In the 1st quarter of 2022, Hamburg’s real estate investment market generated a transaction volume of EUR 1.81 billion, an all-time high for a first quarter, reports real estate consultancy firm Cushman & Wakefield. The transaction volume of the prior-year quarter was exceeded threefold. The main driver was the acquisition of alstria office by Canadian asset manager Brookfield Properties. With this portfolio alone, more than 30 properties worth around EUR 1.5 billion changed hands. Other transactions totalling EUR 305 million are significantly lower and, considered alone, would be around 58 percent below the figure for the prior-year quarter.

Investment focus city centre

With 38 percent of the transaction volume, a major investment focus in early 2022 was the city centre submarket. Four properties of the alstria portfolio, each with a value of more than EUR 100 million, made a significant contribution to this. The next-strongest submarkets, in terms of transaction volume, were City Süd (17 percent) and St. Georg (7 percent), both also central locations.

Clear focus on office properties

Office properties were the most heavily traded asset class in the 1st quarter. A total of around EUR 1.6 billion was invested in office properties and development projects, which corresponds to 86 percent of total commercial real estate investment volume. The most expensive property was the office building at Alten Steinweg 4, which is also part of the alstria portfolio, with a value of EUR 155 million.

The second-strongest asset class was retail real estate, contributing around EUR 100 million or 6 percent of the total volume. This exceeded the previous year's figure by 54 percent and transaction volume has thus reattained the level of the Q1 five-year average.

Compared to last year, the logistics and industrial real estate asset class performed significantly worse. The transaction volume of EUR 95 million or 5 percent of the total volume, is still 19 percent above the Q1 five-year average, but is 40 percent below the figure for the prior-year quarter.

Marc Rohrer, Head of Capital Markets and Branch Manager of Cushman & Wakefield in Hamburg, explains: "Without the alstria acquisition, Hamburg’s investment market would have fallen significantly short of both the previous year's equivalent figure and the five-year average in the 1st quarter of 2022. Despite the political and economic uncertainties caused by the war in Ukraine, looking ahead we see a well-filled transaction pipeline. Significant investment opportunities were already discussed at MIPIM in March 2022 and further product is coming onto the market due to ESG-compliant realignments. We therefore expect a good transaction volume at the level of the five-year average for 2022 as a whole."

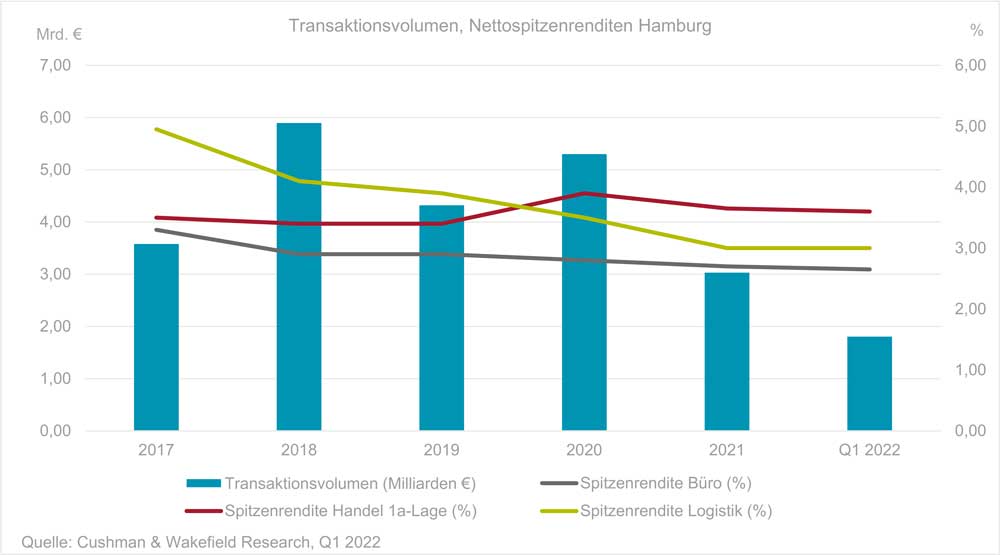

Prime yields for first-class office and logistics properties remain under pressure

The net initial yield for first-class office properties in Hamburg's central locations fell by 15 basis points year-on-year to 2.65 percent. In the course of the year, the already increased financing costs and the expected upward trajectory of the key interest rate are likely to have an inhibiting effect on further price increases. Continued investor interest in high-quality logistics properties has caused the prime yield for this segment to compress by 30 basis points year-on-year to 3.00 percent at the end of Q1 2022. The prime yield for city centre commercial buildings is currently 3.60 percent, which corresponds to a decline of 30 basis points compared to a year previously.