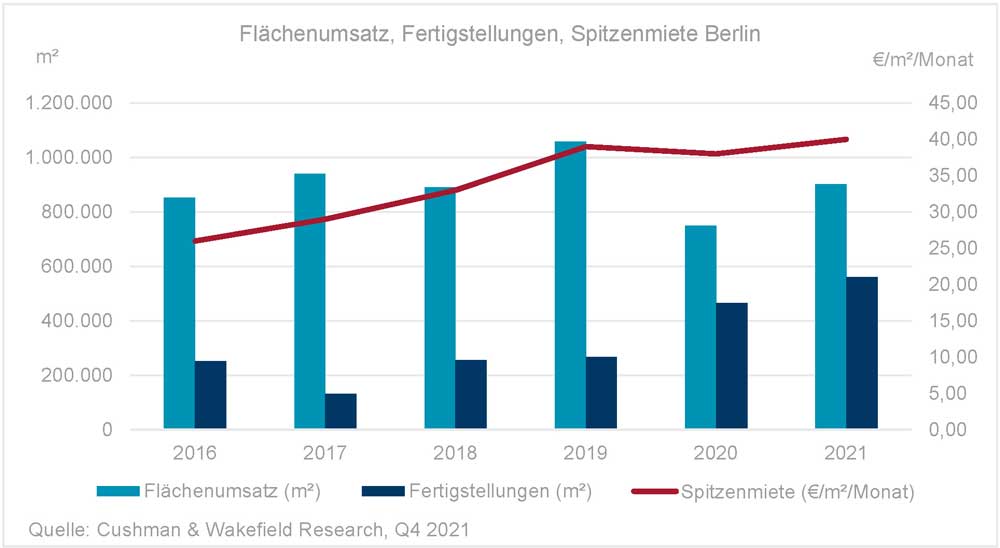

International real estate consultancy firm Cushman & Wakefield (C&W) noted 902,500 sq m of take-up in Berlin’s office letting market in 2021. This is 20 percent more than in 2020 and roughly matches the five-year average. In view of the subdued first half of the year with a take-up of 372,500 sq m, this was a surprisingly good overall result. This was largely due to the strong 4th quarter with 318,600 sq m of take-up, which corresponds to an increase of 51 percent on the previous quarter. This figure is only exceeded by the record-setting Q3 2019 with 383,800 sq m.

Prime rent again at EUR 40.00/sq m per month – average rent at record high

The achievable top rent is EUR 40.00/sq m per month. This means that it is EUR 2.00 higher than twelve months earlier and EUR 1.00 higher than in the 3rd quarter. After a temporary decline, it has now re-attained the record level of early 2020. In addition, the area-weighted average rent climbed to a record high of EUR 27.55/sq m per month, rising by EUR 0.60 compared to the previous year and by EUR 1.00 compared to the previous quarter.

Big tickets return

Numerous major deals marked the 4th quarter. Eight lettings of 10,000 sq m or more contributed a total of 114,600 sq m. Areas between 3,000 sq m and 10,000 sq m generated a further approx. 80,000 sq m of take-up in the 4th quarter. Smaller space lettings had already reached the pre-pandemic level in early 2021.

Donn Lutz, Head of Office Agency Berlin at C&W, on the background to the strong 4th quarter: "Many large users postponed their location decisions at the beginning of the pandemic. However, the return of employees to the office, employee growth or expiring leases have now intensified the pressure to act in some companies, which has increasingly led to leases being signed. As a result, the rented space is often to be occupied in a timely manner, before the end of 2022."

Vacancy rate increased significantly year-on-year but fell from Q3 to Q4

At the end of 2021, the vacancy rate including space offered for subletting was 3.5 percent. In the Berlin office market, 701,300 sq m is available at short notice, 181,400 sq m or 35 percent more than at the end of 2020. However, due to the very high take-up, absolute vacancy and the vacancy rate fell by 35,200 sq m or from 3.8 percent to 3.5 percent from the 3rd to the 4th quarter of 2021. This is the first decline in eleven quarters. However, this does not yet represent a trend reversal as the high level of new construction in the coming years will add further to stock and range of product on offer.

61 percent or 425,800 sq m of the office space available at short notice is in properties within the S-Bahn ring. Since the peak in the 1st quarter of 2021, the contribution of offers for subletting to overall vacancy has fallen from 15.9 percent (89,800 sq m) to 5.7 percent (39,900 sq m).

High level of new construction continues into the new year

Completions in new construction and core renovation projects totalled 560,300 sq m in 2021, of which 114,700 sq m or 20 percent was still available at the end of the year. Development projects totalling 1.76 million sq m are currently under construction. Of the 850,000 sq m expected to be completed in 2022, 64 percent is already pre-let or allocated to owner-occupiers.