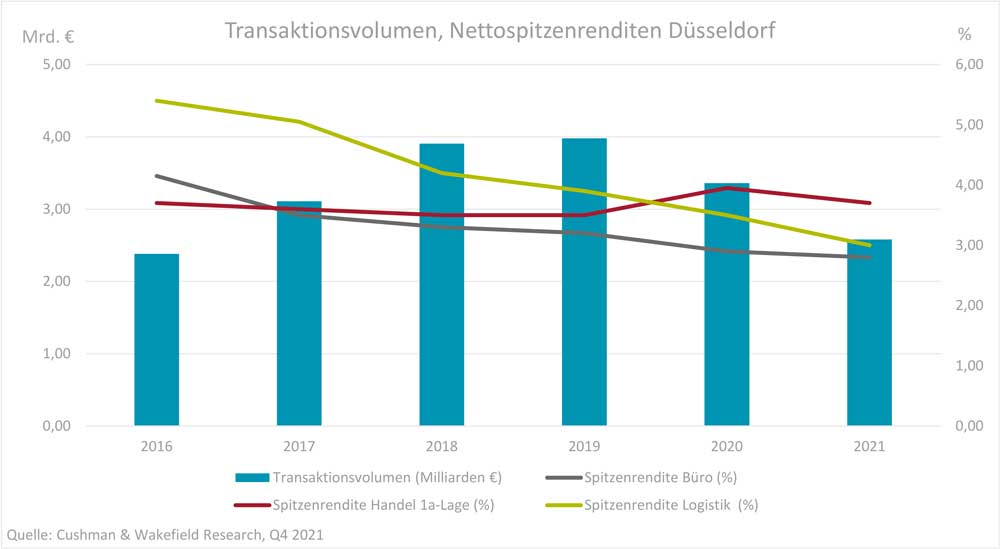

Three major transactions involving purchase prices of more than EUR 100 million ensured a successful 4th quarter of 2021 in the Düsseldorf investment market, reports international real estate consultancy firm Cushman & Wakefield. Transaction volume for the quarter amounted to around EUR 1.08 billion, making a significant contribution to the EUR 2.58 billion for the entire year 2021. The annual transaction volume corresponded with Cushman & Wakefield’s previous forecast. Compared to the previous year, this represents a decline of almost 23 percent.

Focus on office properties

Transactions of office properties dominated, generating a transaction volume of around EUR 1.76 billion for the year as a whole – this corresponds to almost 68 percent of the total commercial real estate transaction volume. Five of the six major transactions involving more than EUR 100 million concerned office properties.

Transactions involving logistics and industrial real estate achieved a market share of almost 10 percent in 2021.

In the retail sector, transaction volumes remained subdued. On the one hand, many investors continue to act cautiously, on the other hand, the range of saleable assets is limited. Overall, retail transactions in 2021 contributed just under 2 percent of the total.

Land and mixed-use real estate have held their own as the second-strongest asset class. With a transaction volume of almost EUR 500 million, their share of the total volume is around 19 percent.

Sustainability criteria are becoming increasingly important

"We are increasingly seeing a stronger focus on ESG criteria by investors in due diligence and negotiation processes," explains Angelo Augenbroe, Head of Capital Markets in Düsseldorf at Cushman & Wakefield. "In particular, institutional investors such as open-ended and special funds as well as insurance companies are coming under increasing pressure to acquire suitable assets. In the coming quarters we therefore expect a steadily increasing demand for real estate with high ESG compliance. The focus is on high-quality core office investments in very good and established office locations. With an increasing recovery in the office rental market, the greatest potential for rent increases can also be expected in this segment in the future."

Yield trends defy the pandemic

The uninterrupted high level of demand for real estate investments has led to further yield compression in the office, logistics and retail sectors in the course of 2021. The prime yield for core office properties was 2.80 percent at the end of Q4. Compared to the same period last year, this corresponds to compression of 10 basis points.

Prime yields for 1A retail properties have compressed by 25 basis points over the past 12 months to the current 3.70 percent. Nevertheless, the pre-crisis yield level of 3.50 percent has not yet been reached.

The prime yield for logistics real estate is currently 3.00 percent and is thus 50 basis points below the level of a year previously. As in previous quarters, yield compression is most pronounced in logistics real estate.

In view of the continuing high demand for real estate investments, the purchase prices for first-class core investments will continue to rise and prime yields will continue to fall slightly until the end of 2022. In contrast, slight yield premiums are to be expected for core+ and value-add segments and in peripheral locations, as investors still prefer low-risk investments in central locations. Here, the past year has shown that investors are still very selective. The rapid significant yield compression seen in the previous quarters is unlikely to continue, especially in logistics real estate.