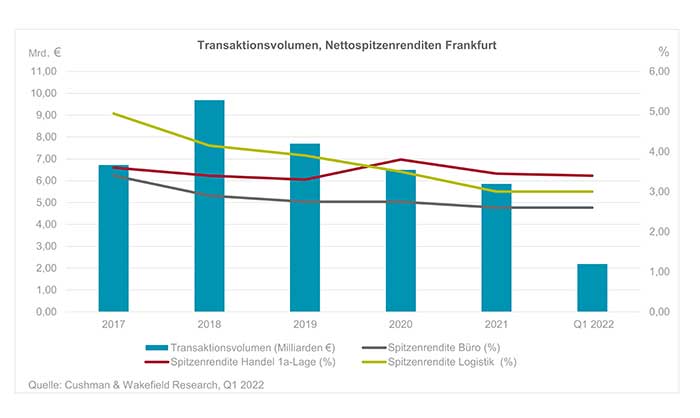

According to Cushman & Wakefield, Frankfurt’s commercial real estate transaction volume more than doubled year-on-year in Q1 2022 to around EUR 2.2 billion (Q1/2021: EUR 970 million). The result was significantly boosted by the takeover of alstria-office REIT-AG by Brookfield Asset Management, as a result of which numerous properties in Frankfurt changed hands. The largest single-property transaction was the sale of the Marienturm for over EUR 800 million to DWS for South Korean pension fund NPS.

Office segment dominates, strong industrial sector result

More than 80 percent of transaction volume in the first quarter was contributed by the office sector. At EUR 1.8 billion, the previous year's result for this asset class of EUR 735 million was very substantially exceeded. The eleven alstria-office REIT-AG office properties in the Frankfurt market area accounted for around 30 percent of transaction volume.

C&W noted industrial real estate transaction volume of around EUR 280 million in the first quarter. This already exceeds the result for the full year 2021 (EUR 260 million). In addition to the sale of a DHL logistics centre in Florstadt, a portfolio transaction of several corporate properties from Cilon to Beos, which also included properties in the Frankfurt market area, contributed to the result.

In the hotel segment, transaction volume was EUR 50m, falling short of the previous year's equivalent figure of EUR 125m by 60 percent. One of the few transactions was the sale of the former Meininger Hotel in the Europaviertel district to Blantyre Capital.

Alexander Kropf, Head of Capital Markets Germany at Cushman & Wakefield, summarises: "The subdued transaction activity in the final quarter of last year has led to a postponement of some transactions to Q1 2022. In addition to the alstria acquisition, this effect ensured an exceptionally strong quarterly result putting Frankfurt in top position among the top-7 cities. As the year progresses, more large-volume product will come to the market in the CBD and city district locations, but investors are likely to look even more closely at location criteria while requiring a creditworthy tenant mix with long lease terms in light of rising interest rates, immense geopolitical uncertainties resulting from the Ukraine war, and concerns about an economic downturn."

Yields stable compared to previous quarter

The net initial yield for first-class office properties in prime locations was unchanged compared to the previous quarter at 2.60 percent. In non-central locations, the prime yield also remained stable at 4.30 percent. However, the current developments in the financing environment due to higher interest rates will also have an effect on yields for office properties, if delayed. Particularly in prime locations, investors are likely to expand their equity share in response, due to the persistently low yield prospects of alternative forms of investment and the unchanged high level of liquidity in the market. Accordingly, C&W expects yields to remain static until the end of the year.

The yield for high-quality logistics properties remained unchanged at 3.00 percent at the end of the first quarter. A further slight yield compression of 10 basis points is expected for this asset class by the end of 2022.

The prime yield for city centre commercial properties fell slightly by 5 basis points compared to the previous quarter, to 3.40 percent.