Last but one: such is Prague’s position in terms of occupancy rates in the hotels that were open last year in a ranking of 35 metropolises across Europe. Whereas the European average according to STR data exceeded 43%, only 26% of hotel capacity that was operational in Prague was occupied. This represents a 26% improvement over the previous years, with last year’s revenue per available room (RevPAR) growing by 36% in year-on-year terms. Still, this is just one-fourth of the figure for the pre-crisis year 2019, and occupancy rate is at one-third. Despite that, hotel operators are still highly interested in Prague – it is the most attractive city for them across the CEE region. They believe in the local hospitality market’s long-term performance potential beyond the short-term pandemic fluctuation. Due to a shortage of hotels for sale, not many transactions take place; nor is there any large-scale construction in the pipeline. New hotels will open mainly in the luxury segment. Major players expect the sector to recover completely in 2024.

With an occupancy rate of almost 80%, Prague was the fifth best in Europe in the pre-crisis year 2019. The restrictions brought by the coronavirus crisis hit the city hard, however: with 21%, Prague ended up at the bottom the year before last, and just one spot higher with 26% last year. Only Bratislava fared worse last year with 22%. Christmas and the New Year’s Eve season did not buck last year’s trend: though the occupancy rate in Prague was 29% in December, more than 3.5 times higher than in December 2020, and RevPAR was almost six times higher, both figures were about one-third of those in December 2019.

Moscow is at the opposite end of last year’s European open hotel occupancy rate chart with 59 per cent, and Istanbul, Edinburgh and Manchester all scored more than 50%. The same four cities also ruled the chart in December 2021, all exceeding 60% rate of occupancy.

David Nath, Partner and Head of Central & Eastern European Hospitality Team, Cushman & Wakefield: “Prague is still suffering strongly from anti-pandemic restrictions, with not all of the flights having been renewed yet. Compared with other countries such as Poland, international tourists are essential for and dominate the Czech market, but they are still absent. In addition, our country did not host any major events last year such as the EURO Football Championship in Budapest, for example.”

Improvement: the latter half of the year and holiday resorts

October and August were last year’s most successful months in Prague (with occupancy rates of 50% and 44%, respectively). During these, Prague quickly outperformed many international destinations.

The increase in occupancy rates in those two months shows that the local market in itself remains attractive and tourists are still interested in it. Their numbers are curtailed primarily by external restrictions and temporary concerns of travel prevailing due to the coronavirus measures and uncertainty. At the times when restrictions are lifted and the appetite for travel grows, Prague repeatedly becomes a popular destination again and the occupancy rates in the local hotels grow.

Also obvious is the powerful influence of the domestic tourism that focuses on destinations in mountain and other holiday resorts. Their popularity has grown several times over during the coronavirus crisis and the resorts are achieving better occupancy rates than before it.

Transaction activity hindered by a shortage of hotels for sale

The Czech market did not see many hotel transactions last year – but this is not because investors are hesitant: in fact, they are still interested in hotels despite the uncertainties. Hotels do not sell mostly because owners want to retain hotel properties long-term or are waiting to sell when the market improves.

David Nath, Partner and Head of Central & Eastern European Hospitality Team, Cushman & Wakefield: “As demand continues to exceed supply, there are more investors seeking opportunities for purchase than hotels for sale. Nor is there any large-scale construction in the pipeline. In the next three years, we expect an additional 1,750 rooms to be built, averaging just 1.5% annual growth. There has also been talk of curbing short-term rentals, and VAT on accommodation services has been cut. Travel has started to return and a major improvement is expected in the latter half of the year as the Czech Republic will take up the EU Presidency and host many international events, mostly in Prague. All this compounds owners’ abiding belief that their hotels carry the same value and retain a long-term growth potential.”

Last year saw primarily sales of small hotels such as the Blue Orange Business Resort and the Ventana. For major transactions, the long-negotiated sale of W Hotel Prague (the former Grand Hotel Evropa) was completed, but this was the fruition of an agreement signed in years past.

Somewhat busier transaction activity is expected for 2022: at this point, several transactions are in progress in Prague as well as in regional centres that have won investors’ trust given the hotels’ solid performance resulting from an increase in domestic tourism. Given the aforementioned shortage of hotels for sale, though, the increase will not be significant.

