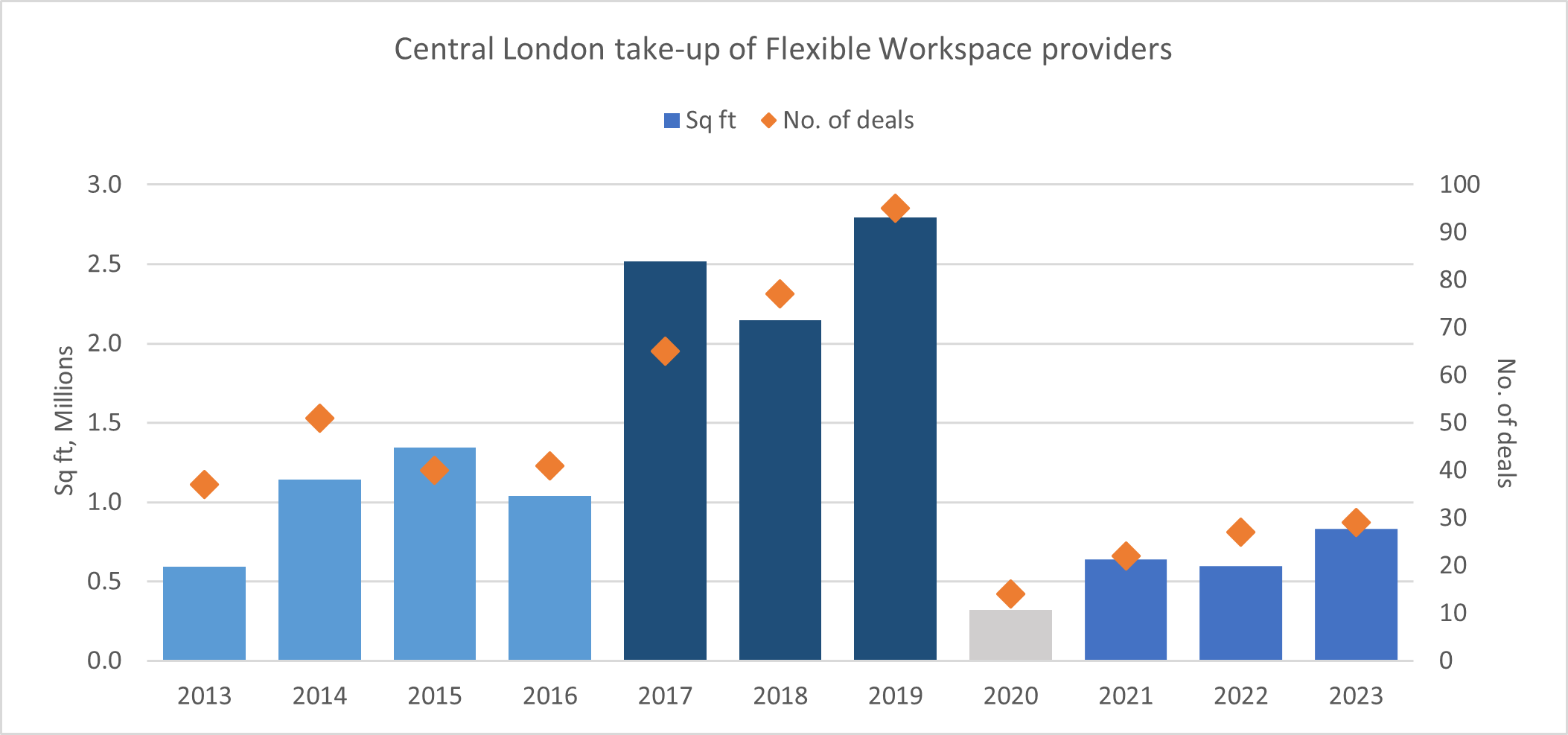

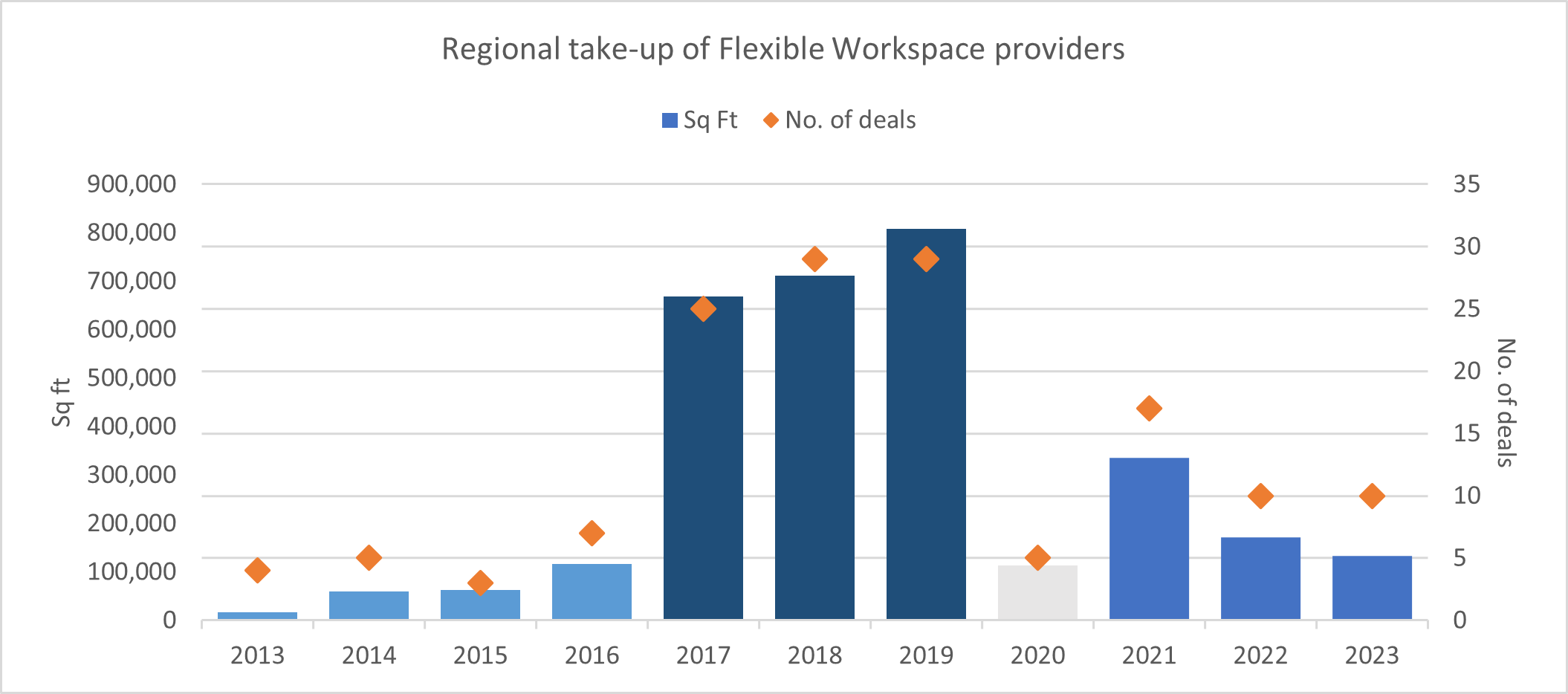

There has been an evolution in Flexible Workspace operator acquisition activity over the past decade, with three notable eras of activity in the UK:

- 2013-2016 – Emerging: providers beginning to acquire smaller units of space

- 2017-2019 – Boom: deal numbers and space acquired notably increases

- 2021-2023 – New era: newer providers emerging

* Regional take-up refers to the 6 CBD markets of Birmingham, Bristol, Leeds, Manchester, Glasgow and Edinburgh and the South East office locations cover West London, Thames Valley, North and South of the M25

From 2013 to 2016, the volume of take-up both in London and the Regional office markets was low and operators were few in number until 2017 when activity boomed. In London, average take-up by providers in the first period totalled 1 million sq ft per year, increasing to 2.5 million sq ft per year during the boom. Across the regional markets, annual transaction volumes increased by a factor of 10 from 2016 to 2017, with acquisitions tripling and larger spaces being taken.

