Long Island Summer 2022: Industrial Construction Pipeline Surges

Dimitri Mastrogiannis • 9/8/2022

MUCH NEEDED NEW WAVE OF PROJECTS BREAK GROUND

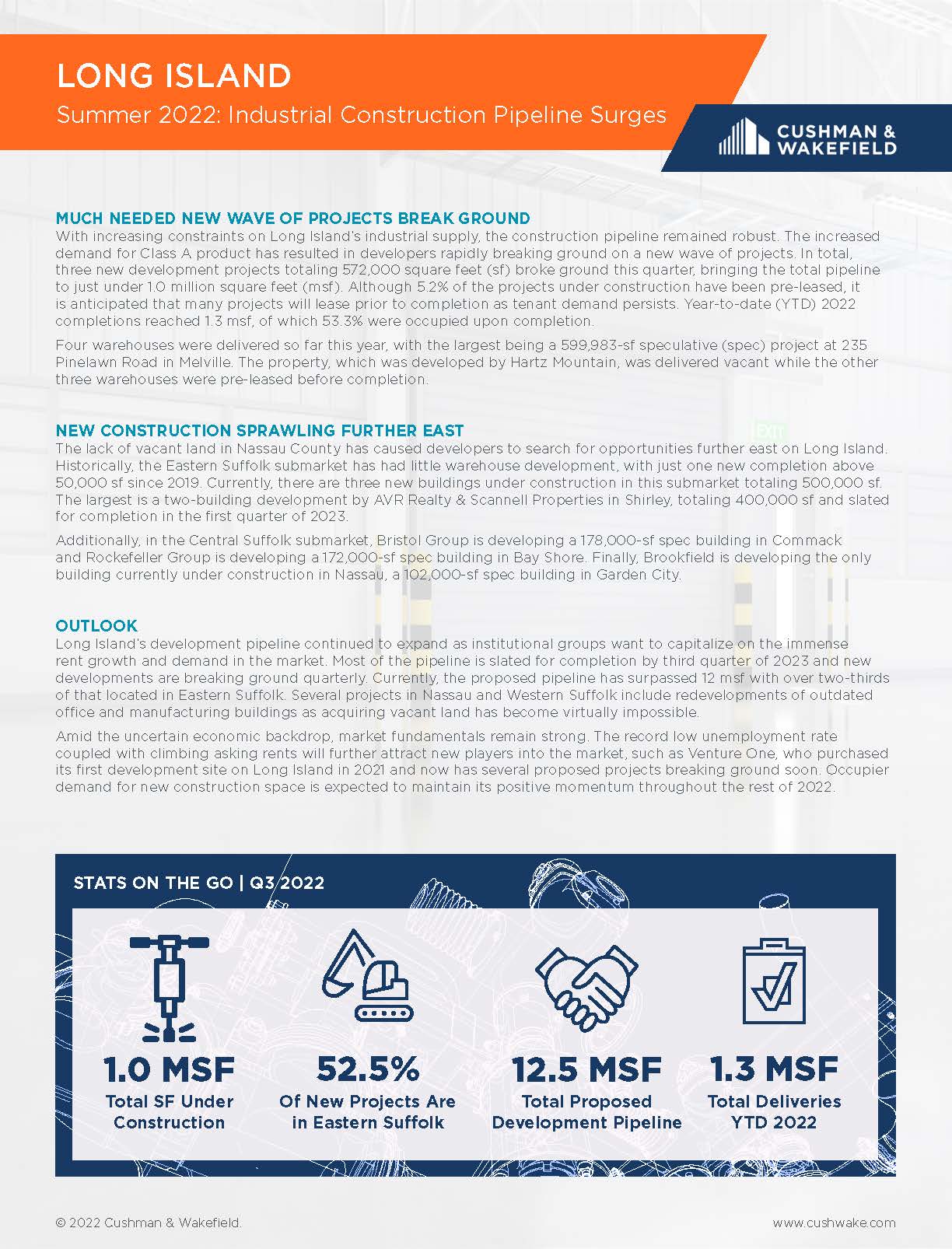

With increasing constraints on Long Island’s industrial supply, the construction pipeline remained robust. The increased demand for Class A product has resulted in developers rapidly breaking ground on a new wave of projects. In total, three new development projects totaling 572,000 square feet (sf) broke ground this quarter, bringing the total pipeline to just under 1.0 million square feet (msf). Although 5.2% of the projects under construction have been pre-leased, it is anticipated that many projects will lease prior to completion as tenant demand persists. Year-to-date (YTD) 2022 completions reached 1.3 msf, of which 53.3% were occupied upon completion. Four warehouses were delivered so far this year, with the largest being a 599,983-sf speculative (spec) project at 235 Pinelawn Road in Melville. The property, which was developed by Hartz Mountain, was delivered vacant while the other three warehouses were pre-leased before completion.

