Four Points to Process in 2022

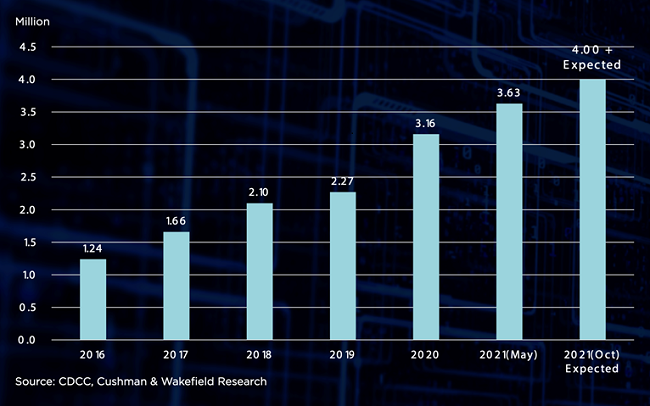

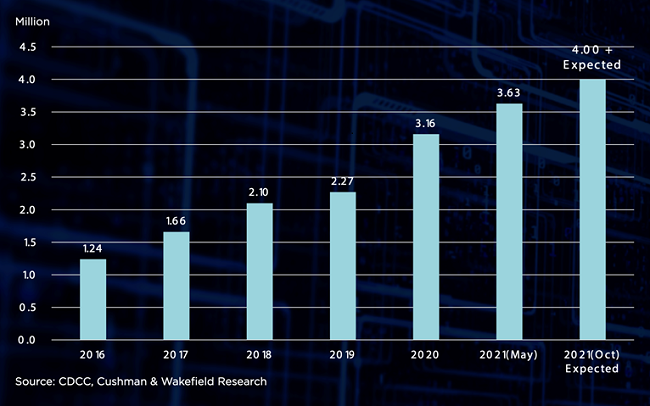

Cushman & Wakefield, a leading global real estate services firm, today released its Data Centres in Mainland China - Four Points to Process in 2022 report. According to the report, at the beginning of 2021, cabinet stock in China touched 3.6 million, with the anticipation that this number will surpass 4 million. The Beijing-Tianjin-Hebei region, the Yangtze River Delta region and the Pearl River Delta region continue to maintain strong data center construction impetus, both in terms of the number of new cabinets and aggregate inventory.

Shaun Brodie, Head of Occupier Research, Greater China, Cushman & Wakefield said, “China’s data center market is rapidly transforming. By thoroughly accessing the market, government policy, the investment dynamics, and factors associated with sustainability, both investors and developers will be in a stronger position to make the right decisions when it comes to their data center property investment in the region.”

In our report we look at four key points:

- Environmental Sustainability

According to CDCC statistics, as of early 2021, cabinet stock in China reached 3.6 million.

Chart 1: Cabinet stock in China, timeline 2016- 2021

As of 31 May 2021, the number of new cabinets planned in mainland China was 469,300. From a regional distribution standpoint, North China accounts for 27%, East China 26% and South China 22%. These three regions lead the country with the total number of new planned cabinets in each region being more than 100,000. When sharpening the focus and looking at the market from a city-level perspective, one can see that mainland China’s first-tier cities have been the focus of much market activity over the past year.

As for Government Policy, one of the most important data center industry-related policies released recently in China is The Three-Year Action Plan for New Data Centre Development (2021-2023). The basic actions of the plan are: the optimization of construction layout, the upgrading of network quality, the enhancement of computing power, the strengthening of the industrial chain, 'green' and low-carbon development, and safety and reliability.

As for Investment, domestic data center financing conduits in China are varied. They are largely split into equity financing and debt financing, including public offering, rights issue, private placement, bond financing, bank loans and other instruments.

Given the appealing cap rate that data center projects can offer, many investors of late have paid much attention to data center properties in China. These investors have executed on investment deals via a number of methods, such as directly purchasing data center property assets, forming a joint venture company, or utilizing financing channels.

Andrew Chan, Managing Director, Head of Valuation & Advisory Services, Greater China, Cushman & Wakefield, said: “The construction of data centers is a capital intensive investment, and the pilot scheme of the domestic infrastructure public REITs market will beget innovative equity financing option to the IDC industry, and achieve breakthroughs in capital recycling, opening up direct financing channels, and broadening the investment horizon of social capital.”

As for Sustainability, recent policies in China aim to guide future data center development in China along a sustainable ‘green’ path, whereby, among other aspects, new development: is systematic, coordinated, and orderly; ensures energy-use efficiency; and utilizes energy from renewable energy sources where possible.

Over the years, the data center industry in China has looked at various energy-saving and ‘green’ technology initiatives. Some data centers in the country have been able to reduce their power usage effectiveness (PUE) value to 1.1 or below. In the long term, regarding the aspiration of going carbon neutral, energy efficiency and energy saving are just small steps in the whole journey to discover a true solution. Moreover, carbon offsetting, carbon trading, carbon capture and other analogous initiatives are also somewhat limited when contemplating the overall objective. For a long-term total solution, the generation and use of renewable energy are the keys to unlocking and revealing the real ‘green’ solution.

Click here to download the Data Centres in Mainland China report.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms in the world, with approximately 50,000 employees in over 400 offices and 60 countries. In Greater China, a network of 22 offices serves local markets across the region, earning recognition and winning multiple awards for industry-leading performance. In 2021, the firm had revenue of $9.4 billion across core services including valuation, consulting, project & development services, capital markets, project & occupier services, industrial & logistics, retail and others. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.