Prague the focal point of operators

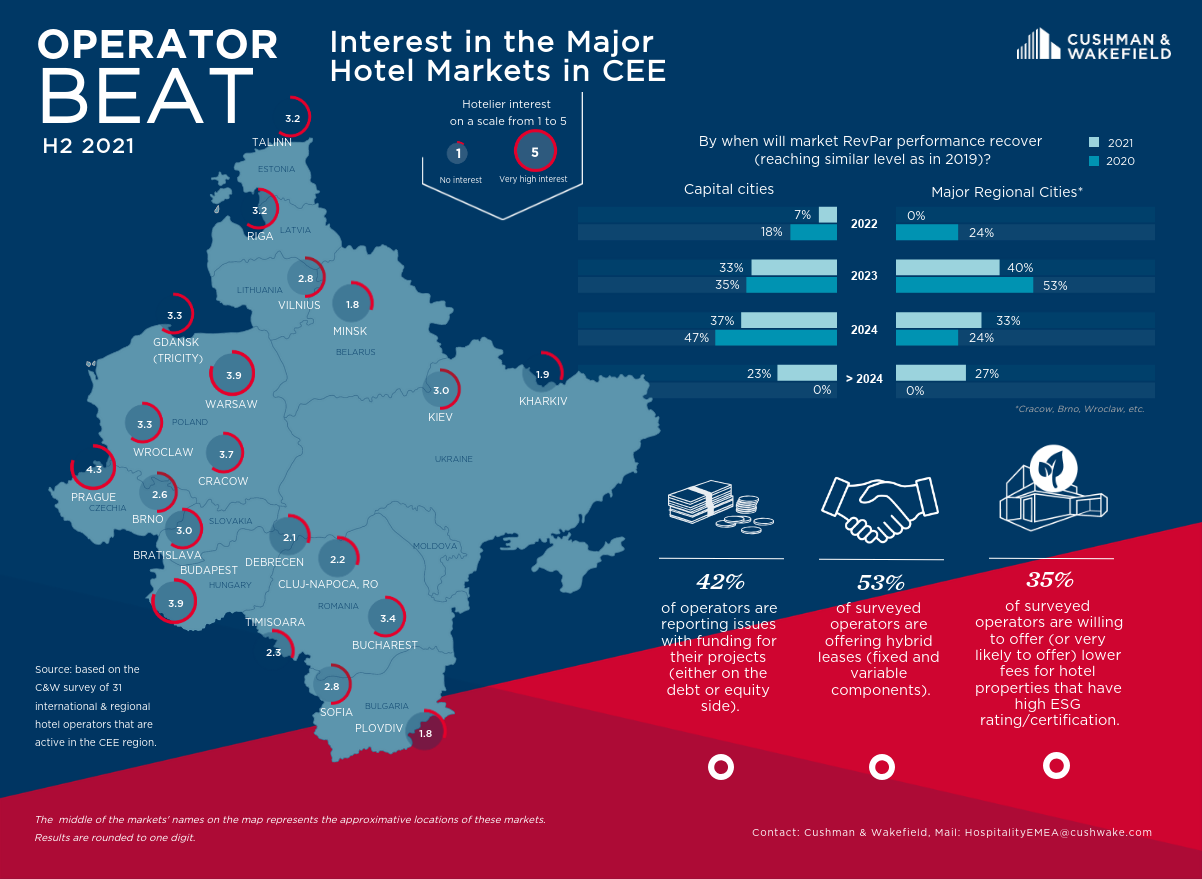

That interest in Prague has been steady is also confirmed by the results of the current OPERATOR BEAT SURVEY that Cushman & Wakefield, leading global real estate consultancy, conducted among both international and regional hotel operators active in the CEE region. Similar to last year, more than 80 per cent of them state they are “highly” or “very highly” interested in the Prague market. Of those who are just “moderately” interested, most already maintain a sufficient presence on this market.

Prague is leading the chart that ranks the appeal of twenty cities in the region: it won an average 4.27 out of five points. Warsaw follows with 3.93 points, Budapest with 3.9, and Cracow and Bucharest also come in the top five.

Table 1: Appeal of Destinations in CEE

| Rank | City | Country | Score |

| 1 | Prague | Czech Republic | 4.27 |

| 2 | Warsaw | Poland | 3.93 |

| 3 | Budapest | Hungary | 3.90 |

| 4 | Cracow | Poland | 3.73 |

| 5 | Bucharest | Romania | 3.40 |

| 6 | Wroclaw | Poland | 3.27 |

| 7 | Gdansk | Poland | 3.27 |

| 8 | Riga | Latvia | 3.20 |

| 9 | Tallinn | Estonia | 3.17 |

| 10 | Kiev | Ukraine | 3.00 |

Source: Cushman & Wakefield, Operator Beat

Tomáš Cejnar, Associate Director, Central & Eastern European Hospitality Team, Cushman & Wakefield: “Other cities in the Central and Eastern European region perform better in revenue per available room: Bucharest posted a year-on-year increase of 67% and Budapest of 61%. Still, Prague has steadily been the focus of interest for all types of players in the hospitality segment – and it seems the coronavirus crisis is not going to change anything about it. The hospitality market has been enjoying a high degree of confidence among major companies in the industry thanks to its pre-crisis performance and lasting values, and we constantly see interest in buying, leasing or operating a local hotel. In this respect, demand definitely exceeds supply and cements the trust in the market stabilising on the pre-crisis level very quickly once the restrictions on international travel are lifted.”

