Commercial Real Estate Insights

Most Recent

Research • Economy

European 10 critical questions for 2025

Research • Workplace

Excellence in Action: How Bank of America Is Navigating the Now

Economy

Research • Economy

What to Watch 2022: 10 Indicators for Occupiers & Investors

Research • Economy

Global Office Impact Study & Recovery Timing Report

Hospitality

Research

Hospitality Real Estate in Paris

Research

InnSights Quarterly Q3 2024 Hospitality Report

Industrial & Logistics

MarketBeat

Article

West Region Industrial Labor Report

Investor

Article • Investment / Capital Markets

Market Matters: Exploring Real Estate Investment Conditions & Trends

Article • Investment / Capital Markets

Press Release • Investment / Capital Markets

Jess Freeman • 12/16/2024

Insights • Valuation

Tatchada Supakornpichan • 11/28/2024

MarketBeat • Investment / Capital Markets

Aymeric Sevestre • 11/15/2024

MarketBeats

MarketBeat

Retail

Research

Main Streets Across the World 2024

Podcast • Workplace

Nicola Gillen • 4/26/2021

Data Centers

Research

EMEA Data Centre Market Update

Research

Research • Investment / Capital Markets

Shaun Brodie • 2/29/2024

Insights • Technology

Vivek Dahiya • 10/31/2023

Sustainability & Wellness

Article • Sustainability / ESG

The greenhouse effect is a natural phenomenon that keeps the Earth habitable by retaining part of the solar radiation in the atmosphere.

Article • Sustainability / ESG

São Paulo, one of the largest global metropolises, is known for its dynamic and constantly growing real estate market.

Article • Sustainability / ESG

11/14/2024

Insights • Sustainability / ESG

Xian Yang Wong • 10/22/2024

Technology

Article • Technology

South Korea's Data Center Industry: Growth and Challenges Amid Power Supply and Regulatory Pressures

Article • Technology

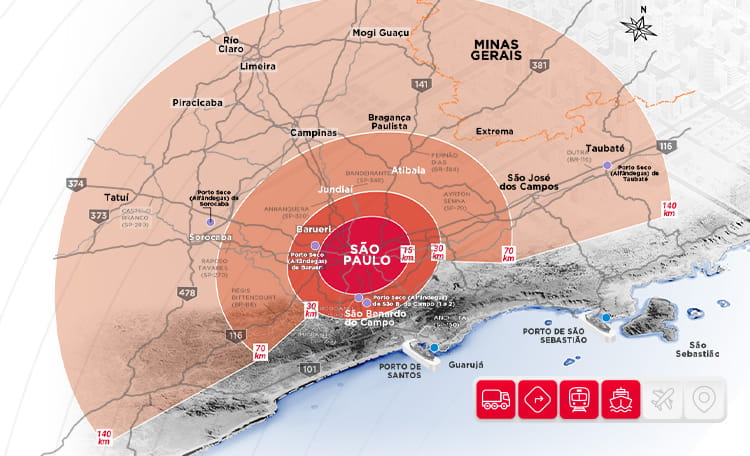

Cushman & Wakefield launches São Paulo Logistics Radius System

Cushman & Wakefield's new São Paulo Logistics Radius System brings a new analysis perspective, more dynamic and real, updated with the most recent data from the quarterly MarketBeats published by the company, and can be accessed by anyone.

Insights • Technology

David Binks • 9/3/2024

Article • Technology

Megan Pendill • 8/1/2024

Research • Technology

Gregory Rogalla • 7/25/2024

The Edge Magazine

Research • Workplace

From Putt to Pint: Everyone Wins with Competitive Socializing

Research • Workplace

Bryan Berthold • 12/8/2022

Workplace

Research • Workplace

Research • Workplace

Excellence in Action: How Bank of America Is Navigating the Now

Research • Workplace

Michael McDermott • 11/22/2024

NHÀ TUYỂN DỤNG LỚN TỐT NHẤT Ở MỸ THEO FORBES

Featured MarketBeat Reports

MarketBeat

MarketBeat

MarketBeat

MarketBeat

MarketBeat

MarketBeat

MarketBeat

Articles

Video • Economy

C&W Insights: What you need to know about commercial real estate market

Article • Workplace

Office Beat Market | 2nd quarter 2019

Insights

A Day in the Life of a Tenant Advisor

Article • Valuation

2020 - What a Year for Self Storage