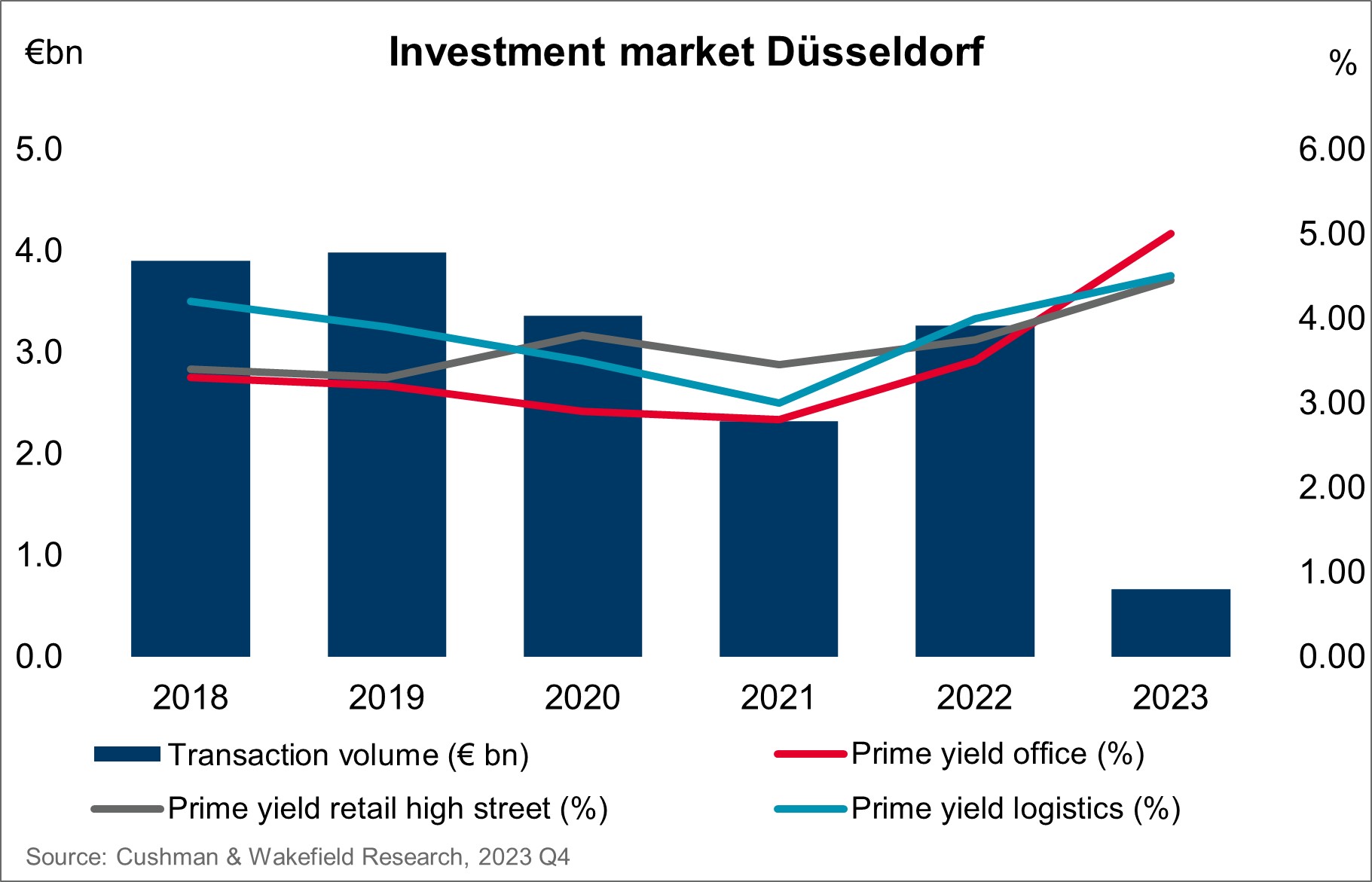

Dusseldorf’s commercial real estate market and its extended logistics market area achieved a transaction volume of EUR 665 million in 2023 as a whole. Compared to both the previous year and the 5-year average, this corresponds to a decline of 80 percent. The was the lowest result since 2004.

