According to figures from international real estate consultancy firm Cushman & Wakefield (C&W), the 3rd quarter was the strongest of the current year with a transaction volume of EUR 5.71 billion. Prime yields have continued to grow and the price expectations of buyers and sellers are gradually converging. Retail properties were the major contributor to the total in the first nine months of the year at EUR 4.17bn, but in Q3 the logistics sector contributed the highest transaction volume at EUR 1.89bn. With a total transaction volume of EUR 2.69 billion, Berlin remains the strongest German market.

Alexander Kropf, Head of Capital Markets Germany at Cushman & Wakefield summarises: "We are approaching a phase in which prime yields for core real estate are reaching their peaks, which makes a flattening-out in the next few quarters appear possible. Across the board, we continue to see few office transactions, with those which do take place mainly involving institutional capital. Against the backdrop of a reliable and calculable financing environment as well as continued rent rises, the recently clearly restrictive attitude towards office properties should already ease somewhat in the coming year:“

Transaction volume

Portfolio transactions drove transaction volume in the third quarter

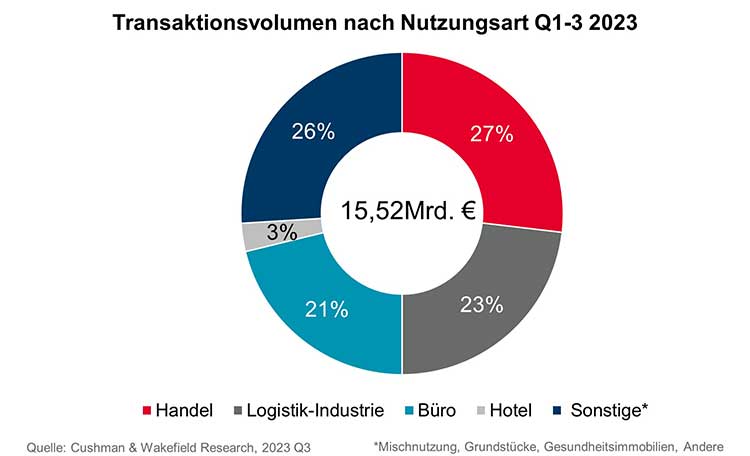

- The German investment market achieved a commercial real estate transaction volume of EUR 15.52 bn in the first three quarters of 2023. Compared to the equivalent period last year, this corresponds to a decline of around 61 percent, as well as in comparison to the Q1-Q3 5-year average.

- With a transaction volume of just under EUR 5.71 billion, the third quarter was the strongest of the year so far.

- Several portfolio transactions in the triple-digit-million-euro range were significantly responsible for the boost in transaction volume in the 3rd quarter, first and foremost the sale of the X-Bricks portfolio with a total of 188 grocery retailers to Slate Asset Management for just over EUR 1 billion, which also marks the largest deal of the year so far.

- In total, portfolio transactions in the first three quarters contributed around EUR 4.06 billion, almost 26 percent of the total German transaction volume, of which EUR 2.69 billion was in the third quarter alone.

Yields

Prime yields rise further, especially for office properties

From the end of June to the end of September 2023, the average prime office yield for core properties in the Top-7 markets rose by a further 45 basis points to the current 4.49 percent. The average prime yield for city centre high-street commercial properties increased by 20 basis points to 4.10 percent. For logistics properties, the average is currently 4.30 percent, 15 basis points higher than in the previous quarter.

- The lowest prime office yields are still being achieved in Munich, currently at 4.20 percent, followed by Frankfurt and Berlin at 4.35 and 4.40 percent respectively. In Düsseldorf and Cologne, prime office yields are highest at 4.75 percent.

- The gap in purchase price expectations between buyers and sellers is gradually narrowing. C&W expects further yield increases for core properties to the end of the year and a price level at which more transactions are likely to take place again.

Property use types

Retail and logistics industrial properties dominate thanks to portfolio transactions

- The transaction volume for office properties continues to be very restrained at EUR 3.29 billion in the first three quarters (Q3/2023: EUR 930 million). Compared to the same period last year, this is a decline of 80 percent. The contribution to the total commercial real estate transaction volume is just under 21 percent. The last time the result was lower was during the financial crisis in 2009 (EUR 2.15 billion).

- The clear majority of transactions had a volume of less than EUR 50 million with a clear focus on value-add and core-plus properties.

- Institutional investors continue to act very cautiously regarding core office properties. The combination of low supply and financing conditions that remain difficult is leading to an overall wait-and-see attitude.

- The transaction volume for retail properties amounted to around EUR 4.17bn from January to September 2023 (Q3/2023: EUR 1.77bn). Compared to the same period last year, this represents a decline of almost 34 percent. The contribution to the total commercial real estate transaction volume for the period was however a strong 27 percent. This proportion was last exceeded in 2015.

- Due to the large-volume portfolio sale of 188 grocery stores by X-Bricks to Slate Asset Management for around EUR 1 billion, the third quarter has been the strongest of the year so far for this asset class, with a transaction volume of EUR 1.77 billion. Also, worth mentioning is the EUR 240 million portfolio consisting of a total of 77 grocery stores which Aldi-Süd acquired from Pimco Real Estate in the 3rd quarter.

- Logistics and industrial properties generated a transaction volume of EUR 3.59 billion in the year to date and is the second-strongest segment (23 percent contribution to total CRE transaction volume) behind retail properties. In the third quarter this segment was actually the strongest in terms of transaction volume, at EUR 1.89 billion.

- Four portfolio transactions of over EUR 100 million contributed to this. The largest portfolio sale, at some EUR 560 million, was the 50 percent share purchase in the context of a joint venture of five logistics properties from VGP by Deka Immobilien.

- Hotel transactions recorded a decline in volume of 62 percent compared to the same period last year, to EUR 440 million (Q3 / 2023: EUR 110 million).

- In the "Other" sector, which totalled around EUR 4.03 billion (minus 53 percent) in the first three quarters, sales of property developments dominated at around EUR 1.7 billion. Properties with a focus on commercial mixed-use have been traded with a volume of EUR 1.2 billion this year.

Top-7 Markets

Berlin strongest Top-7 market by transaction volume due to several large transactions

- Transaction volume in the Top-7 markets, amounted to around EUR 6.42 billion in the first three quarters, which corresponds to 41 percent of the total in Germany. The decline compared to the previous year is around 70 percent.

- Berlin continues to be the strongest market in terms of transaction volume among the Top-7 markets and achieved a total transaction volume of EUR 2.69 billion. Munich was also able to just exceed the 1-billion-euro mark (EUR 1.03 billion). The markets with the lowest transaction volume at present are Cologne with EUR 305 million and Stuttgart with EUR 525 million.

- All markets recorded declines in transaction volume compared to the previous year's result, Stuttgart (38 percent) and Berlin (55 percent) falling the least, and Frankfurt with minus 86 percent and Hamburg with minus 80 percent, the most.