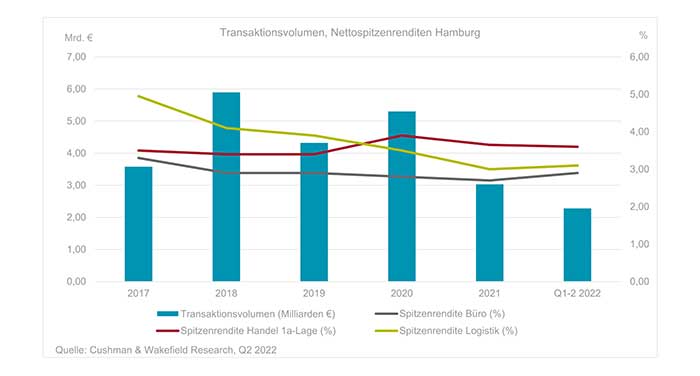

In H1 2022, Hamburg's CRE investment market achieved a transaction volume of EUR 2.28 billion, doubling the level of a year previously, reports international real estate consultancy firm Cushman & Wakefield.

The main driver was the acquisition of alstria office by the Canadian asset manager Brookfield Properties in the first quarter. In this portfolio alone, properties worth almost EUR 1.5 billion changed hands in Hamburg. The remaining transaction volume of EUR 811 million, considered alone, would be around 30 percent below the H1 2021 result and 49 percent below the H1 5-year average of EUR 1.6 billion.

Investment focus on city centre

With 39 per cent of the transaction volume, the focus of investment activity in the first half of 2022 was once again on the city centre submarket. Four properties from the alstria portfolio with a value of more than EUR 100 million each and the sale of the Klöpperhaus department store by Württembergische Lebensversicherung to Tishman Speyer contributed significantly to this. The next strongest submarkets in terms of transaction volume were City Süd (13 per cent) and Hamm / Rothenburgsort / Billbrook (8 per cent).

Office properties remain the strongest asset class in terms of transaction volume

Office properties and office development projects were the dominant asset class in the first half of the year with a total volume of EUR 1.64 billion. This corresponds to 72 percent of total CRE transaction volume. The most expensive property was the office building at Alte Steinweg 4, which already changed hands in the first quarter as part of the alstria acquisition with an individual value of EUR 155 million.

The second-strongest asset class was logistics and industrial real estate with around EUR 280 million or a share of 12 percent. Although this fell short of the previous year’s high figure of EUR 441 million by 37 per cent, it is 85 per cent above the H1 5-year average.

The retail real estate transaction volume contributed a good 11 per cent, at around 260 million euros. The weak previous year's figure was thus tripled and the H1 5-year average was also exceeded by 74 percent. The sale of the Klöpperhaus department stores' contributed significantly to this strong result.

Marc Rohrer, Head of Capital Markets and Branch Manager of Cushman & Wakefield in Hamburg, explains: "Thanks to the alstria takeover in the first quarter, the half-year result registered positive figures, but the mood in Hamburg’s investment market has been gloomy for some weeks. The economic and political environment brings imponderables for buyers and sellers, which has strongly undermined the willingness to invest. The increased financing costs are having an increasingly dampening effect on purchase prices, so that the price expectations of buyers and sellers are drifting apart. The market must first reset under these largely unprecedented circumstances. Thereafter, supply should increase in the 2nd half of the year and the market should pick up speed again, also due to the continuing investment pressure from investors."

Long phase of office real estate yield compression over

The net initial yield for prime office properties in Hamburg's central locations rose by 10 basis points compared to 12 months ago to 2.90 per cent, and by as much as 25 basis points compared to Q1. Taking into account the European Central Bank's announced exit from its current monetary policy, no easing is expected in the financial markets in the further course of the year. It is therefore assumed that prime yields will continue to rise. The prime yield for prime retail properties is currently 3.60 per cent and thus remains stable compared to Q1. For prime logistics properties, the prime yield is quoted at 3.10 per cent, which corresponds to an increase of 10 basis points compared to Q1. Compared to a year ago, prime yields for retail and logistics have fallen by 20 basis points.