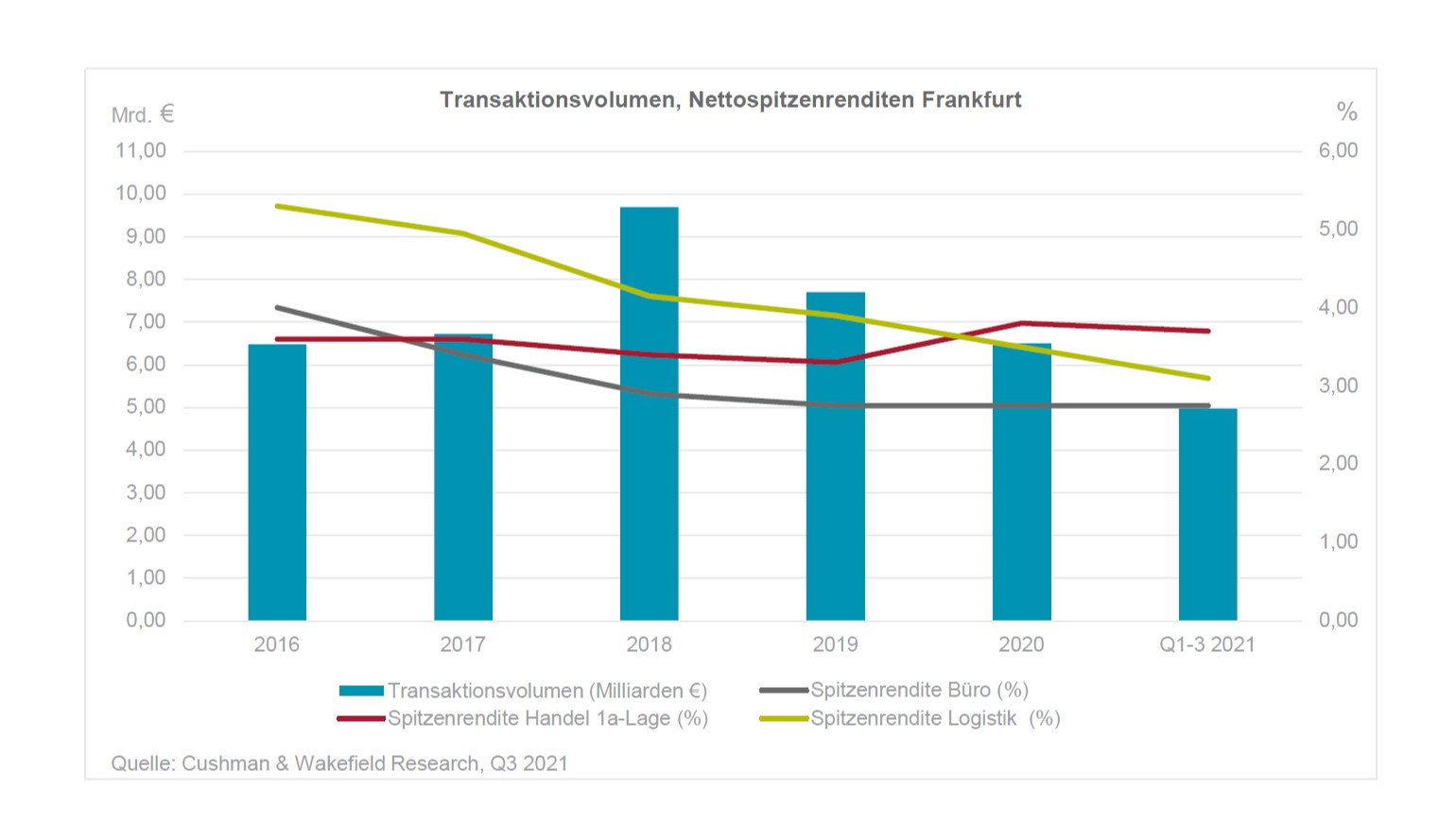

The sale of "T1" in the FOUR high-rise ensemble by Groß & Partner to Allianz and Bayerische Versorgungskammer at a price of EUR 1.4 billion made a significant contribution to investment volume for the first three quarters of 2021 in the Frankfurt commercial real estate market being significantly higher than last year. The transaction volume of EUR 4.96 billion exceeded the previous year’s figure by around EUR 1.3 billion or approximately 38 percent, according to the international real estate consultancy firm Cushman & Wakefield (C&W). The third quarter alone accounted for more than EUR 2.4 billion.

Largest single transaction in Germany makes one forget the weak 1st half-year

The sale of "T1" is also the largest single transaction ever registered in Germany. Together with the sale of the "Skyper" for around 550 million euros, contributing about 40 percent of the total transaction volume of the year to date. In addition, there were numerous deals in the range of EUR 20 million to EUR 50 million.

Office segment accounts for around 80 percent of take-up

The Frankfurt investment market is clearly dominated by office properties, which accounted for around 80 percent of the transactions recorded by C&W so far this year. With the upcoming sale of the "Marienturm", the next major high-rise deal is already on the horizon. If this transaction is completed in 2021, a total transaction volume above last year’s of 6.5 billion euros can be expected. Retail and hotel properties will only account for a small proportion. Transactions in these two asset classes only contributed less than EUR 200 million in the first three quarters.

Richard Tucker, Head of Capital Markets Frankfurt at Cushman & Wakefield, summarises: "The Covid pandemic has reinforced the discrepancy between product and capital. The market activity with its clear focus on the sought-after core properties in central locations reflects this. In addition, bidding processes are causing significant price increases. As a result, further yield compression is to be expected for the prime locations, which will subsequently spill over to the neighbouring submarkets."

Yields remain stable

The net initial yield for prime office properties in prime locations has been stable at 2.75 per cent since the end of 2019. C&W expects a slight softening here by the end of the year. In non-central locations, a level of 4.45 per cent will be reached.

The yield for high-quality logistics properties is quoted at 3.10 per cent at the end of the third quarter, which corresponds to a fall of 20 basis points compared to the previous quarter. A further slight increase in prices is also expected for this asset class by the end of the year.

The prime yield for city centre commercial properties is currently at 3.70 per cent and is expected to remain stable for the remainder of the year.