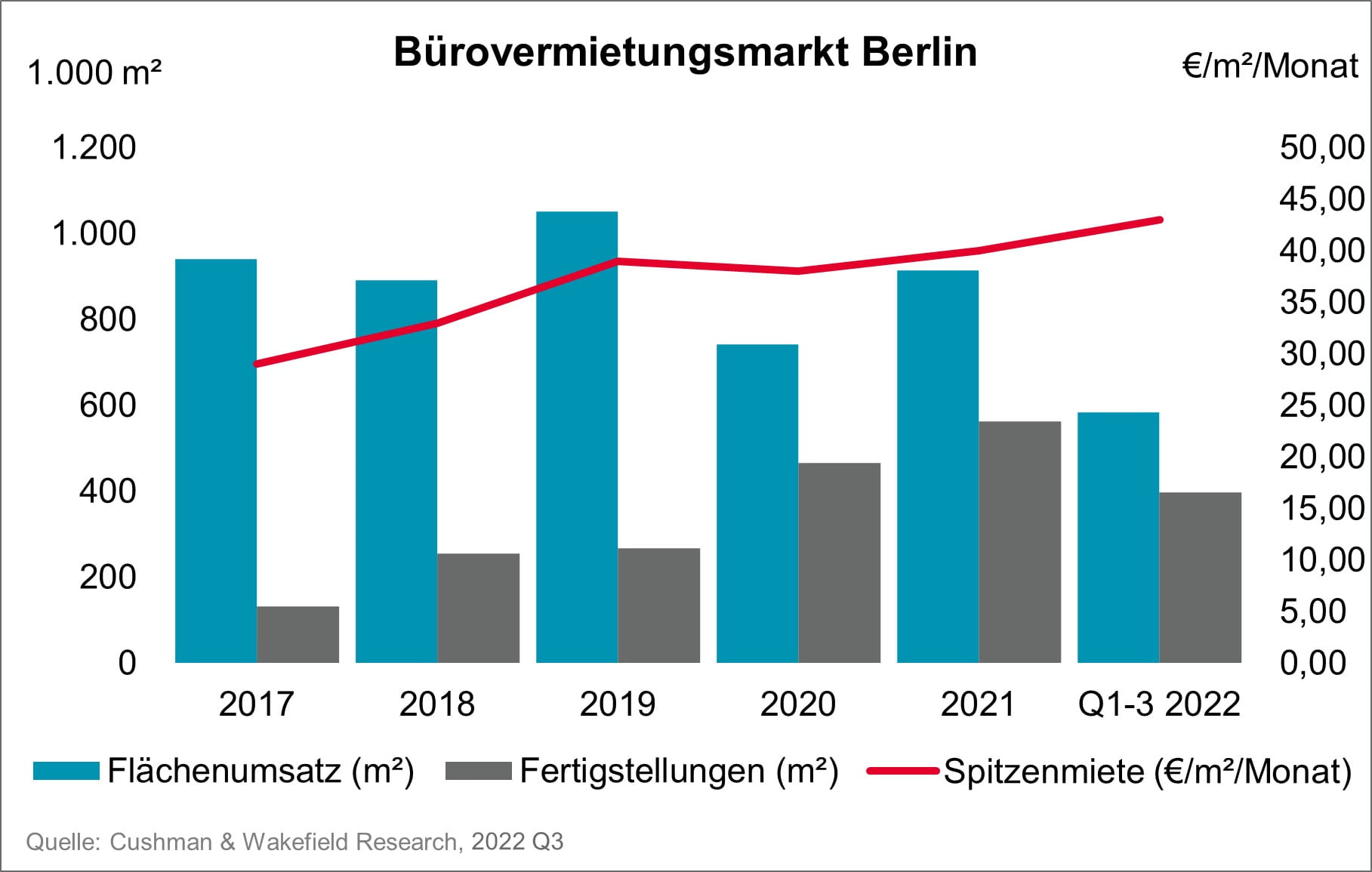

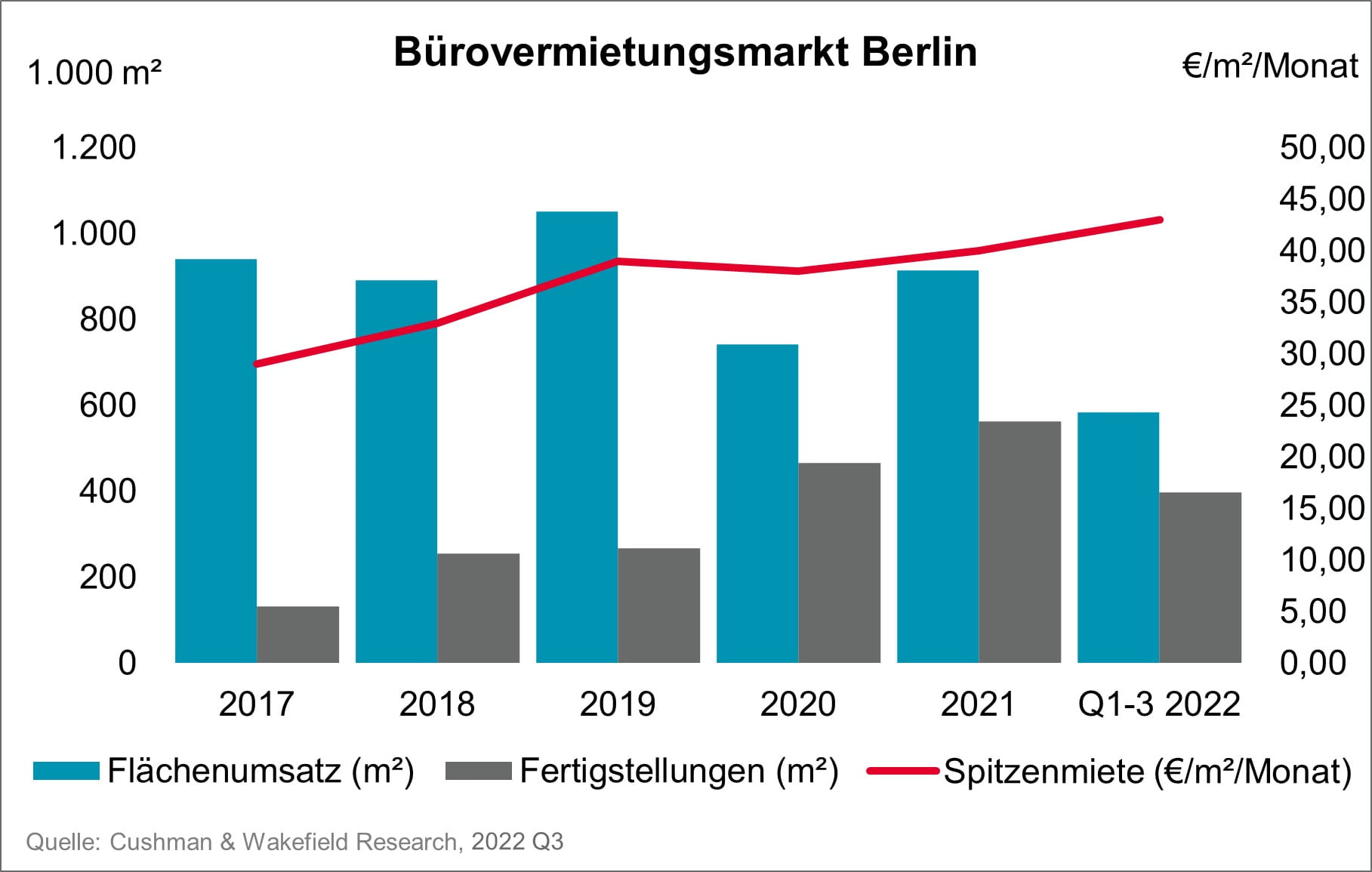

International real estate consultancy firm Cushman & Wakefield recorded take-up of 583,900 sq m in the Berlin office letting market over the first three quarters. This is roughly the same level as in the same period last year.