Sustainability on the rise

As with other segments of the commercial property market, sustainability is gaining in importance in hospitality. In the survey, some operators state that they are willing to give hotels with higher environmental ratings or certificates (such as BREEAM and LEED) more favourable commercial terms. Of those, 35% mention lower operating fees and 31% waiver technical development services fees. Just one-fourth of operators are willing to offer owners of more sustainable buildings higher key money (incentive bonuses for concluding contracts).

Bořivoj Vokřínek, Partner, Strategic advisory, Head of Hospitality Research EMEA, Cushman & Wakefield: “Most international hotel operators have been promoting sustainability as a cornerstone of their strategy for years. Despite that, it is mostly the owners who carry the investments in improving energy demand of buildings and reducing the environmental impact of hotel operation. It is good to see signs of certain operators being willing to at least indirectly contribute towards these, often substantial, investments through better commercial terms. That, along with the mounting pressure among hotel guests, banks and regulatory authorities will have an increasing impact on the prices of hospitality properties while – hopefully – increasing the count of hotels that meet the highest sustainability standards. There are just a few of those in Prague for the time being: for example, a survey on Google.com/Travel shows that there is just a very limited number of hotels labelled “eco-certified”. Among the quite rare examples are both of Prague’s hotels bearing the Hilton badge, the Lindner Hotel Prague Castle and the Mosaic House Design Hotel.”

Recovery in 2024 and project delays

The survey of major hotel operators also sounded out their expectations for the sector’s recovery from the effects of the coronavirus crisis. Most of them are expecting levels on a par with 2019 to be reached in 2023 or 2024, depending on the importance and size of the destination. With leisure destinations, most respondents stated they expected recovery in 2023, and 2024 with capital cities.

Market recovery would benefit from the delayed development of projects in the pipeline visible across the region. 63% of the survey respondents state some of their projects have been delayed and 47% say they had to suspend some projects. According to most respondents, though, the halt affects fewer than 20% of projects. According to two-thirds of the respondents, the delay should not exceed one year.

The primary reason for projects being delayed or suspended is issues with financing, though this is less frequent than in the previous year’s edition of the survey. Increasing development costs are another complication.

In Prague, the exact date of opening of the W Hotel remains unclear and has been postponed repeatedly since 2020. The development of the Hard Rock Hotel in the Letná quarter has been suspended. Projects are currently being delayed and suspended in regional cities as well; this applies primarily to projects associated with the corporate or MICE segment that has been hit hard by the coronavirus crisis.

New hotels mainly in the luxury segment

Thanks to investors’ and operators’ lasting interest and confidence in the hospitality market, Prague will witness the opening of several major schemes this year. Developed by UBM, the Andaz Hotel from the Hyatt international hotel chain will open in Senovážné Square in February. The Julius, a hospitality/residential concept in The House of Julius Meinl group portfolio will open in the same area in the spring. Both projects will enhance the supply of luxury accommodations, which has been quite limited so far; this should help Prague change its image and focus on high-end clients. Such is also the target audience for the Alcron Hotel in Wenceslas Square, which will undergo major renovation and will operate as the Almanac X Prague from the end of this year, and for the aforementioned W Hotel. Another major milestone in this category, expected to launch in 2023, is the opening of the Fairmont Golden Prague Hotel (the former InterContinental) with 297 luxury rooms in the Accor Hotels portfolio whose owner, R2G is currently undertaking comprehensive and extensive refurbishment worth EUR 110 million.

David Nath, Partner and Head of Central & Eastern European Hospitality Team, Cushman & Wakefield: “Prague’s hospitality market is obviously facing difficulties, but a certain delay in the development of several projects and more paced opening of new hotel facilities in the upcoming years will help accelerate the recovery of the hospitality segment as such and the return of the key parameters (occupancy rate and the average room rate) to pre-crisis levels. In effect, Prague is in a better position than Warsaw or Budapest, as the two will face a more rapid increase in new hotel facilities. Even so, the situation in the local market is not easy at all; the pandemic is not over yet and hoteliers struggle with mounting costs and a shortage of staff.”

Get the full CEE Hospitality Operator Beat Report, or contact Borivoj Vokrinek or one of our hospitality experts.