After a prolonged period of pricing dislocation, Australia’s logistics and industrial (L&I) investment market is showing robust signs of recovery. With year-to-date transaction volumes and deal values well outstripping the same period last year, it indicates growing confidence among both more dominant domestic, private investors and global investors looking to re-enter the market.

In the year to early September 2024, approximately $3.8 billion worth of income-producing assets have traded—a 50% increase from transactions in 2023. The Victorian L&I market has led the nation, accounting for 56% of Australia-wide transaction volumes, with 25 assets totalling $2.16 billion traded so far this year. This is well ahead of New South Wales with $805 million and Queensland with $704 million of recorded L&I investment transactions.

Chris Jones, Cushman & Wakefield’s National Director, Capital Markets Logistics & Industrial – ANZ, attributes this resurgence to a combination of macro factors and investor confidence: “We’ve seen L&I investment volumes bottom out globally and have recorded a material uptick in transaction activity over the past quarter.

“In Australia, more certainty around the direction of interest rates is supporting investor confidence and larger asset acquisitions are back on the table. That’s best illustrated by average deal sizes jumping 28% in 2024.”

This confidence is particularly evident when considering $100 million-plus acquisitions, which now account for 67% of total investment volumes in 2024, up from 50% in 2023. Buyers are targeting assets that offer immediate or short-term positive rental reversion, with the weighted average lease expiry (WALE) sitting at 4.6 years, boosted by high-profile deals like the Goodman Portfolio.

Charlie Holmes, Cushman & Wakefield’s Associate Director, Capital Markets Logistics & Industrial – VIC, notes the growing role of superannuation funds and private investment groups in shaping the sector’s capital flows.

“Super funds have become the most active buyers by volume, led by acquisitions from groups like Rest and Aware Super. That’s helped drive the proportion of onshore buying activity higher where, in Victoria, 81% of investment has been from domestic purchasers.

“Meanwhile, private capital and family offices, which historically operated in the sub-$30 million bracket, are now scaling up. We’ve seen multiple acquisitions above $80 million from these groups—a sign of their increasing willingness to take on larger, more strategic assets.”

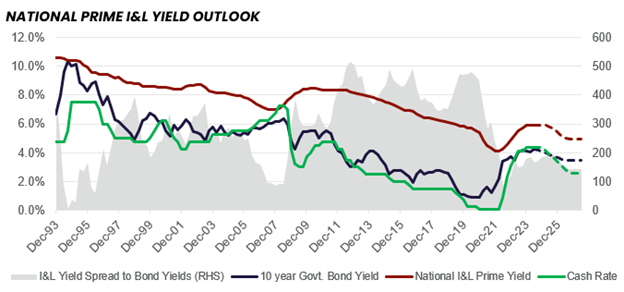

The outlook for L&I yields remains closely tied to interest rates, which are expected to reach an inflection point in Q1 2025. Cushman & Wakefield’s base case scenario anticipates 100 basis points of rate cuts in 2025, beginning in the first quarter, which is anticipated to significantly compress L&I yields.

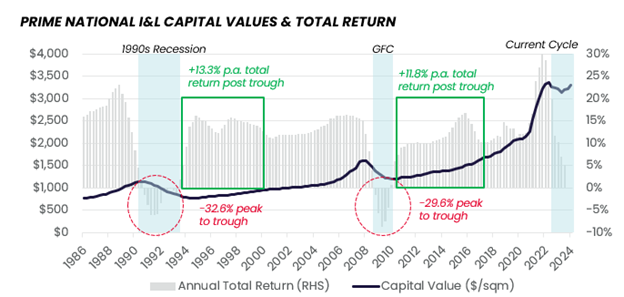

“History shows that the strongest returns often follow periods of dislocation and financial stress,” says Mr Jones.

“The post-recessionary periods of the early 1990’s and post-GFC eras demonstrated above-average returns as investors bought into the market at discounted yields. We’re seeing a similar pattern emerge now, as the resetting of values presents opportunities for investors to enter the market at more favourable rates.”

With more capital entering the market, innovative strategies are becoming a critical tool for investors seeking scale. “As the market continues to evolve, we’re seeing increased creativity from investors,” added Mr Holmes.

“Strategic partnerships, joint ventures, sale and leaseback opportunities, and alternative-use site acquisitions are all on the table. Investors are also exploring land development as a way to build scale and position themselves for future growth.”

Mr Jones also emphasises the importance of skilled capital management in the current environment. “This is a time for quality managers to shine, particularly in unlocking capital partnerships and structuring deals that maximise returns. Over the next 12 months, we expect to see capital flow more freely as interest rates stabilise, creating an environment ripe for opportunity.

“As the logistics and industrial sector continues to recover, the key to success will be navigating this new landscape with agility and foresight. Investors who can adapt to the changing market dynamics stand to reap significant rewards in the years to come.”