Mirko Kittler, Partner Capital Markets Dusseldorf at Cushman & Wakefield, on the outlook: “It was already apparent in the summer that the Dusseldorf investment market would experience an extraordinarily weak result for the year as a whole and that the typical year-end rally would fail to materialise. With real estate prices and interest rates expected to stabilise in the course of 2024, more investment opportunities will open up again on the supply side. The potential for a market recovery in 2024 is therefore present, especially as some attractive properties are already in the sales pipeline. However, investors are also increasingly concerned with repositioning and conversion concepts. All in all, we expect a significant upturn in transaction activity, but with modest volumes.”

Transaction Volume: Challenging debt financing environment for institutional investors

- While transaction volume of around EUR 550 million was still achieved in the 1st half of 2023, real estate with a volume of only EUR 120 million was traded between July and December.

- Core transactions failed to materialise at all in the course of the year and continue to be the risk class most affected by the turnaround in interest rates. On the buyer side, institutional investors continued to take a wait-and-see approach, with most acquisitions being made by family offices, project developers and unlisted real estate companies.

- Contribution only 17 percent of total transaction volume, institutional investors were significantly more cautious than in the previous year (74 percent). Borrowing was particularly challenging against the backdrop of high and volatile interest rates.

- On the other hand, equity-rich private investors and family offices have invested more than at any time since 2019. In 2023, their contribution reached just under 14 percent, or around 90 million euros.

Property types: Logistics and industrial real estate now the strongest segment

- Office properties generated a total transaction volume of EUR 190 million in 2023, representing almost 29 percent of the CRE total in Dusseldorf. In the previous year, properties with a total value of EUR 2.11 billion were traded.

- In addition to increasing ESG requirements, a turnaround in interest rates, high desk-sharing ratios and the resulting lower demand for office space are leading to restrictive financing conditions for office properties.

- The sale of one of the two office projects in the “maxfrei” quarter in Q1 was the largest transaction of 2023. Barmenia Krankenversicherung acquired the project development in the Kennedydamm submarket from Interboden and Hamburg Team in a forward deal.

- The retail real estate transaction volume almost doubled compared to the previous year (+92 percent) to total around EUR 115 million in 2023. Commerz Real's 20 percent stake acquisition in ten SIGNA Galeria department stores nationwide made a significant contribution to the positive result, with two of these properties, Am Wehrhahn 1 and Königsallee 1–9 located in prime high-street locations in Dusseldorf.

- At around EUR 200 million and accounting for 30 percent of the total CRE transaction volume, logistics and industrial real estate was the strongest segment. Transaction volume was only ever higher for this segment in 2018 (EUR 240 million). Together with the municipalities surrounding Dusseldorf, the increase compared to the previous year was around 38 percent. This was driven by the sale of the 23-hectare Areal Böhler in Meerbusch by the Voestalpine Group to Jamestown in the United States for EUR 160 million in Q1.

Yields: Expected to peak in 2024

- The prime yield for core office properties stood at 5.00 percent at the end of Q4, which is an increase of 25 basis points from the previous quarter. Compared to the previous year's figure, this represents an increase of 150 basis points.

- The prime yield for high-street commercial buildings in 1a locations is currently 4.45 percent, which is 25 basis points above the level of Q3 and 70 basis points above the level of a year ago.

- At the end of Q4 2023, the prime yield for core logistics properties was 4.50 percent, up 20 basis points from the previous quarter. At the end of 2022, the prime yield was 4.00 percent.

- The course of 2024, will be characterised by only a slight increase, at most, in yields, with subsequent stabilisation. In particular, the previously sharp price reductions in the office segment will approach their ceiling in the coming quarters.