NEW CONSTRUCTION SPRAWLING FURTHER EAST

The lack of vacant land in Nassau County has caused developers to search for opportunities further east on Long Island. Historically, the Eastern Suffolk submarket has had little warehouse development, with just one new completion above 50,000 sf since 2019. Currently, there are three new buildings under construction in this submarket totaling 500,000 sf. The largest is a two-building development by AVR Realty & Scannell Properties in Shirley, totaling 400,000 sf and slated for completion in the first quarter of 2023. Additionally, in the Central Suffolk submarket, Bristol Group is developing a 178,000-sf spec building in Commack and Rockefeller Group is developing a 172,000-sf spec building in Bay Shore. Finally, Brookfield is developing the only building currently under construction in Nassau, a 102,000-sf spec building in Garden City.

OUTLOOK

Long Island’s development pipeline continued to expand as institutional groups want to capitalize on the immense rent growth and demand in the market. Most of the pipeline is slated for completion by third quarter of 2023 and new developments are breaking ground quarterly. Currently, the proposed pipeline has surpassed 12 msf with over two-thirds of that located in Eastern Suffolk. Several projects in Nassau and Western Suffolk include redevelopments of outdated office and manufacturing buildings as acquiring vacant land has become virtually impossible. Amid the uncertain economic backdrop, market fundamentals remain strong. The record low unemployment rate coupled with climbing asking rents will further attract new players into the market, such as Venture One, who purchased its first development site on Long Island in 2021 and now has several proposed projects breaking ground soon. Occupier demand for new construction space is expected to maintain its positive momentum throughout the rest of 2022.

With increasing constraints on Long Island’s industrial supply, the construction pipeline remained robust. The increased demand for Class A product has resulted in developers rapidly breaking ground on a new wave of projects. In total, three new development projects totaling 572,000 square feet (sf) broke ground this quarter, bringing the total pipeline to just under 1.0 million square feet (msf). Although 5.2% of the projects under construction have been pre-leased, it is anticipated that many projects will lease prior to completion as tenant demand persists. Year-to-date (YTD) 2022 completions reached 1.3 msf, of which 53.3% were occupied upon completion. Four warehouses were delivered so far this year, with the largest being a 599,983-sf speculative (spec) project at 235 Pinelawn Road in Melville. The property, which was developed by Hartz Mountain, was delivered vacant while the other three warehouses were pre-leased before completion.

NEW CONSTRUCTION SPRAWLING FURTHER EAST

The lack of vacant land in Nassau County has caused developers to search for opportunities further east on Long Island. Historically, the Eastern Suffolk submarket has had little warehouse development, with just one new completion above 50,000 sf since 2019. Currently, there are three new buildings under construction in this submarket totaling 500,000 sf. The largest is a two-building development by AVR Realty & Scannell Properties in Shirley, totaling 400,000 sf and slated for completion in the first quarter of 2023. Additionally, in the Central Suffolk submarket, Bristol Group is developing a 178,000-sf spec building in Commack and Rockefeller Group is developing a 172,000-sf spec building in Bay Shore. Finally, Brookfield is developing the only building currently under construction in Nassau, a 102,000-sf spec building in Garden City.

OUTLOOK

Long Island’s development pipeline continued to expand as institutional groups want to capitalize on the immense rent growth and demand in the market. Most of the pipeline is slated for completion by third quarter of 2023 and new developments are breaking ground quarterly. Currently, the proposed pipeline has surpassed 12 msf with over two-thirds of that located in Eastern Suffolk. Several projects in Nassau and Western Suffolk include redevelopments of outdated office and manufacturing buildings as acquiring vacant land has become virtually impossible. Amid the uncertain economic backdrop, market fundamentals remain strong. The record low unemployment rate coupled with climbing asking rents will further attract new players into the market, such as Venture One, who purchased its first development site on Long Island in 2021 and now has several proposed projects breaking ground soon. Occupier demand for new construction space is expected to maintain its positive momentum throughout the rest of 2022.

Insights in your Inbox

Subscribe to the latest local market research, insights and analysis from Cushman & Wakefield across the United States.

Subscribe

Related Insights

Insights

Logistics Tenant Profile – The Origin region of E-Commerce Logistics, Gimpo

Gimpo became a major last-mile delivery hub with the Gochon Logistics Complex near Seoul.

Carter Kim • 4/3/2025

Commercial Real Estate in Melville

175 Broad Hollow Road, Suite 235

Melville, NY 11747-4711

United States