A high level of demand, especially for first-class office and logistics properties in Hamburg commercial real estate market, met with seller caution due to the pandemic. Transaction volume in 2021 was therefore lower than it could have been, reports real estate consultancy firm Cushman & Wakefield (C&W).

Strong transaction volume in the 4th quarter

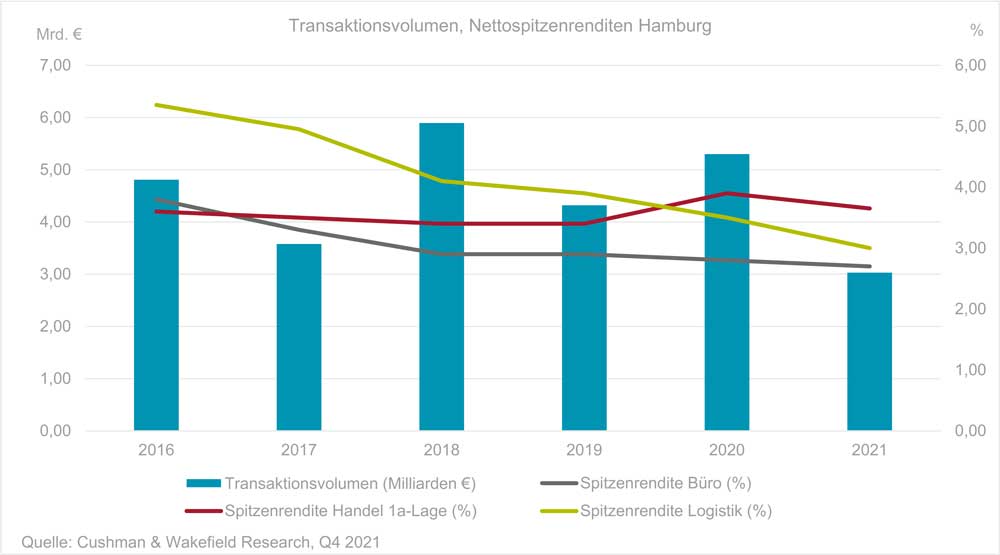

After a weak first half of the year (EUR 1.16 billion), the commercial investment market in Hamburg gained momentum in the 2nd half of the year (EUR 1.87 billion). With the 4th quarter the strongest of the year with a transaction volume of around EUR 1.03 billion. Nevertheless, the annual result for 2021 of EUR 3.03 billion remained below the strong prior-year figure of EUR 5.3 billion and 37 percent below the five-year average.

Investment focus on eastern city locations, central submarkets and offices

With 21 transactions and a good 19 percent of the transaction volume, one particular focus of investment activity in 2021 was in the city’s eastern locations. In the central submarkets, a slightly larger investment volume was achieved via only seven transactions (20 percent), as three of the six large-volume transactions of over EUR 100 million took place here.

In total, around EUR 1.9 billion was invested in office properties and development projects over the course of the year, which corresponds to an office real estate contribution of almost 63 percent to total investment volume. The largest office transaction and the second-largest deal in the overall market was the sale of Marquard & Bahls headquarters in the HafenCity submarket to J.P. Morgan Asset Management in Q4.

The second-strongest asset class was logistics and industrial real estate, at around EUR 500 million or 17 percent of the total volume. This exceeded the previous year's figure by more than 60 percent and more than doubled the five-year average. The sale of the Spectrum logistics centre by Fiege Logistik to DWS Group for around EUR 189 million in the 2nd quarter made a significant contribution to the unusually strong result.

The transaction volume generated by retail real estate reached just over 3 percent with a transaction volume of around EUR 100 million, slumping by 86 percent compared to the previous year.

In 2021 as a whole, 80 percent of the transaction volume was realised via Core and Core+ properties. However, due to the excess demand and supported by positive figures from the office rental market, investors also switched to value-add properties. The volume generated in this segment increased fivefold from the 1st to the 2nd half of the year to around EUR 420 million.

Marc Rohrer, Head of Capital Markets and Branch Manager of Cushman & Wakefield in Hamburg, explains: "In the highly sought-after Hamburg commercial property market, transaction volume was 43 percent lower in 2021 than in the previous year. The reason is the lack of core segment product, because due to the pandemic, sellers held back their properties. They are hoping for higher prices in 2022, especially for Core+ real estate. The Core and Core+ segments will remain a top priority for investors. In addition, there is a significant increase in demand for ESG-compliant assets. As a result, we expect a good transaction volume in 2022 on a par with the five-year average."

Prime yields for first-class office and logistics properties under pressure

The net initial yield for first-class office properties in Hamburg's central locations compressed by 10 basis points year-on-year to 2.70 percent, and to 3.90 percent in non-central locations. The strong investor interest in high-quality logistics properties caused the prime yield in this sector to decline by 50 basis points year-on-year to 3.00 percent at the end of 2021. The prime yield for city centre commercial buildings is currently 3.65 percent, which corresponds to compression of 25 basis points compared to the previous year.