk classes were traded.

Low transaction volume in the 3rd quarter

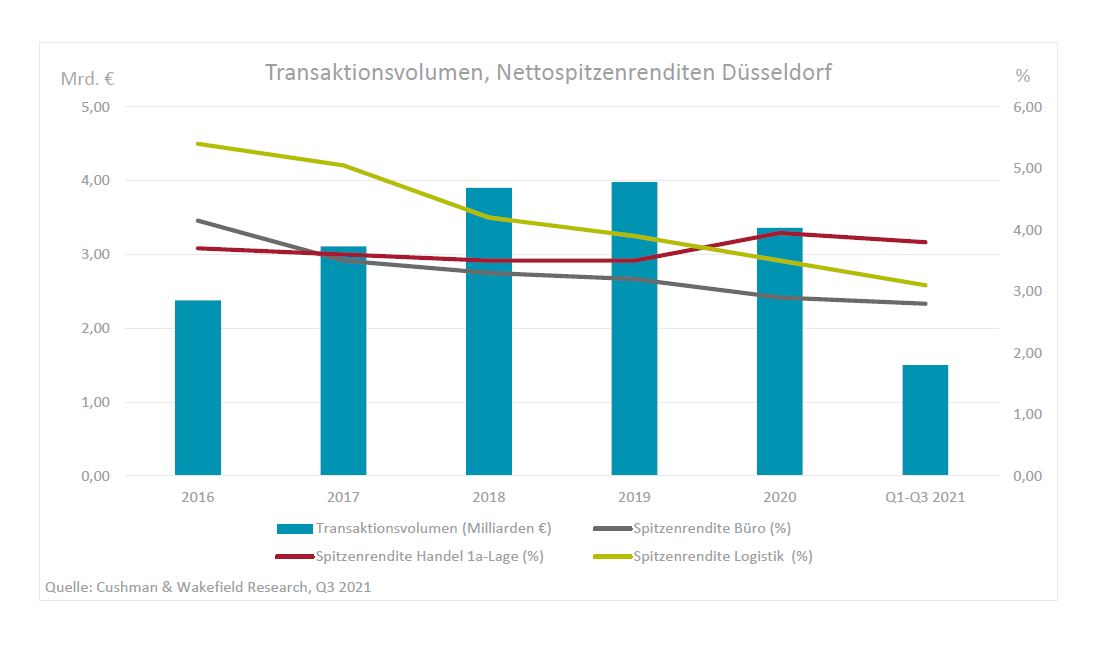

Between July and September 2021, only around EUR 371 million was transacted in commercial property sales in Düsseldorf. This makes the third quarter the weakest of the year so far in terms of investment volume, also due to a lack of large transactions. Overall, the commercial investment market in Düsseldorf achieved a transaction volume of around EUR 1.5 billion in the first three quarters of 2021. Compared to last year, this corresponds to a decline of almost 38 percent.

Office properties remain the focus of investor interest and at the same time represent the strongest use-type. In the first three quarters, a total of around EUR 866 million was invested in office properties, contribution 58 percent of total transaction volume.

The sale of the HSBC headquarters and the "Smart Office" office development project in the second quarter remain the two largest transactions of the year so far, with a volume of over EUR 100 million each.

Strong declines in volume were recorded in retail properties. In the course of the year so far, their contribution has unfortunately amounted to just under three percent of total transaction volume. Logistics and industrial transactions in contrast contributed almost ten percent. In the first nine months, land sales have once again proven to be the second-strongest asset class. with a transaction volume of around EUR 377 million, contributing 25 percent of total investment.

Angelo Augenbroe, Head of Capital Markets Düsseldorf at Cushman & Wakefield, explained: "We are currently observing that investors are becoming involved in a broad spectrum of risk classes. In the first nine months, all risk classes, from core to opportunistic, were represented in almost all asset classes. Low-risk investments in the core category accounted for around 22 percent of total transaction volume. A remarkable 91 percent of all core sales were office properties. Only the very limited supply of core properties is holding back higher transaction volume. At the same time, we are noticing longer due diligence processes for riskier investments, so that one or the other transaction has been postponed to the fourth quarter. The number of high-priced core sales will probably remain modest until the end of the year. At the same time, we expect an exciting final quarter with increasing investment pressure on the demand side and a well-filled investment pipeline, especially aside from core properties. We are therefore sticking to our full-year forecast for 2021 of a commercial real estate transaction volume of around EUR 2.6 billion."

Yield compression in office and logistics

The very high demand for real estate investments has led to further compression of prime yields for high-quality core properties in the year to date. However, yield compression has been very different for the three types of use: office, logistics and retail.

The prime yield for high-quality core office properties with highly creditworthy tenants and long-term leases was 2.80 percent at the end of the third quarter. Compared to the same period last year, this corresponds to compression of 20 basis points.

The "run" on logistics properties can also be observed in Düsseldorf, although the strong impetus is not yet reflected in the transaction volume. Nevertheless, institutional investors are prepared to pay very high purchase prices for modern, high-quality logistics properties. Currently, the prime yield is 3.10 percent, 55 basis points below the level of the previous year.

Prime yields for 1-A retail properties have stabilised in Q3 2021 and are even exhibiting slight yield compression again. In the past 12 months, the prime yield has decreased by 10 basis points to 3.80 percent. Due to the Covid-19 pandemic, tenant occupancy has become a particularly strong and decisive factor in investors' purchase price and decision-making processes.

In view of the high investment pressure from numerous institutional investors, demand is expected to be particularly high in the final quarter. Further slight declines in yields can therefore be expected, especially for logistics properties.