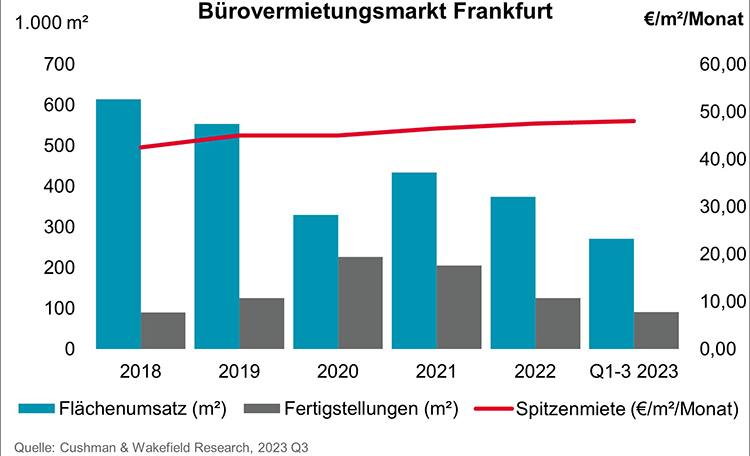

Office space take-up, comprising new lettings and owner-occupancies, in the Frankfurt real estate market in the course of 2023 so far is 270,700 sq m, reports international real estate consultancy firm Cushman & Wakefield (C&W). Of this, 90,000 sq m took place in the Q3 alone. Cumulative take-up is thus around 7 percent below last year's figure for the first nine months. The 5-year average and the 10-year average of the first three quarters of each year were also missed by 12 percent and 15 percent, respectively.

Properties with good building quality driving take-up

In Q3, the first deal of 10,000 sq m or more this year took place. An industrial company leased around 12,400 sq m in the "The Move Orange" office building at Frankfurt Airport, which was only completed this year. At around 5,500 sq m, the next largest letting in Q3 was to LG Electronics Vehicle Components Europe in the "Matchbox" development in Eschborn. This is followed by Sweco with around 4,500 sq m in the "Oval am Baseler Platz" in the station district submarket. Thus, demand for high-quality space continued in Q3. Overall, take-up in category A quality buildings amounted to 131,700 sq m over the course of the year, which corresponds to 49 percent of the office real estate total.

Markus Kullmann, Head of Office Agency Frankfurt at C&W, explains: “In the course of space consolidation by many companies towards first-class offices in central locations with a high sustainability standard, take-up has increasingly been levelling off since the Covid years, to a level that was customary in the market before the 2016 to 2019 boom years. The vacancy rate also reflects this development. In peripheral locations, vacancy rates are even in the double-digit range, whereas CBD vacancy rates remain low.”

Vacancy rate at 9.3 percent

Around 1.09 million sq m of office space was available for immediate occupancy at the end of September. The vacancy rate thus stands at 9.3 percent, an increase of 0.4 percentage points compared to the previous quarter and 2.1 percentage points compared to the same point last year. The proportion of subletting space has also risen by around 14 percent in just three months. At the end of the Q2, 105,400 sq m was offered for subletting, and by the end of Q3 this had risen to 120,000 sq m. A further increase in vacancy is expected by the end of the year.

Increased completion volume in Q3

In Q3, 48,000 sq m of office space was completed within the Frankfurt market area. Completions included Siemens' owner-occupier development “The Move Blue” at Frankfurt Airport with almost 23,300 sq m of office space, the first part of the "LEIQ" in Offenbach-Kaiserlei with around 11,100 sq m and “The Spin” in Europaviertel with around 10,000 sq m of office space. The completion volume in the first three quarters of the year totalled 90,800 sq m. A further 77,900 sq m is expected by the end of the year. Of this, 55 percent is still unlet. Approximately 186,400 sq m of office space is scheduled for completion in 2024, with 49 percent already pre-let.

Average rent down slightly quarter-on-quarter

The weighted average rent across all new lettings in the last 12 months was EUR 24.80/sq m per month. Compared to Q2 2023, this corresponds to a decrease of EUR 0.30/sq m. Compared to a year previously, the weighted average rent has risen by EUR 1.50/sq m. At the end of Q3, the prime rent was EUR 48.00/sq m per month, remaining stable compared to the previous quarter. Over 12-months, the prime rent rose by EUR 0.50/sq m. In the course of the expected lettings in development projects, completions and good quality office stock, C&W expects an increase in prime rents.