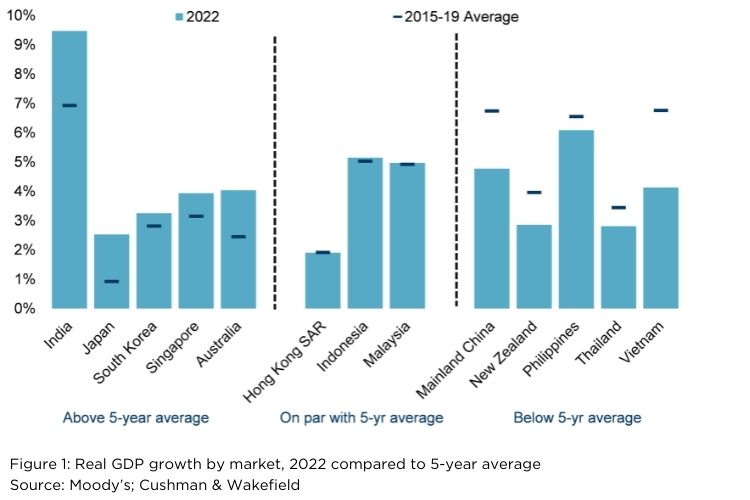

The Asia Pacific economy is set to rebound in 2022 and regain top position in the second half of the year with an expected 4.5% real average annual GDP, while growth in the other two major regions normalizes, according to Cushman & Wakefield’s latest report titled “Asia Pacific Commercial Real Estate Outlook 2022Catch ’22 - ”.

“India is forecast to lead regional growth in 2022, averaging over 9% for the year, in large part due to restrictions being lifted and a resultant leap in domestic consumption and production,” said Dr. Dominic Brown, Head of Insight & Analysis, Asia Pacific at Cushman & Wakefield.

“Similarly, Singapore, Japan and South Korea are all forecast to experience above average growth in 2022 driven by strong demand for exports. We are also expecting rebound growth in Australia following the prolonged lockdowns in New South Wales and Victoria. In China, growth is expected to normalise after a particularly strong 2021.”

“Australia is among the economies expected to lead the APAC region out of the pandemic in 2022. The forecast for above-average GDP growth in 2022, and an equally strong labour market, will create tailwinds for tenant and investment demand for most commercial property sectors,” said John Sears, Head of Research, Australia and New Zealand at Cushman & Wakefield.

Although unemployment remains elevated across the region, levels in most markets are well below their respective pandemic peaks and forecast to sit at or below their respective five-year average over the year ahead. However, aggregate figures of unemployment hide finer details – the “K-shaped” recovery path revealed weakness in retail, tourism and service-oriented sectors compared to tight labour conditions in professional services, IT, finance and manufacturing. Furthermore, countries that are reliant on immigration to boost labour pools, such as Singapore and Australia, are more exposed to labour shortages at least until global migration flows regain momentum. As such, there is an increasing mismatch between required business skills and available labour force which has intensified the war for talent.

Office market outlook: Upbeat as region shows resilience through the pandemic

According to the Catch ’22 report, the Asia Pacific office market has shown remarkable resilience, being the only region to record consecutive quarters of positive net absorption since the onset of the pandemic. Although regional vacancy has edged upwards, it is only marginal and primarily driven by supply exceeding demand, which in turn has exerted only a modest downward pressure on rents.

The outlook for the region is similarly upbeat, with office demand for the full year in 2021 expected to reach 55 million square feet (msf). This is 77% above 2020 levels despite much of the region re-entering prolonged lockdowns as the Delta variant emerged, and this is also in no small part due to record demand in Tier 1 markets in mainland China.

Looking to 2022, demand is expected to increase further to 72 msf – reflective of a stronger recovery across the entire region – before returning to pre-pandemic levels of around 83msf in 2023. Although flexible working practices are likely to be more widely adopted across the region, their impact on demand is expected to be relatively muted as employee desire to work flexibly is lower in Asia Pacific than in the U.S. and Europe. Looking ahead, projected employment growth and gradual return to office - is likely to offset the underlying headwind from remote working. Although the regional vacancy level is forecast to increase to 18% in 2023, this disguises the fact that many markets across the region are entering a period of restrained supply over the next two years. Rather, the regional figure is heavily influenced by the Indian markets which account for 50% of the increase in vacancy to 2023.

At the sub-regional level, office demand is expected to pick up across most markets in 2022. Furthermore, many are forecast to receive below average amounts of new supply. With demand rebounding and comparatively muted supply, rents are now forecast to reach trough in late 2021 through to early 2022, approximately 12 months earlier than envisaged at the start of this year.

“Australia’s economic growth profile in 2022 is expected to underpin particularly strong employment growth in office related sectors. An upswing in office jobs should add further momentum to the rebound in CBD office markets already underway across the eastern seaboard,” John Sears said.

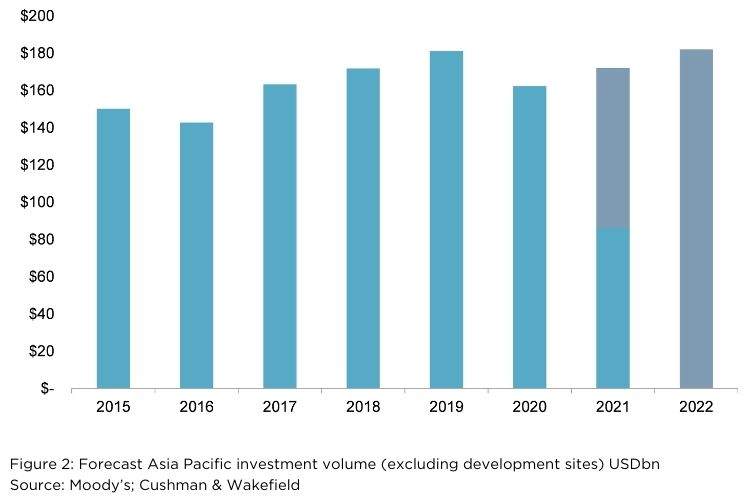

Investment outlook: On track to set another new record in 2022

Although the investment market has not been immune to the negative impacts of the pandemic, it has also been comparatively quick to rebound. Investment volumes in 2022 are forecast to match record levels seen in 2019 at around USD180bn. Key drivers include: still ultra-low interest rates despite modest increases in the past year, real estate as an inflation hedge, record amount of dry-powder and an intensified focus on capital deployment by investors.

While we expect the investment market to remain highly active, a greater focus on industrial assets may dampen average deal size, hence greater transaction activity may not result in higher overall volume. On the upside, total volume may exceed the USD180bn forecast should sufficient high-quality assets or large portfolios be brought to market.

Emerging asset classes such as data centres, multifamily and life sciences have also gained traction among investors seeking higher yields and/or lower volatility. All have strong growth outlook prospects and offer good diversification benefits, however in terms of total investment volume they remain somewhat niche and so provide limited opportunities to diversify capital efficiently. Nevertheless, these asset classes are expected to be increasingly sought-after by the investor community.

“Australian commercial real estate investment demand is expected to remain elevated into 2022. Relatively high yields compared to other global property and financial markets, coupled with robust fundamentals and economic growth, will continue to attract capital from domestic and international investors,” John Sears said.

“We expect a bumper year ahead for office market investment that will build on the steady rebound in investment volumes we saw quarter-on-quarter in 2021. Positive conditions will also continue in the industrial sector into 2022, with a wind-back of retail space in favour of warehousing expected to help industrial rents catch up to the surge in land values.”

Catch ‘22: Asia Pacific Commercial Real Estate Outlook 2022Click here to download .