Between 2017 and 2019 the UK office market experienced a boom in operator acquisitions. The impact this had on the commercial real estate sector was significant and has shaped the ‘flexible workspace / serviced office / managed office’ landscape we see today. Whilst the perception was that the market was being dominated by a handful of providers who acquired space at pace before the pandemic, the reality has always been that those large providers only made up a relatively small proportion of the overall market.

Nevertheless, the pandemic unsurprisingly impacted the demand for large and small flexible workspace alike – and highlighted the stark operating risk – bringing this boom period to a halt in 2020.

The new era

Office operators and space solutions delivered have created today’s diverse marketplace with a turning point heading in to the 2017-2019 ‘boom’ period and a specific increase in managed office solutions and operators since Q2 2021. This has been further supplemented by landlords with their own flexible offerings and a willingness to partner with managed office operators.

The value of collaboration and social interactions in the office is evident. Flexible workspace products have unique selling points to deliver on these themes and support increasing demand for agility. Operators are focused on ensuring occupier retention by delivering newer enhanced services and amenities to maintain maximum occupancy to survive in what is once again a busy marketplace. The use of flexible workspace products; coworking, serviced offices and managed offices now forms part of most occupational real estate strategies across not only the UK, but globally.

Newer providers, and the evolution of longstanding ones, have given occupiers far more choice when it comes to acquiring flexible workspace. This competition can benefit occupiers in negotiating better pricing terms. The diverse marketplace is also undoubtedly stoking innovation in the sector, driving providers to create better spaces and further evolution in the years to come.

Although take-up remains lower in the ‘new era’, both in total acquired size and number of transactions. To put into perspective, the average deal size of c.26,000 sq ft in London from 2021-2023 is 7% higher than the emerging era, but 17% below the 2017-2019 boom period. One explanation for the lower volume of deals could be due to some being agreed on a shared risk basis, through management agreements or profit sharing between the operator and the landlord. Whilst this has been common for select operators previously, it is now being requested more, thereby increasing the negotiation process.

Similarly, outside of London, the market has evolved rather than returning to pre-2017 levels of activity. Average transaction volumes from 2021 to 2023 were more than three times the pre-boom figure – albeit still 71% below the 2017-19 average. Nevertheless, the number of active providers has proved relatively resilient. The pre-boom era reported 2.8 operator transactions per year, increasing to 11 during the boom and now averaging 8.3 per year since 2021, reflecting a more diverse landscape.

While another UK flex boom identical to 2017-2019 is unlikely, given it was largely spearheaded by WeWork’s aggressive acquisition strategy, a different kind of boom could be on the horizon. We believe the focus for growth will be centred around providing best-in-class workspaces, beyond what we’ve seen over the last decade.

In the new era, many businesses remain unsure of their future office requirements, and flexible workspace solutions will be an important consideration in their real estate decisions. They may choose to utilise the space for overflow and hybrid working demands; while businesses trialling HQ relocations cam reap the benefits of multi-site access and amenity rich workspaces. The mix of these factors is driving increased requirement and longer contract terms.