Conspicuously strong IT, green energy and biotechnology take-up

At 228,400 sq m, the third quarter was, as usual in Berlin, stronger in terms of take-up than the first two. In contrast to the first half of the year, there were also four lettings of 10,000 sq m or more in Q3, the largest of which was the pre-letting of 22,500 sq m in the QH Track development project to Cariad SE, a software subsidiary of Volkswagen.

Companies from the ICT sector / online platforms dominated take-up with 62,000 sq m in the third quarter and 125,400 sq m in the year to date. As is usually the case in Berlin, this puts them in first place in the sector ranking.

Industrial companies exhibited conspicuously strong growth in take-up, absorbing 128 percent more space in the third quarter and 195 percent more in Q1 - Q3 than in the same period last year, at 32,200 sq m and 75,100 sq m, respectively. The (green) energy, biotechnology / pharmaceuticals and transport sectors made notable contributions to the strong growth.

Prime rent rises faster than average rent

The achievable prime rent also rose in the 3rd quarter to EUR 43.00 /sq m per month. This is EUR 4.00 more than twelve months ago and EUR 1.00 more than in Q2 2022. The area-weighted average rent also reached a new high of EUR 28.40/sq m per month, having increased by EUR 1.90 over 12 months and by 35 cents in the last quarter. C&W expects further moderate growth in prime rents into next year. This will be driven by development projects and high-quality existing buildings in prime locations, for which demand remains high.

Interest in energy-efficient property development projects increases

At 397,600 sq m, completions of new-build and core refurbishment projects reached a record volume by the end of September, exceeding the 5-year average by 73 percent. 98,300 sq m or 25 percent of the space was still without an occupant on completion. Of the 297,800 sq m scheduled to be ready for occupancy in Q4, 73 percent is pre-let or earmarked for owner-occupiers.

„Demand from office users for space in development projects will remain high“, stated Donn Lutz, Head of Office Agency Berlin at Cushman & Wakefield. „The importance of energy-efficient buildings is currently growing strongly. Prospective tenants are increasingly asking about cost-saving energy standards and sustainable heating systems and energy sources such as heat pumps, geothermal energy and photovoltaic arrays. We assume that such concerns will become still more salient next year with the arrival of running cost statements.“

In total, development projects totalling around 1.7 million sq m are under construction, of which 54 percent is let or for owner-occupation. Due to rising financing and construction costs as well as the growing supply of space, C&W expects property developers to act more cautiously and the number of speculative construction starts to decline in the coming year.

Vacancy rate grows only slightly in Q3

At the end of Q3 2022, the vacancy rate, including sublet space on offer, was 4.4 percent, which is the highest level since the end of 2015. This means that 892,000 sq m is currently available for immediate occupancy in German capital. This corresponds to an increase of 155,500 sq m or 21 percent compared to the same point last year. However, the vacancy rate increased by only 22,500 sq m or 3 percent in Q3 compared to the previous quarter; a much slower pace than in H1. This stabilization was due to the increased level of take-up in the 3rd quarter with fewer completions than in the 1st half of 2022. Further growth in vacancy is however to be expected as the project development pipeline is still extensive.

Total result for the year expected to be below last year’s level

For the 4th quarter of 2022, C&W expects take-up of around 250,000 sq m based on currently ongoing major searches for space. This would leave the overall result at 835,000 sq m which is less than the previous year (2021: 902,500 sq m), but significantly higher than in the core-pandemic year of 2020 (741,900 sq m).

The looming recession could create headwinds in the office letting market if, in addition to higher risk aversion and increasing cost sensitivity among companies, there are also negative effects on the labour market. However, this would have a delayed effect with a stronger impact in the coming year.