Portugal

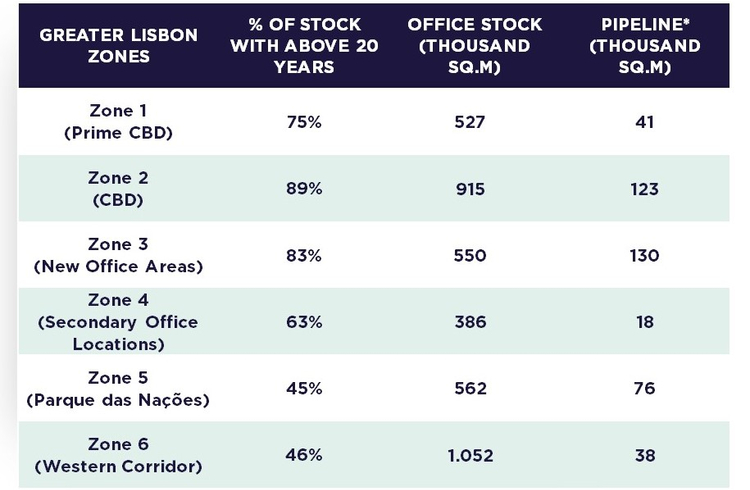

We estimate that 2.86 million sq.m of office stock in Greater Lisbon is at risk of becoming obsolete by 2030.

Given the current age of the stock, the CBD (zone 2) and New Office Areas (zone 3) are under most pressure, followed by the Prime CBD (zone 1).

Additionally, increased demand for higher-quality office buildings continues to drive development activity. The future supply under construction currently stands at 234,400 sq.m, with an additional 195,000 sq.m planned for completion by 2028. Overall, this means that, within the next four years, 429,000 sq.m of new office space will be entering the market.

The influx of new stock poses an increased risk to older office buildings, which may struggle to compete. The strong demand for best-in-class space and premium rents these spaces can achieve are key factors contributing to this trend.

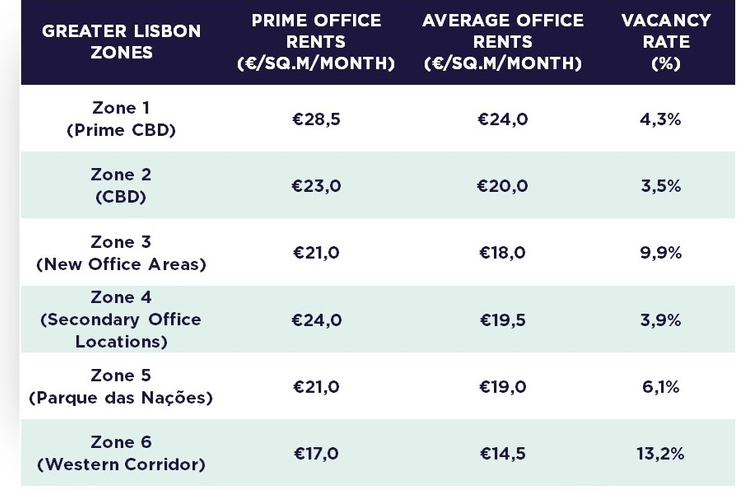

Prime gross rents are at their highest levels in 30 years, while the vacancy rate has been gradually increasing, now standing at 7.2%.

As more leases come up for renewal and companies reassess their occupational needs, we will continue to see changes throughout the remainder of this decade and beyond, many of which are already being felt today.

Repositioning is likely the optimal solution for city center locations. Alternatively, hospitality and residential tend to be the predominant alternative uses in these areas. Moving from central to peripheral locations expands the range of potential uses, such as healthcare, medical facilities, lab space, or data centers, depending on local market dynamics. Lower office values relative to these options and higher vacancy rates may position asset repurposing as the winning strategy.

For landlords, this means that a clear strategic analysis is required at an asset level to determine the optimal solution.

Contact us to inquire about our services for office properties. Our multi-disciplinary team is ready to collaborate with you to develop tailored solutions that drive sustainable growth.