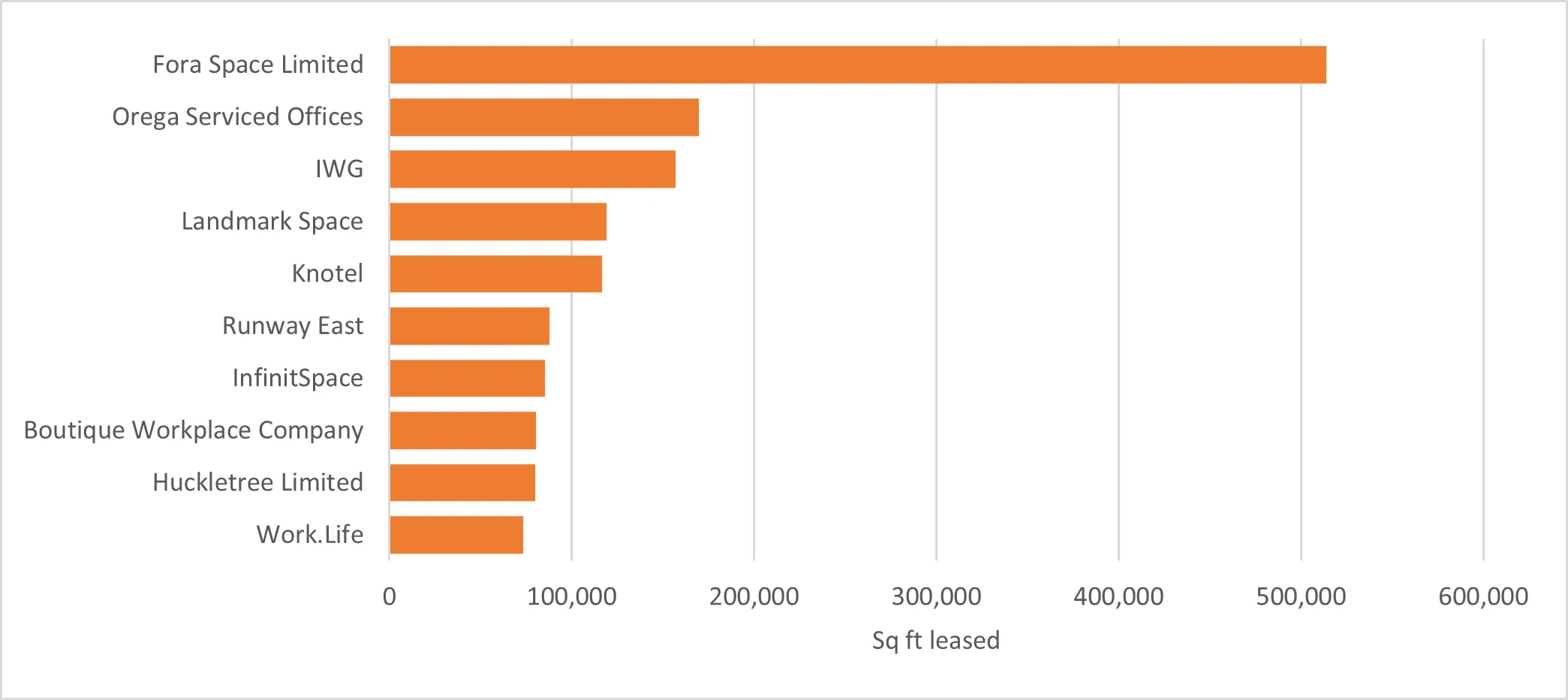

Who are the main providers acquiring space in Central London since 2021?

Fora Space, now the combined entity of Fora and The Office Group, has emerged as the most acquisitive provider since 2021, leasing over 500,000 sq ft during that time. In total, the merged entity has acquired over 2.3 million sq ft across multiple Central London sites since 2013, making it the second largest operator of flex space, behind WeWork.

Orega and Runway East have notably increased activity, with total space acquired through leases and management agreements over the last three years higher than pre-Covid. Orega has acquired close to 250,000 sq ft since 2013 on management agreements, 70% of which was in 2023 alone. Runway East has now acquired over 150,000 sq ft, more than half of which has been in the last three years.

IWG, the parent company behind brands such as Regus, Spaces and others, have been a steady presence in the London market throughout the last decade, largely through the Regus brand. In total, over 1.3 million sq ft of acquisitions have taken place since 2013, two thirds of which was during the flex-boom period. Whilst activity has slowed somewhat, they were active again in 2023, acquiring two units in the West End totalling 130,000 sq ft, including a 73,000 sq ft pre-let at Kensington Olympia at the end of the year.

New flex: absent in London, but active in the regions

New and exciting operators such as Cubo, X + Why, Clockwise and others are adding to the flexible workspace offer in the regions, some having started acquisition activity in London before branching out. These new and agile operators are creating bespoke spaces for modern tenants and push the boundaries of what workspace can offer. One example of this is Eighteen, the exclusive members club at 103 Colmore Row, operated by X + Why in Birmingham, alongside its flexible offering within the same building.

The quality of offer being put forward by these providers – particularly in the context of the modern city centre office market that is increasingly focusing on high amenity, top quality assets – is changing the perception of the sector held by developers and landlords.

This means that while flexible workspace may have formerly been accepted into the last space of a stacking plan, they are now often sought out before any other tenants – for those landlords looking to provide the best quality offer. This ensures that prospective companies know they have the option to expand into the flexible workspace if needed, as well as potentially benefiting from the wider offer that these companies can provide.