The advent of 5G and the shift to remote working have created a remarkable, urgent appetite for data centres across the Asia Pacific region. In our latest series of market reports we’ve looked at four key locations and the unique dynamics of their data centre markets. With opportunity abound, these reports are an essential guide for investors, operators, and service providers alike as they consider their next steps in Asia Pacific.

Singapore

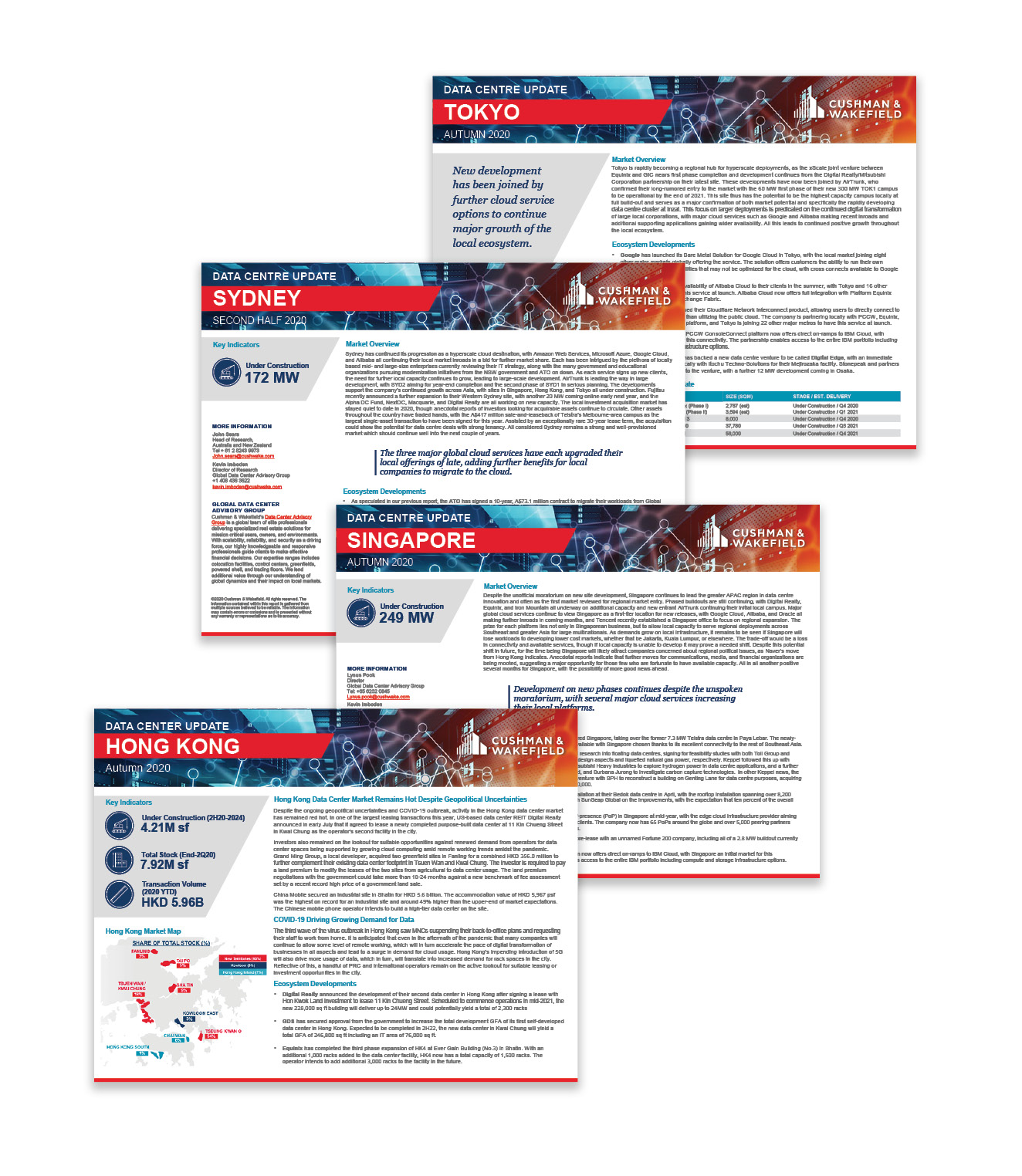

Although much has been made of the Singapore government’s moratorium on new data centre builds through into 2021, demand has seen no sign of slowing down. With some 249 MW under construction, and with major cloud service providers continuing to favour Singapore in their future expansion plans, the island state seems like a good bet for continued data centre growth into the future.

Much of this interest comes down to Singapore’s low-risk environment, allowing cloud service providers more confidence in longer term returns on data centre investment (find out more in our Prepped Cities report). Coupled with outstanding infrastructure, Singapore is able to comfortably answer critics who suggest that investment would be better made in one of the several neighbouring Southeast Asian states offering favourable pricing on power and labour.

For more on how Singapore is flourishing as a data centre market of choice for firms including Singtel, Zoom, Oracle Cloud, download our latest Singapore Data Centre Update report.

Sydney

As major cloud service providers have expanded their footprints across Asia Pacific, the Sydney market has been increasingly seen as an essential link in that chain. Sydney’s status as a regional capital has meant significant opportunity for firms looking to take advantage of MNCs moving their IT infrastructure to the cloud. Currently with 172 MW under construction, we’ve seen significant expansion momentum that belies the a quiet local investment market in 2020.

It’s of note that it’s not just private sector institutions providing the growing demand for managed cloud services in the Australia market. From the Australian Taxation Office to the University of Sydney, 2020 has seen significant IT modernisation initiatives within the Australian public sector, all with the goal of driving efficiency and saving on cost.

Find out more about the growing data centre opportunity in Sydney, including why the likes of Microsoft, Amazon Web Services and AirTrunk are making significant investments, by downloading our latest Sydney Data Centre Update report.

Tokyo

Japan’s capital city has of late been seen as a significant hub for Hyperscale data centres within the Asia Pacific region, of which the US$1 billion Equinix and GIC joint venture earlier this year is a standout example.

Joining them are the likes of Google, Alibaba and PCCW, who see significant opportunity as a result of the ongoing digital transformation of the many Japanese corporations looking to avoid falling off what has been termed the “digital cliff”. Certainly the fact that AirTrunk have finally confirmed their entry into the Japanese data centre market with the development of the first phase of their 300 MW TOK1 campus should provide significant impetus for growth across the rest of the ecosystem.

For more on how the Tokyo data centre market is set to grow into 2021, download our latest Tokyo Data Centre Update report.

Hong Kong

The Hong Kong data centre market is set to maintain its remarkable growth trajectory, despite the headwinds that have been faced over the last 12-18 months. With deals being done across the territories, we’ve seen sizeable investments in particular in the Sha Tin, Tsuen Wan and Kwai Chung areas.

Of particular note was the deal done in Sha Tin by China Mobile for HKD 5.6 billion, some 49% higher than market expectations. With the site set to become a high-tier data centre, we expect deals of this magnitude to spur on other major ecosystem players to add to the 4.21m sqft of data centres currently under construction.

Featuring insights into the latest Alibaba Cloud, Digital Realty and GDS moves in Hong Kong, download our Hong Kong Data Centre Update report now to find out more.